The NYT has an article about Gabriel Jimenez, a 25-year-old who has been battling an identity thief for half his life. His SSN was stolen and used by an illegal immigrant when he was 11, and it’s been a nightmare ever since.

lending

WaMu To Stop Offering Cetain Types Of Subprime Mortgages

WaMu, the nations largest Savings & Loan, is going to stop issuing certain risky types of subprime loans.

Blue Hippo Takes Your Payments, Doesn't Send Your Merchandise

Blue Hippo is one of those “no credit check” computer-buying companies. The basic idea is that you start making payments to Blue Hippo in order to “establish your credit history,” then, after 9 weeks, they send you a computer. You continue to make payments on the computer for a year, after which it is yours.

$325 Million Amerquest Settlement Payout Might Average $812.15 Per Person

If you got a mortgage through Ameriquest from 1999-2005, you may be eligible for a $325 million settlement Ameriquest reached with 49 states over their shady lending practices, which included failing to disclose that the loans had adjustable rates, failing to disclose the terms of the loan, refinancing homeowners into inappropriate loans, inflating home appraisals, and charging excessive fees such as prepayment penalties and loan origination fees. Ameriquest did not admit wrongdoing.

New Record For Foreclosures In The First Half

Foreclosures hit an all time record in the first half of 2007, according to Bloomberg. Since the beginning of the year 926,000 foreclosures have been filed, 56% more than a year earlier.

Department Of Education Sends Warning Letters To 921 Colleges

The Department of Education wants you to know that they’ve sent warning letters to 921colleges and universities warning them not to limit students in their choice of lenders, according to the Chicago Tribune.

Jeff Baker, policy liaison at the Education Department’s federal student aid office, said a search of a student loan database showed that a vast majority of students at each of 921 campuses chose the same lender.

Doomsday Coming in October For The Subprime Mortgage Industry

Many consumers who signed up for adjustable rate mortgages in 2004 and 2005 will see their mortgage payments jump this October, according to CNNMoney. With foreclosure rates already as high as one foreclosure filing for every 656 households in the US, this can’t be good news.

Student Aid Administrators Are Pleasantly Paranoid

The National Association of Student Financial Aid Administrators is too paranoid about the recent student loan scandal to allow Wachovia to splash its logo all over the nylon bags it ordered for its annual conference, according to the Chicago Tribune.

The group, which represents about 12,000 college-aid officials across the country, didn’t want to appear to be acting improperly by accepting money from Wachovia in exchange for the marketing opportunity. The association also ditched lanyards and pens from other businesses — and even cut off the bottom of notepads that featured the name of a financial-services company — forfeiting about $200,000 in sponsorship fees paid by various vendors.

H&R Block Continues To Hemorrhage Money

The subprime lending arm of tax giant H&R Block continues to hemorrhage money, to the extent that it’s close to being unsalable, according to Bloomberg.

H&R Block Inc.’s mortgage unit lost a $1.5 billion credit line, falling “dangerously close” to the minimum amount demanded by a hedge fund firm that has agreed to buy the money-losing home lender.

Watch Out For "Equity Stripping" Scams

The New York Times has an article about a growing problem, a scam called “equity stripping.” Here’s how it works: You answer an advertisement targeting people who are facing foreclosure, but want to stay in their homes. You think you’re refinancing your loan at a lower rate, but in reality you’re transferring the deed to someone else. That person then takes out as much as they can against the value of your home. From the NYT:

Jessica Attie, co-director of the foreclosure prevention project at South Brooklyn Legal Services and the lawyer for the Johnsons, said her office was overwhelmed with homeowners who had handed over their deeds to people pretending to help “save” their homes.

We know times are tough and a lot of homeowners are facing difficult financial decisions, but make sure you know what you’re signing. If someone offers to “temporarily” buy your home, warning bells should go off.

12 Steps For Digging Yourself Out Of Debt

If you’re in debt and you don’t want to be, (and who wants to be?) you might want to take a look at Zen Habits 12-Step Get Out of Debt Program.

Pending Home Resales Drop To Lowest Level Since September 2001

Pending sales of existing homes dropped for the third straight month as troubles in the mortgage industry continue to disrupt the housing market. Figures released today show a 3.5% drop in May, following April’s drop of 3.2% and March’s drop of 4.5%.

Consumerist's 10 Commandments of Credit

Keeping a balance on a credit card is a sin in the eyes of the Consumerist. If you have a balance, make it your priority to pay it off as quickly as possible.

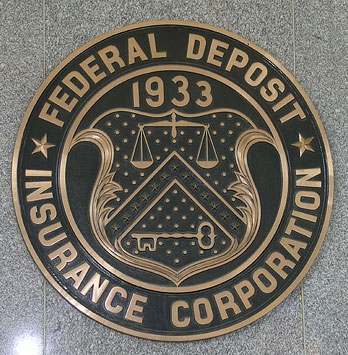

FDIC Launches Program Encouraging Banks To Offer Small Dollar Loans

The FDIC has announced a program designed to study and encourage small dollar lending programs designed to compete with payday lenders. Under the program banks would offer “loan amounts of up to $1,000, mandatory savings components, payment periods that extend beyond a single pay cycle, interest rates below 36 percent, low or no origination fees, no prepayment penalties, prompt loan application processing, and access to financial education to help with asset building.”

Your Credit Score Demystified!

Bankrate has an interview with Craig Watts, public affairs manager at Fair Isaac Corp., the creator of the popular FICO credit score. Craig talks about credit myths and strategies for people who are looking to raise their credit scores. Nothing terribly ground-breaking, but we know our readers tend to obsess over their credit scores, so it’s good to get some info straight from the horse’s mouth.

American Airlines Offers 6 Month No Interest No Payments Financing

American Airlines is offering no interest no payments for 6 months on airline tickets purchased through an offer on their website. This means that, essentially, one can purchase an airline ticket in the same way that one purchases, say, furniture or a camcorder.

H&R Block Subprime Lending Division Loses $676.8 Million

The company reported losing $85.5 million, or 26 cents per share, during the February-April period, which is when the nation’s largest tax preparer sees the majority of its revenue. By comparison, the company earned $587.5 million, or $1.79, during the same period a year ago.

H&R Block says it will sell its subprime lending operation to a private equity firm.