The Fed cut interest rates by half a percentage point this afternoon, citing “tightening of credit conditions” that have the potential to “intensify the housing correction.”

lending

Foreclosures Up 115% From Last Year

Foreclosures “zoomed” in August, up 115% from last year and 36% from July according to the newest numbers from RealtyTrac. This is the beginning of one of three remaining waves that will hit the market in the next year. This wave is expected to peak in October as 2 million 2/28 ARMs reset to market rates and an estimated 600,000 homeowners can no longer afford their payments.

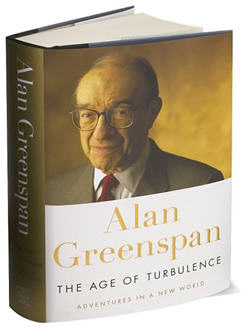

Greenspan "Didn't Really Get" That Subprime Lending Could Hurt The Economy

Former U.S. Federal Reserve chairman Alan Greenspan told 60 Minutes that he “didn’t really get” that irresponsible subprime lending could be significant enough to hurt the economy, but he still defends the decision to keep interest rates low from 2001-2004.

The Big, Big List Of Subprime Mortgage Layoffs And Closures

The Truth About Mortgage has been compiling a list of mortgage lending layoffs and closures since the end of February and the effect is staggering. The list, last updated today, now has over 250 entries. Anyone looking for a quick and easy way to freak out about the mortgage market need look no further than this list.

Ameriquest Is Dead

Ameriquest, the lender the epitomized everything that was f*cked up about the subprime mortgage meltdown, is dead.

WaMu Says Housing Market In "Perfect Storm"

“The combination of rising delinquencies, higher foreclosures, more housing inventories, increasing interest rates on many mortgages and greatly reduced availability of mortgages due to limited liquidity is creating what we call a near-perfect storm for housing,” Chief Executive Officer Kerry Killinger said.

Mortgage Industry Lays Off More Workers

The mortgage industry isn’t just hemorrhaging money anymore, it’s hemorrhaging jobs. Two more mortgage lenders (Lehman Brothers Holdings and the National City Corporation) announced that they would be laying off 2,000 employees.

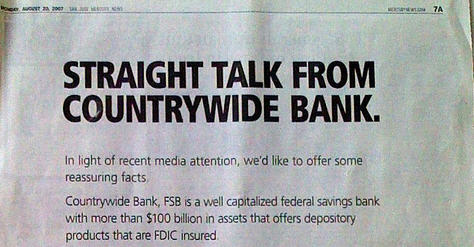

Inside The Countrywide Subprime Lending Frenzy

The New York Times has a very interesting article about the business practices that resulted in Countrywide’s dramatic spiral into the dirt. Recently, the nation’s largest mortgage lender had to tap $11.5 billion in emergency credit and was the beneficiary of a $2 billion investment bailout from Bank of America.

Mortgages Are Disappearing But The Advertising Isn't

Even as lenders face bankruptcy and banks are closing down their mortgage divisions and cutting jobs, the advertising for subprime and non-conforming loans is still going strong. What’s the deal?

Capital One To Close Mortgage Unit

“Current conditions in the secondary mortgage markets create significant near-term profitability challenges,” Capital One said in a statement. “Further, recent and continuing developments in the mortgage markets reduce the long-term outlook for profitability in the business, as the company expects markets for prime, non-conforming mortgage products are likely to remain challenged.”

Later, gator.

Countrywide Borrows $11.5B from 40 banks

Countrywide has secured $11.5B in financing from 40 banks in an effort to remain afloat as the mortgage market crashes.

Whoops, Where'd My Mortgage Go?

NPR interviewed a would-be Brooklynite named Claudia who is trying to buy an apartment for herself and her teenaged sons. Everything seemed settled, when all of a sudden the lender that was going to be offering Claudio her HELOC loan decided they didn’t really want to anymore.

Countrywide, America's Largest Mortgage Lender, May Have To File For Bankruptcy

“If enough financial pressure is placed on Countrywide or if the market loses confidence in its ability to function properly then the model can break, leading to an effective insolvency,” Bruce wrote. “If liquidations occur in a weak market, then it is possible for Countrywide to go bankrupt.”

Attention: The Subprime Meltdown Will Be Politicized

The subprime meltdown has made its way into campaign speeches, thanks to one Sen. H. Clinton (D-NY).

The Truth About Credit Card Debt

Recently we noted that 90% of American households thought they held average or below average levels of credit card debt. This made us think that Americans were in denial when it came to their credit card debt since “90%” and “average” simply don’t mix.

Subprime Meets Wall Street, Investor Forced To Sell Yacht

Meet the subprime mortgage meltdown’s other victim, a millionaire mortgage investor who has been forced to put his yacht up for sale—for $23.5 million.

Easy Money Drying Up, Taking The Economy With It?

What happens when easy credit, the lifeblood of our economy for the past few years, dries up? Consumer spending slows and people start mouthing the word “recession.”