We know you just graduated and you don’t want to think about your student debt. Really. We understand. Sadly, you need to think about it, and you need to think about it before July 1st.

lending

Private Student Loans Are Potentially Evil

The New York Times has an article explaining some of the reasons that private loans are both more popular and more risky that they really ought to be.

Ask The Consumerists: What Do I Do About Credit Cards I Never Requested?

I’ve gotten two of these unwanted cards in the last 12 months after signing up with two different financial institutions for two different reasons. The first was a mortgage I signed, the second for a business checking account where I was the primary account user. I’ve worked hard all my life to maintain good credit, and I don’t want these things to affect my excellent rating. What should I do now?

Read Beau’s letter and our advice, inside.

Bankruptcy Protection For Students?

In 2005 congress changed the law to exclude student loans (private or public) from bankruptcy protection, meaning that it is almost impossible to discharge your student loan by filing for bankruptcy.

Cuomo Goes After Student Lending Criteria, Is So Not Bored Of This Investigation Yet

What criteria do student loan companies use when determining which students to give loans to and how much to give? Don’t know? Neither does New York Attorney General Andrew Cuomo, but we’re pretty sure he’s going to find out. From the NYT:

“What criteria are they using in the underwriting of these loans?” Mr. Cuomo asked. “Parental income? Student income? Student creditworthiness? How about the school you attend? How is that weighted?”

20% of Americans Fear They'll Never Escape Credit Card Debt

According to a new survey by Lending Tree, 20% of Americans fear that they will never escape their credit card and other non-mortgage related debt and will be stuck with it for the rest of their lives. That’s depressing. Elizabeth Warren at Credit Slips says:”Lending Tree tries to put a happy face on some of the data (most people “perceive themselves as some day being debt free”), but I didn’t feel any better when I read it.” Yeah, we don’t feel any better either.

Should You Burn Your Mortgage When You're Done Paying It Off?

Uh, no. Although people do have “Mortgage Burning Parties.” In fact, take, for example, this little tale from the LA Times:

When he was a kid in Elmira, N.Y., title attorney James Wytock lived near a church that decided to hold a combination service-ceremony to commemorate paying off its mortgage.

Piggybacking On A Stranger's Good Credit To Raise Your FICO Score?

Brian Kinney, 44, a retired Army officer in Glendale, Calif., pulls in more than $2,500 a month by lending out 19 credit card spots on two old Citibank cards with strong payment histories. Kinney, whose FICO score is above 800 on the scale of 300 to 850,

$2,500 a month? What? It’s a good deal for the “renters” too. Just ask this guy:

Estruch paid $1,800 in December for three credit card spots, and by January, his FICO score jumped from 550 to 715. In mid-March, he closed on his four-bedroom beige stucco house after obtaining a 30-year fixed-rate mortgage from a unit of American Home Mortgage Investment Corp. It carried a 7.5 percent interest rate and required no down payment.

Guess what he does for a living? He’s a mortgage broker. Ha! Of course too much of this behavior could cause creditors to take action and change the effect that authorized user accounts have on FICO scores, essentially making them useless to those for whom they were designed. —MEGHANN MARCO

Columbia University Settles With NY Attorney General

The New York Times is reporting that Columbia University will pay $1.1 million into a fund to educate students about loans, and will have its student loan office monitored by the state of New York for 5 years under the terms of a settlement that NY Attorney General Andrew Cuomo announced yesterday.

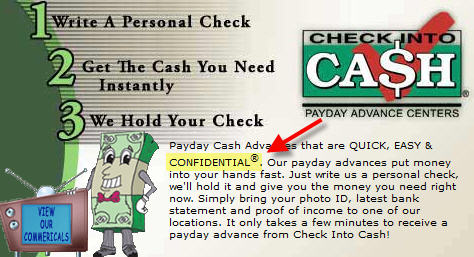

Payday Lender Leaves Customer Information Out In The Street

As if you needed another reason not to get a payday loan… —MEGHANN MARCO

Even Reporters Can Not Get Capital One To Act Responsibly

Capital One is so evil that not even media inquiries phase it. Around here we tend to roll our eyes just a little bit at consumer reporters who praise companies for doing the right thing post-media inquiry. After all, what company wouldn’t fix a situation rather than suffer a public shaming by a newspaper? Finally, the answer has been found. That company is Capital One.

College Financial Aid Directors Are Dropping Like Flies

Columbia University has finally fired their director of undergraduate financial aid, David Charlow, after suspending him over “questionable financial ties” to Student Loan Xpress.

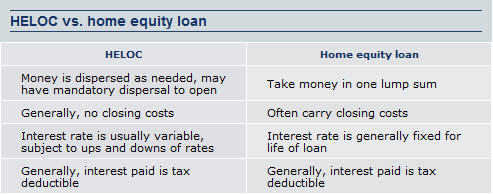

A Bunch Of Information About Home Equity Loans

Got questions about home equity loans and home equity lines of credit (HELOC)? You’re not alone. Thankfully, Bankrate has tons of information about this very topic, and when we say tons… We’re not kidding. This should keep you busy for awhile. —MEGHANN MARCO

House To Walmart: No Banks For You

The House is poised to pass a bill that will keep Walmart, and all who seek to follow them, from ever having a bank to call their own. The measure, H.R. 698, prevents industrial loan companies (ILCs) from being owned or chartered by any institution that doesn’t derive at least 85% of their revenue from financial activity.

Something To Think About The Next Time You Pull Out Your Credit Card

According to Bob Lawless at The Credit Slips Blog, if no one in America spent any of this year’s personal income on “trivial” things like food, shelter, taxes, and medical care,” it would still not be enough to pay off all of our mortgages, credit cards, and other “other personal indebtedness.” In 2003, this wasn’t true.

Student Loan Advice For New Graduates

Graduation is coming and soon you will need to pay back your Student Loans. Thankfully for you, Make Your Nut has compiled a lengthly post full of advice for you new grads.

Meet The Credit Card Accountability Responsibility and Disclosure Act of 2007

Remember all of that government debate about the credit card industry? Well, a piece of legislation that addresses the debate has been introduced in the House of Representatives and is currently before the Financial Services Committee. The bill requires several changes, including things like advance notice of interest rate changes.