Here’s the official court filing (PDF) so you can get the full details on how Wells Fargo pushed or even fraudulently placed black borrowers into sub-prime loans, even when those borrowers could afford prime loans, along with an office environment where employees threw around racist slurs, calling black borrowers “mud people” and their mortgages “ghetto loans.” The official statements referenced in the NYT article are in this document in full. The affidavits begin on page 48. Two screenshots inside…

subprime meldown

Loan Officers Detail Wells Fargo's Blatantly Racist Subprime Loans

UPDATE: Read the affidavits here.

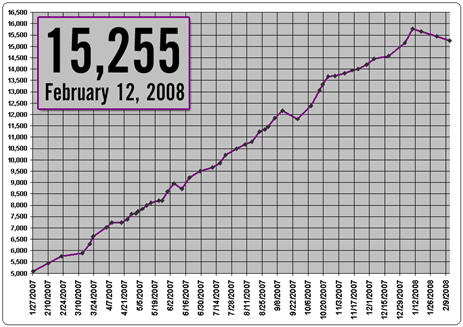

Countrywide Home Loans Has Over 15,000 Repossessed Properties For Sale

The Countrywide Foreclosures Blog keeps a running tally of the amount of repossessed or REO (Real Estate Owned) properties Countrywide has for sale on their website.

H&R Block Subprime Lending Division Loses $676.8 Million

The company reported losing $85.5 million, or 26 cents per share, during the February-April period, which is when the nation’s largest tax preparer sees the majority of its revenue. By comparison, the company earned $587.5 million, or $1.79, during the same period a year ago.

H&R Block says it will sell its subprime lending operation to a private equity firm.