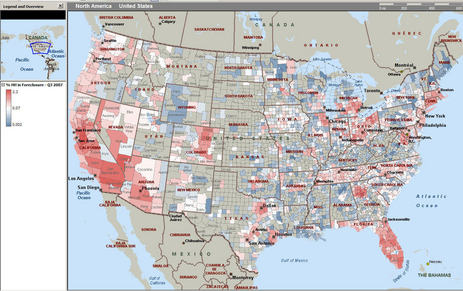

The third quarter foreclosure numbers are in and 45 of 50 states saw increases in foreclosure activity, though some, like Ohio, Michigan, California, Arizona, Nevada and Florida, were much worse than others.

lending

255,129 Foreclosed Homes Went Unsold In 2007, And Are Now Owned By Lenders

Foreclosure tracking firm RealtyTrac has been delivering lots of bad news this year, not least of which is some sobering numbers on Real Estate Owned properties or REOs. An REO is what happens when a home cannot be sold at auction and becomes the property of the lender.

5 Expenses You Can't Afford If You Have Credit Card Debt

5) Cable. Your Excuse: “But, but, but I need cable! I get a good deal! It’s only $100 a month! I use it a lot! It’s bundled with my phone and my internet. I’ll only save $30 a month if I cancel it.”

College Costs Rising At Double The Inflation Rate

College costs are accelerating in price, according to a new study released this morning.

FDIC Chair Suggests Fixing Rates To Solve Mortgage Crisis

Sheila C. Bair, the chair of the FDIC, suggests that lenders “restructure all 2/28 and 3/27 subprime hybrid loans for owner-occupied homes in cases where the borrower has been making timely payments but can’t afford the reset payments. Convert these to fixed-rate loans at the starter rate.”

Anatomy Of The Subprime Meltdown

Three years ago, Colorado truck driver Roger Rodriguez was in the market for a new mortgage loan. With radio and Internet ads trumpeting easy approvals, he picked up the phone.

WaMu's Net Income Down A Whopping 72%

The “housing correction” is turning out to be “more dramatic and more rapid” than Kerry Killenger, WaMu’s chairman and chief executive had expected.

Critics Say Countrywide Isn't Doing Enough To Help Foreclosed Homeowners

Countrywide is catching hell from consumer advocates who say they’re not doing enough to help the homeowners they’ve foreclosed on.

Virgin Money USA Helps Americans Lend To Family & Friends

VirginMoneyUSA, which launches today, is a lending service designed to manage personal loans between friends and family, by taking care of documentation, repayment schedules, and reminders. At first glance, the service sounds like an intrusive middle-man; however, anyone who’s ever been on either side of a personal loan knows how delicate the situation can be, so we can understand the appeal of putting some distance between the personal relationship and the fiscal one.

Foreclosures Doubled In September

Last month saw twice as many foreclosures than last September, says RealtyTrac, the foreclosure tracking organization.

Subprime Meltdown Kicks WaMu's @#$, Profits Down 75%

It must not be fun around WaMu headquarters today. Profits are down a whopping 75%.

Citibank Warns Of 60% Drop In Earnings Due To Subprime Meltdown

Citibank is warning investors to expect a 60% drop in earnings due to “dislocations in the mortgage-backed securities and credit markets, and deterioration in the consumer credit environment.”

5 Ways Credit Cards Can Make You Happy

The ways that credit cards can make you unhappy are legion. Fees, balances, crazy interest rates, universal default, the list goes on. But, even though we just saw Bank of America digging a pit in your backyard, and word has it the zoo is missing 3 tigers and a crocodile, there are a few ways that a credit card can make you happy. (Not all of these tips are unique to credit cards, so check to see which benefits your debit card has.)

Worst Month For New Home Sales In 6 Years

Here’s a cute but meaningless graphic from ABC News that illustrates a very important statistic: New home sales are down. Way down. 8.3% down. It’s the worst month for new home sales in 6 years.

Ohio Attorney General Sues Credit Card Marketers Over Ohio State "Free Burrito" Event

Ohio Attorney General, Mark Dunn, is suing Citibank-affiliated credit card marketers for violating Ohio’s consumer protection laws during a “Free Burrito” event at Ohio State University.

In Wake Of Fed Cuts, Mortgage Rates Rise Slightly

Bankrate has a really interesting article about the effect that the Fed’s rate cuts are having on the mortgage industry. As constant readers of the site are already well aware, the subprime meltdown has lead to a crisis in the secondary mortgage market—investors are no longer interested in purchasing non-conforming loans.