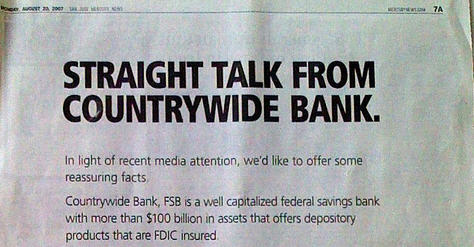

The New York Times has a very interesting article about the business practices that resulted in Countrywide’s dramatic spiral into the dirt. Recently, the nation’s largest mortgage lender had to tap $11.5 billion in emergency credit and was the beneficiary of a $2 billion investment bailout from Bank of America.

bank of america

Inside The Countrywide Subprime Lending Frenzy

By 8.27.07