Legislation to create a Consumer Financial Protection Agency (CFPA) is making its way through Congress. Interested parties have spoken out (“It sucks!” “It’s awesome!“). Now the White House wants to know what you think.

legislation

Consumer Financial Protection Agency Gets Watered Down

There’s been so much resistance to the proposed Consumer Financial Protection Agency that Rep. Barney Frank, the chairman of the House Financial Services Committee, has proposed a less powerful version of the agency in an attempt to get it passed. Here’s what’s changed:

Congress Seeks To Move Up Credit Card Act Implementation To December 1st

Today, Reps. Barney Frank and Carolyn Maloney are going to request that the implementation date for the rest of the Credit Card Act‘s rules be moved to December 1st of this year instead of February 2010, after seeing companies “jacking up their rates and doing other things to their customers in advance of the effective date” all summer, reports Mary Pilon at The Wall Street Journal.

FDA Banned Flavored Cigs, But Not Menthols. Why?

Back in June we noted that the FDA was about to get a lot more say over the tobacco industry if the Senate approved a new bill. Well they did, and so yesterday the FDA flexed its new muscles by banning fruit, herb, spice, and candy flavorings from cigarettes. That’s right: clove cigarettes were just banned by the FDA, which is bad news for gothy teens and great news for everyone else.

Ban On Long Tarmac Delays Close To Being Passed

If Senator Barbara Boxer has her way, the Senate’s Federal Aviation Administration Air Transportation Modernization and Safety Improvement Act will soon require airlines to “deplane passengers after three hours and would require [the airlines] to provide basic services such as food and water while they are waiting on planes.” The requirement is in the current version of the bill, and Boxer and another Democrat, Senator Amy Klobuchar, have threatened to filibuster it if the language is removed.

Congressman Introduces Bill To Oversee Cemeteries

Remember Burr Oak this past summer? That was the Chicago cemetery that dug up bodies and resold the graves to new customers. Well, yesterday a U.S. Representative from Illinois introduced the Bereaved Consumers Protection Act, a bill that would standardize record-keeping, make cemeteries accountable to federal officials as well as state, and protect consumers from shady business practices.

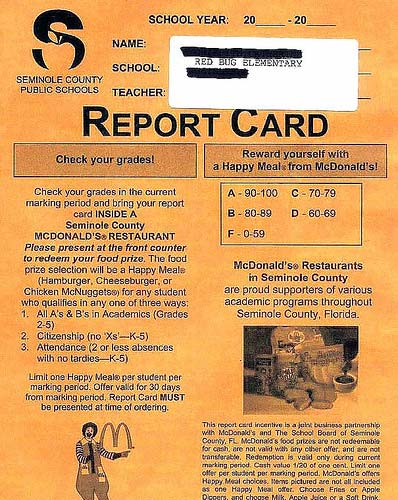

New Bill Proposes Study of Junk-Food Marketing in Schools

New legislation proposed in Congress today would require the U.S. Department of Education to study the nutritional value of foods available in schools, as well as the forms of food marketing. Sponsored by Representatives Carolyn McCarthy (D-NY) and Todd Platt (R-PA), the National School Food Marketing Assessment Act has a large roster of supporters, including the American Academy of Pediatrics, National Parent Teacher Association, American Heart Association, and the Center for Science in the Public Interest.

Should Banks Be Forced To Ask Permission Before Overdrafting Your Account?

Sen. Chris Dodd plans to introduce legislation that would require banks to get permission before allowing fee-generating overdrafts. Banks are on track to earn $38.5 billion in overdraft fees this year and, according to a study by the Federal Deposit Insurance Corp, most banks offer the “service” automatically. Common “features” of the programs include not notifying customers when an overdraft is about to occur, not offering them a chance to cancel the transaction, and processing the transactions in ways designed to increase the number of fees.

Banks Cling To Overdraft Fees Because They Need Them To Survive

Banks now make more on debit card overdraft fees than credit card penalties—they’ll rake in about $27 billion in 2009 alone, according to the New York Times. They obviously have zero incentive to curb the practice. In fact, one economist told the paper that “45 percent of the nation’s banks and credit unions collect more from overdraft services than they make in profits.”

Health Insurance Companies Hope For Reform For Excuse To Sell Cut-Rate, Shoddy Insurance

Here’s a dart to deflate the feel-good dreams of universal health care — those nefarious, profiteering insurance companies are actually hoping it passes.

What Does Health Care Reform Mean For You?

The debate over health care reform has devolved into scaremongering with death panels and rationed care. What’s really going on, and what does it really mean for you and your family? Inside, the New York Times breaks down the competing bills…

AmEx, Discover Ditch Overlimit Fees

American Express and Discover will no longer bill customers who exceed their credit limits, according to company spokespeople. The creditors aren’t eliminating the fees because they care about their customers. No, they’re providing what American Banker calls “the first concrete examples of how a new law will restrict issuers’ abilities to turn a profit.” The new CARD Act that Congress passed in May requires consumers to opt-in before they can exceed their credit limits. Since overlimit fees, which can reach $39, aren’t very profitable for creditors, they decided to ditch the fees altogether.

Another Arbitration Firm Pulls Out Of Credit Card Arbitration

Just days after the National Arbitration Forum agreed to stop arbitrating consumer credit card disputes, the American Arbitration Association has decided to do the same. This is good, but passage of the Arbitration Fairness Act is still necessary.

Airline Passengers Bill Of Rights Lurches Down Congressional Runway

Tomorrow, a Senate committee will hold a hearing on legislation that grants passengers the right to deplane if their plane is delayed on the runway for more than 3 hours. The legislation will also require that airlines provide water, food, and bathroom facilities during delays. If passed, it will be ignored by Delta.

Enlightened Nation To Banks: Either Explain Excessive Fees Or Eliminate Them

Australian consumers will soon be able to challenge any bank fee that they consider “unreasonable,” thanks to a new law that could save consumers up to $1 billion. Banks that want to keep levying excessive fees for late payments and overdrafts will need to prove that the charges are reasonable by revealing the true processing costs behind the fee.

Here Comes The Consumer Financial Protection Agency!

Shhh, everyone, gather near and listen to Treasury Secretary Timothy Geithner deliver the most beautiful, wonderful mandate we could give to a new federal agency: “The agency will have only one mission—to protect consumers.” And with that, the Treasury Department sent to Congress legislation that will create the brand new Consumer Financial Protection Agency.

Bill Would Boost The Size Of Carry-On Bags, Charge TSA With Enforcement

H.R. 2870 would require all airlines to accept slightly larger carry-on bags, which is great if you actually abide by the published carry-on limits. If you don’t, well, get ready to change your scofflaw ways because the TSA will enforce the new limits, and even slightly oversized bags won’t make it past security checkpoints.

New Law Would Let FTC Stop ISPs From Capping Broadband Usage

We’ve looked at Time Warner Cable’s unnecessary, overly greedy attempts to slap meters on broadband usage before, and it’s clear to everyone but TWC that metering Internet is bad policy, but now Congressman Eric Massa (D-NY) is setting out to make the practice illegal.