On Friday, a federal judge signed off on a settlement that will have JPMorgan Chase paying out at least $300 million to around 750,000 mortgage borrowers. It’s the first of what could be several large settlements with major lenders over the issue of forced-place insurance. [More]

jpmorgan chase

Justice Dept. Sued Over Validity Of $13 Billion Chase Mortgage Settlement

Remember back in November when JPMorgan reached the massive $13 billion settlement with the Justice Dept. over allegations tied to toxic mortgage-backed securities sold to investors before the housing market went kerflumpp? A non-profit group filed suit today against the DOJ, challenging the validity of the deal and asking for a court to review it. [More]

JPMorgan Chase To Pay $614M In Settlement For Defrauding Federal Agencies

JPMorgan Chase & Co. is running up quite the legal tab this year. On Tuesday, that tab grew by $614 million when the company agreed to settle its latest legal woe with the U.S. government. [More]

Too Big To Jail? Not So Much Says Attorney General Eric Holder

There’s no such thing as too big to jail. We’ve heard the saying a number of times since the 2008 financial crisis, but now Attorney General Eric Holder is attempting to put a stop to assumptions that financial institutions and their executives are too large to be indicted. [More]

Citi To Replace Debit Cards Linked To Target Hack

A month after Target first revealed that its in-store credit and debit card payment system had been breached, Citi has finally announced plans to replace all debit cards for customers whose account information was stolen in the hack. [More]

JPMorgan Chase To Pay $2 Billion For Failing To Notice Madoff Was Giant Scheming Schemer

It’s only the first week of January and already it’s an expensive year for giant bank JPMorgan Chase. Just blame Bernie Madoff. [More]

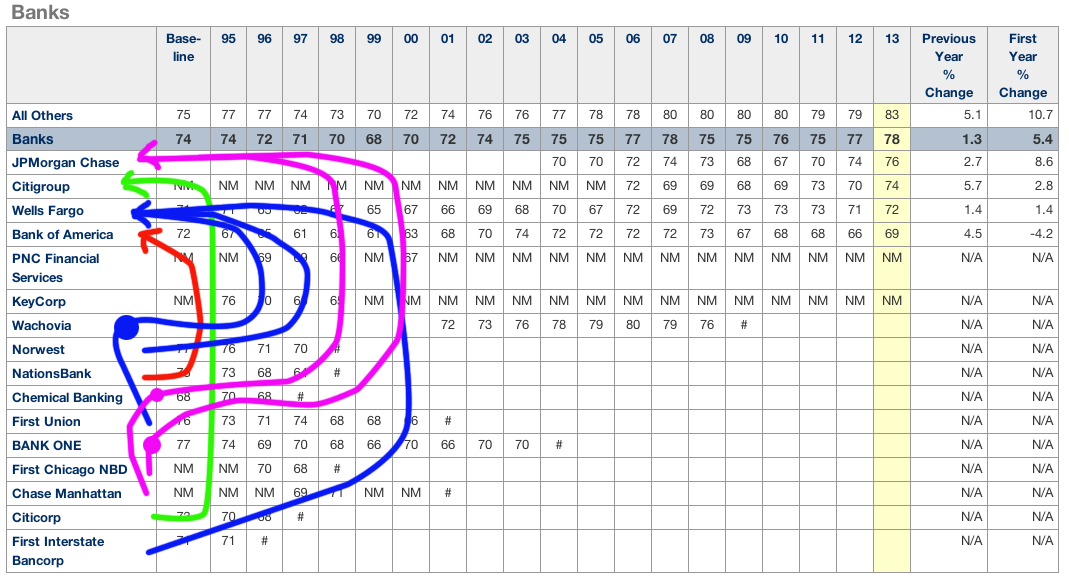

This Bank Customer Satisfaction Chart Is A Sad Reminder Of Rampant Consolidation

Maybe last week’s news that there are now fewer banks in the U.S. than ever before didn’t bother you. But here’s a chart of historic customer satisfaction scores that stands as a reminder of how so many banks have been absorbed into larger banking Voltrons in just the last two decades. [More]

$13 Billion JPMorgan Settlement Includes $4 Billion In Consumer Relief

Today, it’s expected that JPMorgan Chase and various federal agencies will announce a settlement worth a total of $13 billion to put to bed numerous bank-related investigations tied to mortgages and mortgage-backed securities. And about 30% of that money is reportedly earmarked for some form of consumer relief. [More]

Chase To Pay $389 Million Over Illegal Charges For Credit-Monitoring Services

It’s not been a banner week for JPMorgan Chase, which has agreed to pay out nearly a billion dollars to close investigations related to the 2012 “London Whale” trading fiasco, and now is told it must pay out $309 million in refunds and $80 million in penalties over illegal credit card charges for ID and fraud-protection services customers never ordered. [More]

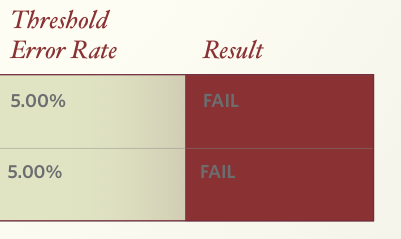

Big Banks Failing To Comply With All The Rules For National Mortgage Settlement

Remember that massive $25 billion settlement between the nation’s largest mortgage servicers — Bank of America, Wells Fargo, Chase, Citi, Ally — and attorneys general from around the nation? Well, it comes with a lot of rules for these institutions to follow. But the person in charge of monitoring the settlement says most of the banks are failing to comply fully. [More]

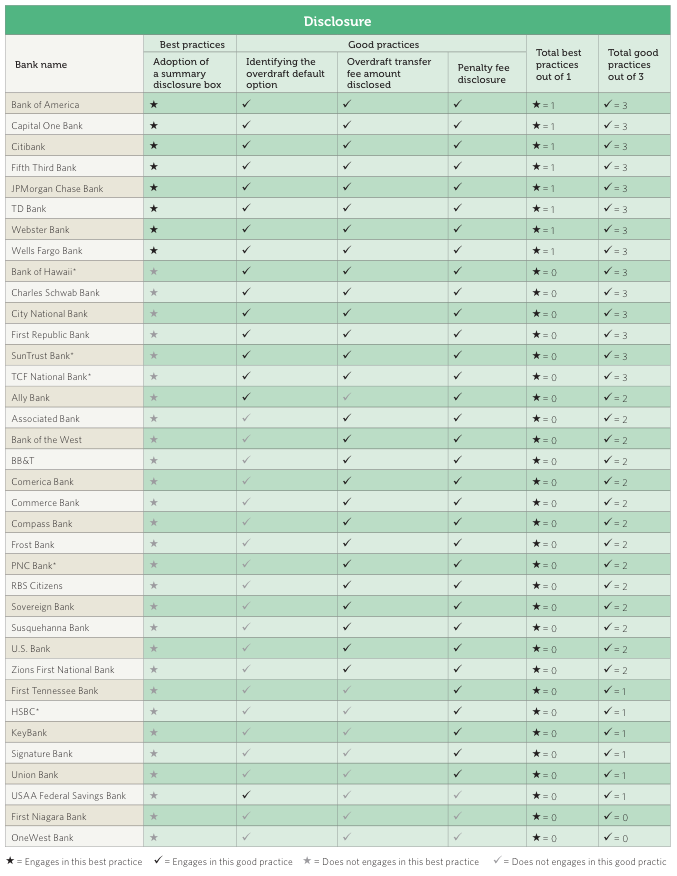

Consumer-Friendly Checking Account Practices Vary Wildly From Bank To Bank

Unless you’ve been hiding under a bed for the last six years, you probably know that the banking industry isn’t exactly beloved by many American consumers. As a reaction to public sentiment (and threats of regulation), a number of banks have begun phasing in some more consumer-friendly practices, but a new study shows these changes are not industry-wide and that several banks are still years behind. [More]

California Sues JPMorgan Over How It Collected Credit Card Debt

If the big banks thought they were out of the clear, well, they thought wrong. This time it’s California going after JPMorgan, suing the company over claims that it used aggressive and illegal tactics to collect credit card debt from thousands of consumers. [More]

Chase Won’t Stop Robocalling About My Low Account Balance: I Don’t Have An Account

Late last year, Dennis got a new phone number. That shouldn’t be anything to complain about, and indeed he has no complaints about his mobile carrier or about his new phone. The problem is that Chase Bank keeps calling him about his account balance, which he would appreciate if he actually had an account with Chase or a low account balance. He does not. [More]

Congratulations, Jamie Dimon, You’re The Sexiest CEO In America!

The last week has been great for Jamie Dimon, CEO of JPMorgan Chase, or would be if he were a regular reader of Consumerist. Last Thursday, our readers voted his company to be less terrible than Bank of America in our annual Worst Company in America tournament. Today, our readers declared him to be the official Sexiest CEO in America! [More]

Worst Company In America Round 2: Bank Of America Vs. Chase

It’s time for Banker Battle 2013, as these two Wall Street Warriors take a break from trading toxic securities in order to trade some deadly blows to the head. [More]

Worst Company In America Round 1: Chase Vs. Wells Fargo

The tournament’s first banking battle gets Day Three of WCIA competition off with a bang! [More]

JPMorgan Chase Site Hit By Cyber Attack That Kept Some Users From Accessing Accounts

Banks are no strangers to cyber assaults on the sites customers use to access accounts, and it appears JPMorgan Chase was the most recent victim of such an attack yesterday. The bank said last night it was working to restore normal service after an unspecified amount of down time during the day. [More]