Consumer Reports cautions that buyers of popular hybrid vehicles may soon be ineligible to claim the Alternative Motor Vehicle tax credit. The credit sunsets when a manufacturer sells more than 60,000 qualifying vehicles, a figure Toyota has already reached.

The credit has already begun to phase out for Toyota and Lexus hybrids purchased after September 30, 2006, and others will follow suit as they reach the sales volume target. The 2006 Prius’ tax break, for instance, dropped in half to $1,575 if it was purchased after that date, and it will split again to $788 between April and the end of September, 2007. After that, the Prius rebate disappears altogether.

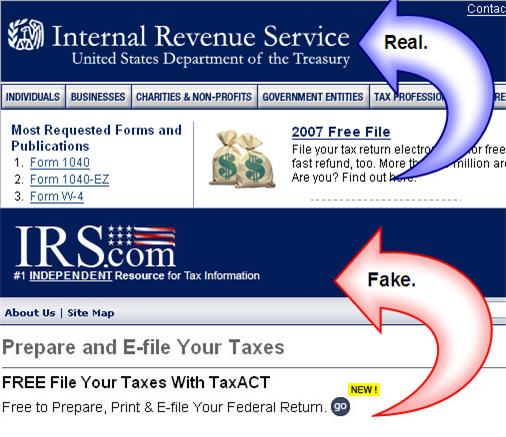

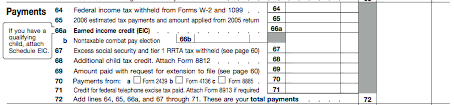

The IRS provides a list of models certified for credit. Available only to those not subject to the alternative minimum tax, the credit can be worth up to $3,150 for vehicles purchased after 2005. — CAREY GREENBERG-BERGER