December tax law changes mean 1040 filers claiming college deductions will have to take special steps.

IRS

File Taxes For Free If You Make Under $52k

You can e-file your federal taxes for free if your adjusted gross income falls below $52,000 using Free File from the IRS.

Two Free Tax Tools: DeductionPro and OrganizIT

Thanks to H&R Block, today is National Tax Advice day, and they’re offering two free tax prep tools.

I.R.S. Employ Of Private Debt Collectors Criticized

The national taxpayer advocated yesterday asked congress to forbid the IRS from using private debt collectors.

Do I Need To Report This Income?

The IRS wants to eat all your money. They don’t care where you got it, even if its from bribes or selling drugs.

HOW TO: Donate to Charity

It’s the end of the year, so we thought we’d offer some tips on charitable giving. There are only a few days left to donate items before the end of the year. Giving to charity is about more than just saving on your taxes, it’s also about helping a cause that’s important to you. You could save a panda, or cure a disease, or help someone who is hungry. Giving to charity is a way for you to decide where your money goes.

HOW TO Reduce Real Estate Taxes

How can you make sure you’re not paying too much real estate tax?

Charitable Cash Donation Deductions Now Require Proof

Blueprint for Financial Prosperity scrutinized the new IRS rules about charitable donations and found an important change.

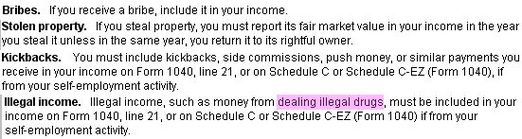

Don’t Forget To Declare Bribes On Your Taxes

When filling out the “other income” section on your taxes this year, there’s a few things you might forget to declare. Like your income from selling drugs. AllFinancialMatters spotted this while cruising the this years IRS FAQ.

Get Ready For Tax Time With 3 Folders

AllFinancialMatters has a suggestion for preparing for taxtime year round, something easy and low-energy you can do on a regular basis. Get three folders and label them Income, Expense, and Credits. File records accordingly. Ding!

IRS Axes Displaying Loan Pitches Alongside Tax Refunds

The IRS will no longer include pitches for high interest refund loans alongside its e-tax filing service.

Start Thinking About Filing Your 2006 Taxes

In this restive spot after Thanksgiving and before Christmas-time madness, why not start getting your taxes together? Blueprint For Financial Prosperity has a roundup of useful tax time articles. — BEN POPKEN

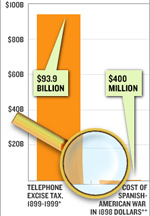

Consumers Get Refund For Moribund Telephone Tax

Next April, you can get $30-$60 in drinking money and whoop it up on Uncle Sam. The IRS announced a new deduction for consumers following the May repeal of a moribund long-distance telephone tax.

Oxymoronically, H&R Block Teaches Tax Classes

With $174 and 11 weeks, H&R Block will teach you to fuck up tax returns like the pros.

Mighty Morphin’ Tax Shelters Foil IRS

The NYT reports that tax cheating by the supperich may be so pervasive that the government doesn’t even have enough resources to fight it.

IRS to Cut 50% of Rich People Auditors

The federal government is moving towards cutting half of the IRS workers who audit the wealthiest Americans’ returns.