This may not come as a surprise to any of you, but those ads on the radio that offer to settle your debt to the Internal Revenue Service for a fraction of the bill may be a scam. [More]

internal revenue service

Tax Season Will Start Late This Year Due To Government Shutdown

Those 16 days the government spent shut down will have far-reaching consequences into the future. Basically the Internal Revenue Service just can’t get those two weeks back, and as such it’ll be delaying the start of the 2014 tax filing season by one to two weeks. [More]

Government Shutdown Furloughs IRS Taxpayer Advocates, Keeps Imposing Tax Levies

Earlier this week, we pointed out that just because most of the federal government is closed for business, that doesn’t mean citizens get out of our obligation to pay taxes. If what the IRS is asking you to pay is confusing or unfair, we usually recommend that readers turn to the Taxpayer Advocate Service. Those noble workers are furloughed during the shutdown. [More]

IRS Keeps Losing Couple’s 2010 Tax Return, Doesn’t Know Why

A California couple was trapped in the seventh level of bureaucratic hell. They aren’t just dealing with the IRS: they’re apparently dealing with a part of the IRS whose talent for losing paperwork rivals only Bank of America. They’ve sent in their 2010 tax return four times, and the IRS keeps losing it. [More]

H&R Block Sending $25 To Customers Impacted By Filing Delay

Last month the Internal Revenue Service said H&R Block had bungled over 600,000 tax returns, potentially causing refund delays for those customers. The tax preparation firm says to make up for that glitch, it’ll be sending out $25 gift cards to any customers who filed their taxes at company-owned H&R Block locations and were impacted by the processing delay. [More]

IRS Issued $11 Billion In Improper Refund Payments, Is Totally In Trouble With Mom

Someone’s got some explaining to do: the Internal Revenue Service sent out about $11.6 billion in payments it shouldn’t have, through the Earned Income Tax Credit program last year, according to a report by the inspector general. This isn’t going over well with its parents at the White House because that is way more than its allowance. [More]

IRS: H&R Block Causing Refund Delays After Bungling 600,000 Tax Returns

Many of us find the Internal Revenue Service’s income tax return pretty darn difficult to figure out, which is why companies like H&R Block exist — ostensibly, to help customers maneuver the complicated forms and get them a nice tax refund if possible. But it seems H&R finds those forms confusing, too. [More]

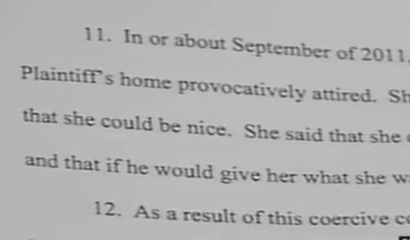

Oregon Man Claims IRS Agent Pressured Him Into Sex Or Face Tax Penalty

In a lawsuit filed against the federal government and an agent for the Internal Revenue Service, an Oregon man claims the agent used threats and harassment to pressure him into having sex against his will. [More]

The IRS Just Can’t Keep Up With All These Potentially Fraudulent Tax Returns

If you’re one of the two million people who filed a potentially fraudulent tax return last year, well, you’re causing the Internal Revenue Service to have a really rough time. That number is a sharp increase, up 72% from the previous year, and it’s giving the IRS a huge headache as it struggles to keep up. [More]

Average Income Among America’s 400 Richest Dropped 25% In One Year

Guess who’s making about $202.4 million? Not you, unless you happen to be among the 400 richest tax filers in the nation. While it might bum you out a bit not to be rolling around in piles of cash, those who live like Richie Rich are likely feeling a bit blue about the news because that 2009 average is down 25% from 2008 — and down from a peak of $344.8 million in 2007. [More]

What Would You Do With A $434,712 Tax Refund Check?

Coming into accidental money can be a heady thing — but while some of you might get a little nutty and go out and spend that “free” cash, we know others would return it. A Cleveland waitress spent her mistaken money only in her daydreams, musing about what she’d do with $434,712 from the Internal Revenue Service. [More]

Why Can't The IRS Just Calculate & File Your Taxes For You?

How come we all have to go through the terrible, awful, no good, very bad experience of mucking our way through filing personal income taxes every year, when the IRS already has all the numbers they need to calculate stuff for themselves? Well, because then tax preparation businesses would have nothing to do, and no money to make, of course. [More]

Tax Nuances That Could Get You Audited

By most accounts, Internal Revenue Service auditors aren’t much fun to meet with. Even if you’ve filed your taxes with impeccable precision, facing an audit can be nerve-wracking, so you’re best off making sure you aren’t tossing up any signs that draw attention to yourself. [More]

Tax Nightmare: What Did I Do To Deserve An Audit By The IRS?

Moaning and groaning won’t make it go away when the IRS comes a’calling with an audit. Ask the auditor what you did to deserve such a terrifying experience and you’ll likely be met with a shrug, or perhaps a vague reason involving some kind of forms. So really, why did they pick you? [More]

You Might Have To Pay Taxes On That Canceled Credit Card Debt

That credit card debt you had was canceled or forgiven — yay! But you might have to pay the Internal Revenue Service taxes on it anyway, so — boo. You’ll find out you owe money when a 1099-C tax form comes in the mail from your lender, and probably not before then. [More]

Watch Out For Tax Scams Pushing False Stimulus Credits

The Internal Revenue Service issued a warning for a tax preparation fraud involving phony credits based on stimulus packages. Hucksters are apparently targeting the elderly and tricking them into taking tax credits geared toward college students. [More]

Beware Of Identity Thieves Filing Fraudulent Tax Returns To Steal Your Refund

So you finally drag yourself to your desk/computer/accountant and get your taxes done. Good job. Now wouldn’t it just totally stink if you found out someone had already filed a tax return using your information, and that they’d snagged whatever refund you had coming to you? Yes, it would, which is why the Internal Revenue Service is warning people of just such a scam. [More]

Watch Yourselves, Moneybags: The IRS Says It It's Auditing More Of You Than Before

The Internal Revenue Sercice is onto you, millionaires, so you best be careful as to how you spend all that money and file your taxes right. The IRS revealed in an enforcement report this week that they’re auditing more wealthy taxpayers for 2011 than 2010. [More]