Statistics show that 80% of credit histories have at least one error. Most of them are minor and inconsequential but some can have an adverse effect on your credit score, often costing your thousands on mortgages and car loans. I believe credit bureaus were so lackadaisical about accuracy because it forced consumers to buy their credit reporting services. You wouldn’t know there’s an error unless you paid Equifax for a copy of your report. Fortunately, federal law now makes it possible for us to police our own records and force bureaus to correct them, all on their dime. Here’s how:

fico

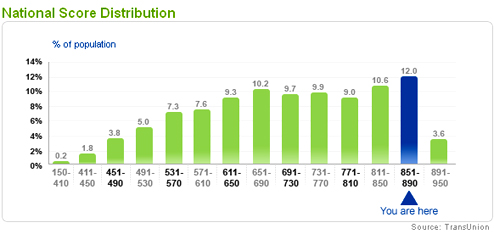

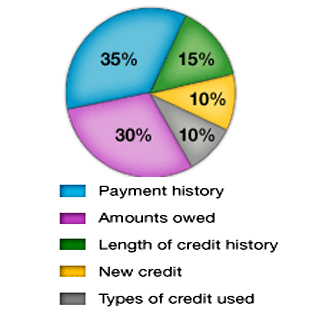

What Goes Into Your FICO?

How the heck do they figure out your FICO credit score? The five different factors, in order of decreasing importance are: 1) payment history 2) amounts owed 3) length of credit history 4) new credit 5) types of credit used. For a bit more detailed explanation on how each of these plays out, the “What’s in your FICO score” at myFico.com is a good place to start.

A World Where A 340 FICO Is "Excellent"

At first glance, this ad for CreditReportAmerica seems to have the credit score system reversed, with 350-619 listed as “excellent” and 750-840 listed as “poor”…but then you realize it’s actually a graphical depiction of the system shady mortgage brokers used to get when whoring up the sub-prime mortgage orgy. Travel blogger Mark Ashley says he spotted the ad on the frontpage of Yahoo Finance. At the bottom, the ad says the service does not include credit scores. Remember folks, the place to get a free credit report is annualcreditreport.com.

Paying Cards Off Doesn't Mean Reported Balances Are Zero

Personal finance columnist Liz Pulliam Weston saw Rebekah’s story yesterday, “Is It OK To Use Credit Cards For Everything, If You Pay Them Off Every Month?” and wanted to clarify something important. If you pay off the cards in full, the balances reported to the credit bureaus will not be zero. More likely, it will be the balance from your last statement. Liz writes:

Is It OK To Use Credit Cards For Everything, If You Pay Them Off Every Month?

Reader Rebekah has a question about credit cards. She and her husband pay off their cards every month, but like to charge most of their expenses because they enjoy the reward points. She’s wondering if this is a good idea and how it affects her credit.

Your Inactive Credit Cards Could Be In Danger

If you’ve got a few credit cards lying around that you haven’t used in a while but don’t want to lose, you might want to talk them out for a walk.

PRBC Helps You Create A Credit Score From On-Time Rent, Bill Payments

Payment Reporting Builds Credit (PRBC) is an alternative credit reporting agency that will record your payment histories for things like rent and utilities bills. PRBC says you can then use this verified credit history to supplement your FICO score and credit history from the big three reporting companies. It’s meant in part as a way to help people who don’t have extensive standard credit histories, or who have always paid monthly expenses on time but have other blots (like medical bills) on their official credit histories.

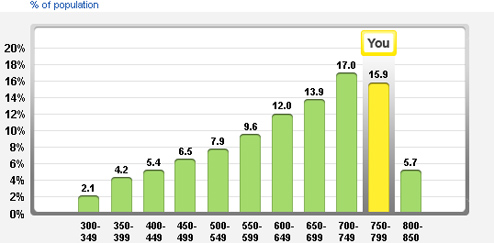

CreditKarma.com Makes Free Credit Score More Like FICO's

The CreditKarma.com site we told you about in our roundup of “5 No BS Ways To Get A Credit Score For Free” has changed its calibration system so the free, advertising-supported, credit score it gives you is now on the 300-850 range, just like your FICO score. It’s still not your FICO score, but it does make the approximation, based on TransUnion data, more relevant. If you’re do some major money moves, like getting a mortgage, you would still want to pay for the FICO score for total accuracy, but if you just want a general sense of how you’re doing, CreditKarma.com is a great way to do it for free.

Use Your Credit Card At A Marriage Counselor, See Your Limit Get Reduced

The FTC claims that CompuCredit didn’t properly disclose that it monitored spending and cut credit lines if consumers used their cards at certain places. Among them: tire and retreading shops, massage parlors, bars, billiard halls, and marriage counseling offices. “What they didn’t say was that you could be punished for specific kinds of purchases.”

Sallie Mae's 100+ Point FICO Drop Error Getting Fixed

Sallie Mae has publicly apologized for a coding error, potentially affecting around 1 million customers, that caused some consumers credit scores to drop over 100 points, and some consumers report that their dinged scores are already back up. If your score is not back to normal and you are in the middle of a transaction where your good credit is at stake, Sallie Mae said it will provide a credit reference letter. You can also call Sallie Mae customer service at 1-888-2-sallie. Sallie has pledged that the fix is in, but consumers can still take matters into their own hands by pulling their free credit report from annualcreditreport.com and disputing the incorrect information with Experian. Note, it’s against Federal law for creditors to report false information to credit bureaus, and consumers can sue violators up to $1,000.

FICO Scores Drop Over 100 Points After Sallie Mae Recode, Potentially Millions Affected

Consumers are complaining that a change in how Sallie Mae decided to recode some loans caused their credit score to drop by over a hundred points. That’s enough to make a $93,240 difference in a home loan’s total cost. Here’s what happened.

Is Your HELOC In Danger Of Being Frozen?

If you have an open home equity line of credit you were counting on for renovations or other projects, you might want to read CNN Money’s article about how lenders are freezing them around the country. The main triggers for HELOC freezing are credit score changes and a rapid drop in home value in your area. The freeze may also be a computer-determined action, so if your HELOC suddenly goes away and you don’t think it was justified, it may be worth checking your FICO score and then contacting the lender to reopen the line or renegotiate it.

AT&T Won't Sell Man GoPhone Because It Can't Verify His Credit History

Nathan’s been having trouble this week buying a prepaid GoPhone from AT&T Mobility’s website. He finally found out the reason: they couldn’t verify his credit history. This is confusing because it’s a prepaid GoPhone and because his credit history is superb. “Cheryl refused to transfer me.

How Much Do Credit Scores Really Matter?

Obsessing over a number that’s only three digits long sounds a little OCD, until you realize how much a hundred or so points on it can cost you. I’m referring to credit scores. This three-digit number that lenders use to determine how favorable a loan to give you can affect many of your financial transactions, but it especially becomes a big deal when you take out a mortgage on a house. Let’s look at a home loan for $300,000 with two different sets of scores:

Know Where To Fix Your Credit Score By Getting Your Reason Codes

If you want to improve your credit score, a score from 300-850 that lenders use to determine whether you qualify for a loan and how much interest to charge you if you do, you’ll want to know your “reason codes.” These are 2-digit numbers that come with you credit score when you purchase it. Each bureau usually gives you four reason codes with their report, so get your score from each one for a total of 12. One wiki tutorial says that reason codes are listed in order of importance. Armed with that, The Mechanics Of Credit site decodes all the reason codes and prescribes solutions for each one. With this info and tactics, you should be able to boost your score a couple of points and save a bundle.