Marketplace’s Paddy “Sexycakes” Hirsch whips out the whiteboard to explain the how and why of the latest gimmick the Fed is deploying to ease the financial crisis. Now they’re making “bad banks” which will go buy the toxic assets from the banks so they can clean up their books. Hopefully over time these assets will mature past their heavily discounted value and the taxpayers can make money on the deal. But if the situation deteriorates and too many of the assets go to zero, as some indeed may, then we’ll be sitting on a big fat goose egg, again. Video inside.

federal reserve

Federal Reserve: Don't Get Excited, We're Not Done Bailing Out Banks Yet

Federal Reserve chairman Ben Bernanke said that the $800 billion stimulus plan being discussed by the new administration might “provide a significant boost to economic activity,” but that it wouldn’t work without more bank bailouts.

Now Is The Time To Lock In Interest Rates With CDs

If you’re a saver, the Fed flipped you the bird this week. They dropped interest rates and introduced “quantitative easing,” two things that will make interest rates plummet. Here’s how you can protect yourself.

Fed Cuts Rates To ZERO. Yes, Zero. 0%.

The Federal Open Market Committee today established a target range of zero to 0.25% for its fed funds rate. This, as you might imagine, is unprecedented.

Stock Market Pleased By New Phase Of Bailout

Today the Federal Reserve announced the creation of a new special purpose entity that will buy consumer and business debt. Under the new plan, the Treasury will provide $20 billion dollars in of credit protection (from the Troubled Asset Relief Program) — and will absorb most of the losses, should they occur.

How Uncle Sam Killed The Liberty Dollar

There’s a new story in Triple Canopy about The Liberty Dollar, an alternative American currency started by Bernard von NotHaus that experienced a grassroots backing among some shoppers and merchants, until the Feds shut it down. Unlike the “real” dollar, Liberty Dollars are in fact…

American Express Becomes A Bank… And Wants Bailout Money

American Express won U.S. Federal Reserve approval to become a bank holding company — giving it access to the bailout party as credit card defaults climb. Bloomberg News says that the Fed waived the usual 30 day waiting period because (in the words of Fed Chairman Ben Bernanke) we’re experiencing “unusual and exigent circumstances affecting the financial markets.” Today, American Express has requested $3.5 billion in taxpayer-funded capital from the federal government, says the WSJ.

Greenspan Says That His Free-Market Ideology Was Flawed

Here’s something that probably doesn’t happen too often. Former Federal Reserve chairman Alan Greenspan had a crappier day than you did. He had to admit before our federal government that his free-market, anti-regulation ideology was “flawed.” Ouch.

Fed Chairman Discusses Passing Another Stimulus Package

Fed Chairman Ben Bernanke suggested today, while testifying before the House Budget Committee, that Congress should consider passing some sort of economic stimulus package that would improve access to credit by homebuyers and other borrowers.

What Does The Bailout Mean For You?

So, Congress finally passed the bailout bill. You know about the Treasury’s newfound $700 billion, and you’ve heard about the snipped golden parachutes, but what does the 451-page week-old shotgun savior of a bill actually mean for you?

It's "The End Of Wall Street As We Have Known It"

Goldman Sachs and Morgan Stanley will no longer be investment banks, says the New York Times. Instead, they will “transform themselves into bank holding companies subject to far greater regulation.”

Two Economists From The University Of Chicago Explain What The Hell Just Happened

It’s one thing to understand what just happened to the financial markets, and yet another to actually be able to explain what just happened. Thankfully, Steven Levitt from Freakonomics walked down the hall and found two economists from the University of Chicago (Doug Diamond and Anil Kashyap,) who gave him the best explanation I’ve been able to find about what the hell just happened.

AIG's "Strength To Be There" Commercials Are Suddenly Hilarious

When Treasure Secretary Henry M. Paulson Jr. and the Fed chairman, Ben S. Bernanke, convened a meeting with House and Senate leaders on Capitol Hill last night to discuss giving AIG an unprecedented $85 billion loan, do you think they had a laugh about AIG’s commercials? We picture Paulson saying something like, “Ha, ha, ha… ‘strength to be there.’ That’s rich! Rich! Ha! I’m on a roll!”

Consumers: We're Mad As Hell And We're Not Going To Charge It Anymore!

Once upon a time, Peter Finch won an Oscar for telling us to go to our window, open it, and yell, “We’re mad as hell and we’re not going to take this anymore!” Now thousands and thousands of consumers are doing just that, but instead of yelling out their windows, they’re yelling at the Federal Reserve in the form of a record breaking number of public comments about some proposed credit card reforms. Not as sexy as yelling like a madman, but far, far more effective.

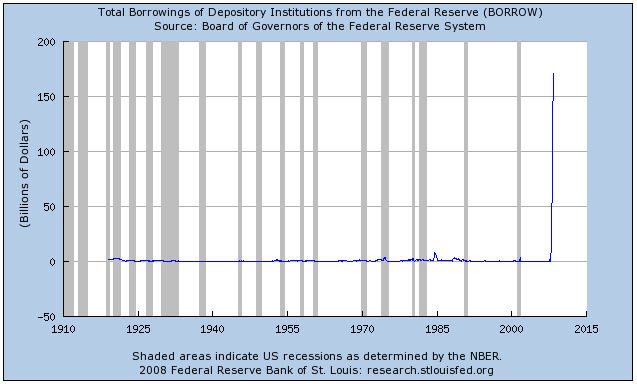

So, How Much Money Are Banks Borrowing Thanks To The Mortgage Meltdown?

Here’s a graph from the Federal Reserve Bank of St. Louis that shows, historically, how much money banks have borrowed from the Federal Reserve.

Federal Reserve Chairman Thinks High Gas Prices Are Here To Stay

Federal Reserve Chairman Ben Bernanke told congress today that he expects the economy to stay sluggish, and was extremely pessimistic about the price of oil in the future. Despite the the airline industry’s open letter to consumers claiming that speculators are driving up the price of oil and causing a commodities bubble, Bernanke doesn’t agree.

U.S. Treasury Attempts To Save Freddie, Fannie, Avert Apocalypse

This Sunday the Bush administration asked Congress to approve a “rescue package” that would give officials the ability to inject “billions of federal dollars” into Freddie Mac and Fannie Mae. The Federal Reserve also announced that it would make its short-term lending programs available to Freddie and Fannie, said the NYT.

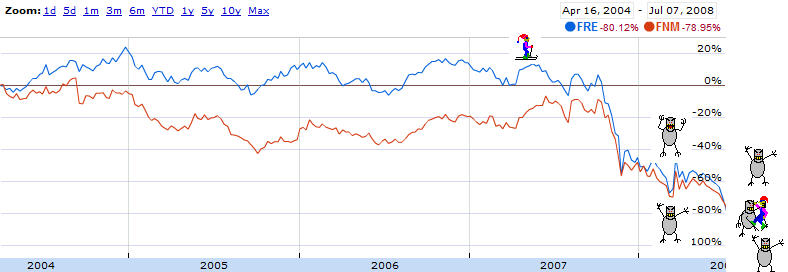

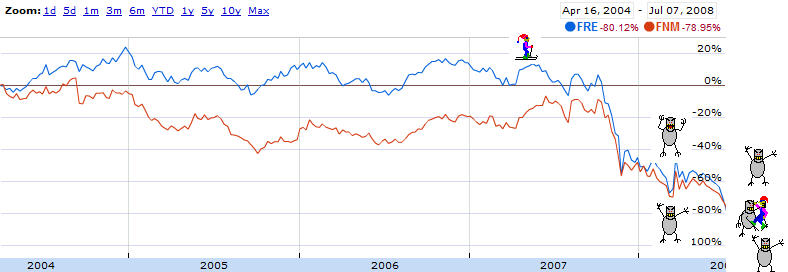

Mortgages Of The Apocalypse: Are Freddie And Fannie Going To Collapse?

Freddie Mac and Fannie Mae, the “government sponsored” enterprises that are supposed to bail us out of the current mortgage crisis, may be in danger of collapsing, according to William Poole, the former president of the St. Louis Federal Reserve, who told Bloomberg the companies are already “insolvent.”