Good news? Federal Reserve Chairman Ben Bernanke says that the recession is over, but that it won’t really stop the rise of unemployment — currently at a 26-year high of 9.7%.

bernanke

Fed: The Economy Is Recovering — Even If Nobody Has A @#$*@* Job

Fed Chariman Ben Bernanke testified before the House Committee on Financial Services today, reassuring lawmakers that the bailouts were working — but cautioned that they shouldn’t expect their constituents to have jobs again until 2012.

Bank Of America CEO: We Had To Acquire Merrill Lynch To Save The Economy

Are you a Bank of America shareholder who is angry at CEO, (and former chairman of the board) Ken Lewis for going ahead with the Merrill Lynch deal? Well, you’re just mean. It wasn’t his fault. At least, that’s what he’s just testified before the House Committee on Oversight and Government Reform.

Good News? United States Shed 532,000 Jobs In May

A report from a private employment service says that US employers shed 532,000 jobs in May, less than in April, but not much less. It’s also less than expected.

Fed Chairman: A.I.G. Was Essentially Running An Irresponsible Hedge Fund

Fed Chairman Ben Bernanke told the Senate Budget Committee he was “angry” at A.I.G. for exploiting a loophole in the regulatory system in order to run what was essentially a hedge fund tied to an insurance company.

Federal Reserve: Don't Get Excited, We're Not Done Bailing Out Banks Yet

Federal Reserve chairman Ben Bernanke said that the $800 billion stimulus plan being discussed by the new administration might “provide a significant boost to economic activity,” but that it wouldn’t work without more bank bailouts.

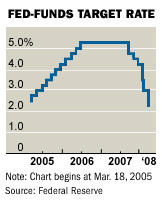

Fed Cuts Rates To ZERO. Yes, Zero. 0%.

The Federal Open Market Committee today established a target range of zero to 0.25% for its fed funds rate. This, as you might imagine, is unprecedented.

../..//2008/10/15/the-dow-fell-500-points/

The Dow fell 500 points after Fed Chairman Ben Bernanke gave a speech about the state of the economy. If you’re interested, the text of the speech can be found here. [CNBC]

Finance Officials Beg Congress To Give Them $700 Billion

Treasury Secretary Henry M. Paulson Jr. was not warmly received at today’s bailout hearing when he stared down an angry and disenchanted Senate Banking Committee. Federal Reserve chairman, Ben S. Bernanke, who appeared with Mr. Paulson, warned that unless Congress gave Mr. Paulson $700 billion that “inaction could lead to a recession.” Oooh, they said the “R” word….

AIG's "Strength To Be There" Commercials Are Suddenly Hilarious

When Treasure Secretary Henry M. Paulson Jr. and the Fed chairman, Ben S. Bernanke, convened a meeting with House and Senate leaders on Capitol Hill last night to discuss giving AIG an unprecedented $85 billion loan, do you think they had a laugh about AIG’s commercials? We picture Paulson saying something like, “Ha, ha, ha… ‘strength to be there.’ That’s rich! Rich! Ha! I’m on a roll!”

Federal Reserve Chairman Thinks High Gas Prices Are Here To Stay

Federal Reserve Chairman Ben Bernanke told congress today that he expects the economy to stay sluggish, and was extremely pessimistic about the price of oil in the future. Despite the the airline industry’s open letter to consumers claiming that speculators are driving up the price of oil and causing a commodities bubble, Bernanke doesn’t agree.

Another Deep Rate Cut From The Fed

The Federal Reserve Open Market Committee today announced a rate cut of 75 basis points to 2-1/4 percent.

Fed Cuts Rate by Half Percentage Point

The Fed cut interest rates by half a percentage point this afternoon, citing “tightening of credit conditions” that have the potential to “intensify the housing correction.”