The Federal Reserve has proposed some new regulations that would, among other things, require banks to let you opt-out of the “overdraft protection” services that often result in consumers being charged large fees for buying one too many (or 6 too many) packs of gum with their debit cards. The Center for Responsible Lending thinks the programs should be “opt-in”. Either way, without the overdraft program, your debit or atm transaction would be denied for non-sufficient funds and you would not be charged a overdraft fee.

federal reserve

Treasury Secretary Calls For Supercharged Fed, Streamlined Regulatory System

Treasury Secretary Henry Paulson wants to consolidate the nation’s financial regulators into a tripartite gang that can save the economy from distress and doom. The plan to give the Federal Reserve broad new regulatory powers and streamline the regulatory community has been in the works since last March, before the start of the subprime meltdown. Paulson is worried that the U.S. markets are no longer competitive with maturing world markets, some of which aren’t hampered by nuisances like regulation. After the jump we’ll explain the consumer impact of the plan and introduce you to your three new regulators.

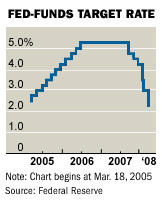

Another Deep Rate Cut From The Fed

The Federal Reserve Open Market Committee today announced a rate cut of 75 basis points to 2-1/4 percent.

Critics Decry Feds' Weak Predatory Lending Plan

The Fed proposed new sub-prime lending rules designed to protect consumers from predatory lending practices, in the future. You know, because the most important thing is to prepare for the next sub-prime meltdown. Critics were quick to lambaste the plans:

What The Fed's Rate Cut Means For You

The Fed’s recent quarter-point rate cut could either mean more or less cash in your pocket, depending on what you accounts you own. Here is the breakdown:

Stash Your Cash In CDs Now

The Federal Reserve Board is expected to cut interest rates soon, and you can bet that banks will quickly follow their lead and slash rates on savings accounts and certificates of deposit. By purchasing a CD now, you can lock in favorable rates ahead of the Fed’s September 18 meeting. From the Chicago Tribune:

“Banks usually are really fast to cut rates and slow to raise,” he said.

Fed Issues Guidelines To Prevent Subprime Implosion Redux

•Refinance Opportunities: Prior to any rate increase, consumers will have 60 days to refinance the loan.

Trade groups find fault with the regulations because they will prevent risky borrows from receiving credit:

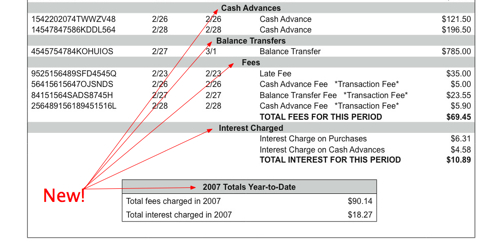

Credit Card Companies Cheer New Regulation?

The Federal Reserve Board wants credit card companies to clean up their act, and the credit card companies couldn’t be happier. The Fed’s proposed regulation would give customers 45 days notice before a change to their card’s terms, require fees and interest to be shown separately on each bill, and would transform default APR into the more menacing-sounding penalty APR. None of this is objectionable to the credit card companies:

“We strongly agree that improved disclosures empower consumers to make better choices in our competitive marketplace,” said Edward Yingling, head of the American Bankers Association, a lobbying group that represents the biggest credit-card issuers.

We tell you why creditors are grinning, after the jump…

No, Really, WaMu Gave Out Counterfeit $100s

Despite the horde of commenters asserting he got slipped fake $100s by an African Safari company, reader BC persists in laying the blame on WaMu.

WaMu Gives Out Counterfeits, Doesn’t Care

BC hit a hiccup on his African safari honeymoon. When he went to pay the adventure company with $100s his wife took out their WaMu bank in ATM, three of the Franklins turned out to be counterfeit.