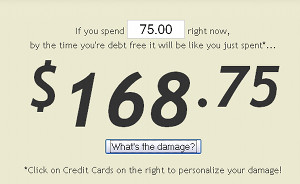

One of the most important lessons students learn in college is how to get into debt and stay there. It’s crucial to the success of the Republic. An indebted population is easier to control; needing to pay off crushing debt – a debt that if defaulted on has been stripped of many normal consumer protections and rights – graduates more willingly shuttle into cubicles, becoming the square pegs demanded by the square holes. After a few futile years of floundering idealism, their souls have been successfully jackbooted into powder and they’re ready to keep the thumb on the next generation of would-be drones so as to protect their empire of matchsticks. But how did we get here? This chunky infographic examines the origins and (d)evolution of the student loan leviathan. [More]