Let’s play a game. Can you figure out who said the following? “You’re a loser. Why don’t you just jump in front of a train?” “You a f***ing thief, you know. “I’m gonna find you and you gonna be walking like a b***h on the side of the street.” “I’m the guy who’s gonna end your life. That’s who I am.” Find out the answer after the jump! [More]

debt

Fighting About Money Frequently Increases Risk Of Divorce

You already know that it’s not healthy to fight about money all the time, but it might be a bigger risk factor for divorce than you think. A 2009 University of Virginia study found that couples who argue about finances every a week are 30% more likely to divorce than those who argue less frequently. In addition, a couple that marries with no assets are 70% more likely to divorce in three years than a couple bringing $10k in assets into the union. [More]

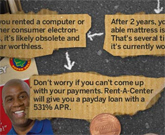

Rent-A-Center Responds To Predatory Lending Infographic

Sonia, Rent-a-Center’s Public & Community Affairs person, saw our popular post, “How Predatory Lending Works, From Payday Loans To Rent-To-Own” and has a rebuttal that shows how they do math. I showed it to Jess, the creator of the infographic, and he has a rebuttal to the rebuttal. Let the chips fall where they may: [More]

My Dental Bill Was Sent To Collections By Mistake – Who Do I Pay Now?

S. writes that in 2008, she owed a lot of money–about $8,000–to her dentist. She worked out a payment plan with the office, and asked them to auto-bill her credit card every month. They frequently forgot to bill her, but she wasn’t too concerned about the situation. At least, until a debt collector called her, saying that the dentist had sold her balance to them. The dentist’s office claims that this is a mistake. Now both entities want S.’s money, and she’s not sure who she should pay. [More]

Late Payments Are Dropping Thanks In Part To The CARD Act

Banks and card issuers warned against the credit card reforms that went into effect a few months back, but so far it’s been a good thing for consumers, according to new delinquency numbers. [More]

Some Homeowners Worse After Getting Rushed Into Gov't Loan Mod Program

Despite fulfilling every obligation under trial government-sponsored loan modification programs, some homeowners can end up far worse off than if they had never joined up at all, Propublica reports. That’s because if they’re denied a permanent modification, they have to pay the entire amount that was being discounted, often within a very short period of time. This pushes already strapped families past the breaking point. [More]

How Predatory Lending Works, From Payday Loans To Rent-To-Own

You’re a savvy, savvy consumer. You pay your credit card bills in full every month, auto-deduct a generous portion of your paycheck into savings, invest in index funds, and always make sure you’re getting the best deal from your cable and wireless providers. Unfortunately, some of your brethren do not read Consumerist and can get caught up in the jaws of predatory lenders, wasting limited cash on things like payday loans, bad credit cards, and using rent-to-own stores. So let’s take a walk down the wild side and see how each of these bad choices work, in a giant infographic, courtesy of Mint and WallStats, after the jump. [More]

Dow Jumps 400 On Euro Stimulus Loan News

Got whiplash? US and global indexes jumped on Monday, responding to news of a $1trillion European loan package to staunch their debt crisis. The rally reinstated the gains erased by a panicked sell-off driven by concerns that Greece’s debt crisis would infect other markets. [More]

Man Seals Self Inside Foreclosed Home

Now we finally understand the secrets of the pharoahs: a bunch of angry people in Stony Ridge, Ohio have sealed up a home with the homeowner inside, with his permission, leaving only a golf ball-sized hole in the front door. The man, Keith Sadler, says he fell behind last year after paying on his mortgage for 12 years, and that his bank promised to work with him but instead proceeded with foreclosure. [More]

Supreme Court Makes It Easier To Sue Debt Collectors

Last week, the Supreme Court ruled that debt collectors can’t use a “bona fide error” defense to avoid being sued for misinterpreting the Fair Debt Collections Practices Act (FDCPA). In other words, if a debt collection agency makes a demand that’s in violation of the Act, it can’t say it didn’t know any better. Well, it can, but you can go right ahead and sue. [More]

What To Do If You Didn't File Your Taxes

So you couldn’t pay your taxes and you opted not to file them, or an extension, at all. Don’t sit around worrying about when the IRS will catch on and come after you; file them as soon as possible, writes consumer reporter Iris Taylor, so that you can set up a repayment plan and move on with your life. The sooner you do this, the sooner you can pay them off (you can take up to 5 years to pay them), and the less you’ll end up paying in penalties and fees over the long run. [More]

If You Were Broke, You Don't Need To Pay Taxes On Forgiven Debt

Here’s an important caveat to our “You Need To Pay Taxes On Forgiven Credit Card Debt,” post: you don’t need to pay the taxes if you were insolvent at the time the debt was discharged. [More]

You Need To Pay Taxes On Forgiven Credit Card Debt

If you had some credit card debt canceled in 2009 the IRS might want a piece of it. [More]

When Should I Make Extra Mortgage Payments?

We get a surprising amount of letters from people who regularly make extra mortgage payments. (Extra payments sometimes confuse the bank and causes headaches.) It seems like it would always a good idea to pay off debt if you can afford it, but with current mortgage rates as low as they are.. does it still make sense? [More]

Sued By Chase For $7k, In Debt For $40k+, I Think I'll Declare Bankruptcy

Justin’s friend who was being sued by Chase Bank for $7,500 has an update for us after he and his friend read our advice and your comments on his situation. Turns out he’s not just in debt for $7,500, but for over $40,000: [More]

Reader Pays Off $14,330 In 20 Months

Stuck in a $14,300 debt hole, reader Trixare4kids was dug herself out using tips she learned about on Consumerist. Let’s learn how she went on a personal finance rampage, learned to live frugally, did it all in 20 months, and how you can do it too! [More]