We’ve been toting quite a heavy load, economically speaking but it appears that for the average U.S. family, the debt burden has been lightened to where it was before the recession. That means that all of the unwieldy home mortgage debt, credit card debt and other debt loads have been trimmed down, making us more aerodynamic as we try to speed toward economic recovery. [More]

debt

More Than 1-In-5 Students At For-Profit Colleges Default On Student Loans Within Three Years

For the first time, the Dept. of Education has provided stats for people three years into their student loan repayments, and the numbers don’t paint a pretty picture. The percentage of college students defaulting on their loans is on the rise, with 9.1% of recent students defaulting within two years of their first payment coming due, and a whopping 13.5% defaulting within three years. And at controversial for-profit colleges, that number is alarmingly higher. [More]

We Cosigned Our Unemployed Son's Student Loans. Now We're Screwed

If you retain one piece of information from reading this site, let it be this one: never co-sign anyone’s student loans. Not your spouse’s student loans. Not your best friend’s student loans. Not your nephew’s student loans. Not even your own child’s student loans. It is the worst possible kind of debt to assume on behalf of someone else. The balances can be huge, the debt can’t be discharged in bankruptcy, and there’s nothing to repossess. That’s what anonymous parents M and D have learned, the very hard way. [More]

Justifications For Going Into Debt

It’s usually wise to avoid spending your way into the red, but sometimes it makes more sense to go wild and take on some debt rather than play things conservatively. [More]

Not-So-Fun Facts About Home Equity Lines Of Credit

Homeowners whose property is worth more than what they owe have the option of using their equity to get a hold of more money. Home equity lines of credit can fund education expenses, home improvements or help you pay off debt with higher interest. The credit can be a lifesaver, but can also get users in trouble. [More]

Despite What TV Commercials Tell You, Cars Aren't Gifts

There are some occasions in which cars can be gifts. Say, you turn 16 and your parents give you the hunk of junk in the garage that barely runs. Or you’re on The Price is Right and Drew Carey tells you you’ve just won one. Other than that, the image — popularized by commercials — of a new car with a giant bow on it sitting in the driveway on Christmas morning are nothing more than an attempt at inception by ad wizards. [More]

Banks Agree To Take 50% Loss To Ease Euro Zone Crisis

European banks this morning agreed to take a 50% loss on Greek debt, a critical step towards ending the financial crisis gripping the euro zone. [More]

Top 10 States With Highest Debt Per Capita

Are you in a state that has saddled its citizens with a big debt load per person? This list tells you. It may surprise you that the state with the highest debt per capita is also the one with the most penny loafers per capita. [More]

4 Things Debt Collectors Won't Tell You

Of all the industries the Federal Trade Commission receives complaints about, debt collectors are involved in the most, accounting for around 27% of all complaints received in 2010. A big part of the problem is misinformation about the rules regarding what debt collectors can legally say and how nuch authority they actually have. [More]

Obama's Debt Reduction Plan Includes Letting Debt Collectors Robo-Call Cellphones To Collect On Federal Student Loans

One part of the debt-reduction bill Obama sent to Congress is a provision that would let debt collectors robo-call cellphones to collect on what’s owed to the government, like federal student loans. [More]

How To Tell Whether A Debt Is "Bad" Or "Good"

While most types of debt will financially hobble you and should be eliminated as soon as possible, other varieties can enrich you. Those who distinguish between the effects of debts and tune their financial plans toward paying down the most destructive types will sit the prettiest. [More]

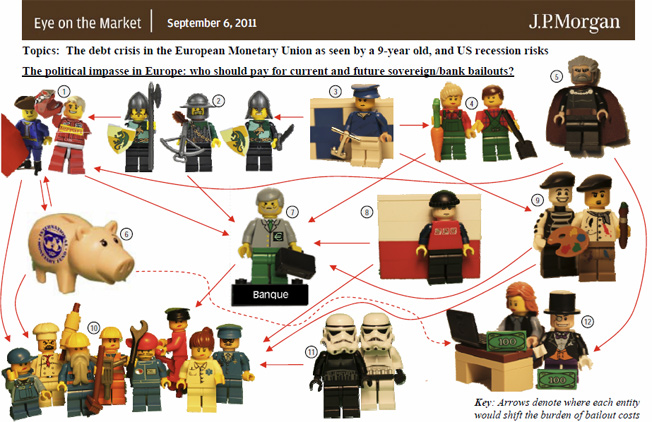

JP Morgan Explains Euro Debt Crisis With Legos. Really.

In order to explain the Euro debt crisis, Michael Cembalest, the Chief Investment Officer of JP Morgan’s private bank, sent around a research note that used Legos to depict the different players. The Legos were fashioned by his 9-year old son. This really happened. Here’s the legend to explain which parties each figure represents, or you can play a fun game and guess on your own first. [More]

Buffett Begs Congress To Raise His Taxes

Famous uberrich guy Warren Buffett has penned a NYT editorial begging Congress to please, please, raise his taxes. Last year, he writes, they were only 17.4 of his taxable income. He says folks like him, who make over $10 million a year, are treated by Washington “as if we were spotted owls or some other endangered species.” It’s time to stop the “coddling,” he says and make the super-rich pay their fair share. [More]

Chase Drops Thousands Of Debt Collection Cases Against Borrowers

Chase is dropping thousands of pending debt collection cases against defaulted credit card borrowers, WSJ reports. Remember the big deal over robo-signing foreclosure cases a few months ago? The problem of bulk signing sloppy paperwork, and, in some case, filing fraudulent documents, could be even bigger when it comes to credit cards. It looks like JP Morgan Chase is trying to get its house in order before they’re forced to by government and legal forces. [More]

Class Of 2011 Have Most Debt Of All Time

Congratulations, graduating class of 2011. You’ve pulled all-nighters, subsisted on ramen for weeks, and worn pajamas to class, all to achieve the beautiful shining goal of a college degree. Add to that another distinction, one that probably won’t be mentioned during too many commencement speeches. You’re also graduating with the highest debt of all time, an average of $22,000 a person. Hope that business about a degree giving you a higher earning potential is true, because you’re gonna need it. [More]

Forgiven Credit Card Debt Over $600 Is Taxable Income

Did you negotiate a debt settlement in 2010 on your credit card? If the amount you knocked off is more than $600, LowCards notes, the IRS considers it income and you’ll have to pay tax on it. Sorry Charlie, you’re not out of the woods yet. [More]