If at first you don’t succeed try again… and again, and again. That appears to be the approach members of Congress are taking when it comes to a bill that would allow student loan borrowers to refinance their private and federal student loans. [More]

debt

Woman Wants To Back Out Of Buying House Saddled With $400K Debt, Blaming Winning Bid On Diet Pills

Feeling like maybe you shouldn’t have splurged on that shirt when you’ve already got a bunch like it already in your closet is one thing, but deciding you’d rather not own a home you purchased is an entirely other category of buyer’s remorse. A Florida woman is blaming her winning bid on a home that comes with a $400,000 debt on it on diet pills, saying they caused her to become confused. [More]

Student Aid Bill Of Rights Aims To Overhaul Federal Student Loan Repayment, Servicing Process

The way in which borrowers pay back their federal student loans – from checking the balance to filing complaints against servicers – is set to change with the signing of a presidential memorandum Tuesday. [More]

Credit Bureaus Agree To Revamp Practices For Handling Errors, Unpaid Medical Bills

Experian, Equifax and TransUnion – the three largest companies to collect and disseminate credit information for millions of Americans – must undergo an overhaul of credit reporting practices as part of an agreement with the New York Attorney General’s Office. [More]

Senators Chastise Govt. For Making Money Off Struggling Student Loan Borrowers, Not Offering Enough Relief

For several years now the government has offered federal student loan forgiveness programs aimed at helping borrowers to avoid defaulting on their debts. While recent reports have shown that the popularity of the programs has exceeded expectations, a group of six senators say the Department of Education could do more given the billions of dollars in payments it receives from federal loans each year. [More]

Current, Former Corinthian College Students Go On “Debt Strike,” Refuse To Pay Private & Federal Loans

With for-profit educator Corinthian Colleges Inc. selling off campuses and closing schools, thousands of Everest, WyoTech, and Heald College students are waiting to learn the fate of the more than $1 billion in private and federal student loan debt used to finance their education. While the Department of Education and the Consumer Financial Protection Bureau have worked to secure deals in which some of that debt will be forgiven, some students are increasing the pressure on such deals by staging a “debt strike.” [More]

Target Owes Minnesota-Based Businesses $3.8M Over Failed Canadian Stores

Target Corporation isn’t the only company losing money by closing its Canadian division. The retailer owes nearly $3.8 million to more than 60 businesses in Minnesota. [More]

New Requirement Aims To Curb Inaccurately Reported Medical Debt

Medical bills account for nearly half of all collections notices on consumers’ credit reports, affecting more than 43 million Americans. Meanwhile, it’s been shown that medical billing is fraught with errors and many consumers sent to collections for these debts are penalized too harshly. A new federal requirement hopes to reduce this overly negative impact of medical debt on credit reports. [More]

Poll: 1-In-5 Consumers Say They’ll Die While Still In Debt

Millions of Americans dream of the day that they exit the dark, desolate tunnel of debt and can live their lives without owing money to anyone. But sadly, a new report finds that most consumers actually have little hope of ever being debt-free. [More]

Debt Collection Is A Great Line Of Work For Ex-Cons

When a debt collector calls you, there’s a good chance that he or she might be an ex-convict calling you from a strip mall in Buffalo, New York. Buying and collecting debt is a lucrative business, and some people who had a rough upbringing have a real gift for it. Learn about the “Buffalo Talk-Off” and the Excel Spreadsheets of Doom. [NPR] [Planet Money] [More]

Why Does Negative Info Linger On Your Credit Report For Up To 7 Years?

Credit-related mistakes can follow you link a stink you can’t wash off. Have an account go into collections, miss payments on your student loans, credit cards, mortgage, car loan, and that info can linger on your credit report for up to seven years, even if it’s just a fluke. This is particularly a problem with medical debt, where even someone with otherwise pristine credit is unable to pay a huge hospital bill. So why is seven years? [More]

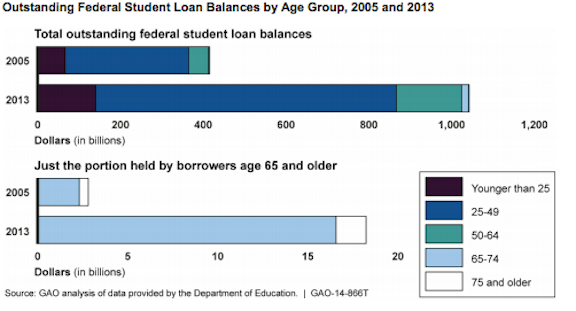

Report: Student Loan Debt Isn’t Just An Issue For Young Americans

When we talk about student loan debt it’s easy to picture a spry, young 20-something who is struggling to get out from under mountains of high-interest loans. But, as a new report points out, that’s not always the case, sometimes those who graduated even decades ago continue to struggle in paying back their student loans. [More]

Medical Debt Still Stinks, But New Credit Score Change Will Make It Hurt Your Life Less

Credit reporting behemoth FICO is making changes in the way it calculates credit scores. And for once, there’s some good news. The changes are expected to make it easier for most Americans to access credit — that is, to borrow money and take out loans — and will punish fewer consumers for incurring some debts that were out of their control. [More]

Parents Stuck With $200K In Student Loan Debt After Daughter Dies

The last thing families want to deal with after the death of a loved one is a phone call reminding them of their departed’s debt. But that’s the case for a number of parents who have inherited the obligation to repay the student loans they co-signed for their deceased child. [More]

Study: One Third Of Americans Have Debt In Collections

Sometimes debt isn’t so bad, and sometimes it is, but one thing is clear: 80% of Americans owe someone, somewhere, some money. It might be a mortgage or student loan, or a five-year-old fee that got forgotten about, but the vast majority of us have some outstanding debt. And worse: a third of the country may have debt collectors chasing after them for that cash. [More]

Illinois Files Suits Against Debt Settlement Companies That Allegedly Scammed Student Loan Borrowers

We already know that some debt settlement programs provide little relief for debtors, and consumers who contributed to the $1.2 trillion student loan debt tab appear to be the top target for these companies. Today, the Illinois Attorney General announced lawsuits against a pair of debt-settlement companies that targeted, and allegedly misled, student loan borrowers. [More]

Expected Bill Would Allow Private Student Loan Debt To Be Discharged In Bankruptcy

If at first you don’t succeed, try again with a more drastic measure. Just two weeks after a bill to allow private student loan borrowers to refinance at lower interest rates failed to gain traction in the Senate, a new bill expected to be introduced this week takes things a step farther. [More]

Report: Millennials Feel Overwhelmed By Debt, But They See A Bright Future Ahead

In news that is in no way shocking, millennials say they are overwhelmed by debt. [More]