NCLC: More Can Be Done To Protect Consumers From Hurtful Medical Debt On Credit Reports

Nearly four months after the Consumer Financial Protection Bureau reported that some credit bureaus were over-penalizing consumers for their medical debt, the National Consumer Law Center released a report [PDF] detailing just how the CFPB can protect consumers from unfair collection and reporting issues.

We already know that inaccuracies on credit reports can lead to low credit scores, which in turn, can create long-lasting negative effects on consumers’ lives – from getting jobs to renting or buying a home. And one of the areas of consumer debt that most often contains inaccuracies is medical debt the NCLC reports.

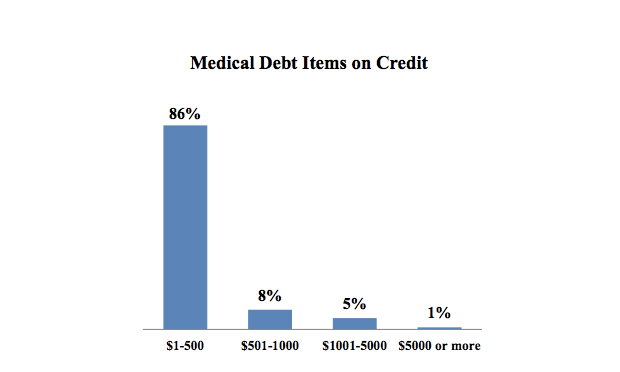

Nearly 75 million working adults experienced problems with medical bills in 2012 and more than 41 million adults were contacted by a collection agency for unpaid medical bills. The vast majority of these medical debts are for small amounts; the Federal Reserve found that over 85% of medical debts on credit reports were for bills under $500.

Yet, the debts tend to have more impact on a consumer’s credit than other forms of debt because of involuntary and often unplanned occurrences.

The NCLC report points out that medical debt collection items on a credit report are often not an accurate reelection of a consumer’s creditworthiness, something that was first reported by the CFPB in May.

That report found that the presence of medical debt on a credit report unfairly penalizes a consumer’s credit score, resulting in a credit score that is typically lower by ten points than it should be. For consumers who have medical debt on their credit reports that were paid off, their scores are up to 22 points lower than they should be.

And while the FICO changes may make the debt less devastating to consumers, the NCLC says it won’t be a true solution to the problem.

Instead, the NCLC report proposed that the CFPB tap into its authority to prevent some of the negative impacts of medical debt.

To do that the CFPB should:

• supervise larger medical debt collection agencies;

• require debt collectors to give consumers a notice before “parking” medical debt on their credit reports;

• prevent reporting of medical debt to credit reporting agencies before the consumer has a chance to dispute non-• payment of the debt with his or her health insurer or apply for financial assistance or charity care;

• prevent damage to a consumer’s credit report from medical debts that are disputed or result from billing errors;

• prohibit debt collectors from dunning low-income consumers for inflated “chargemaster” prices for medical care.

In addition to more oversight from the CFPB, the NCLC proposes that Congress could do more to protect consumers. While legislation that would require credit reporting agencies to delete paid or unsettled medical debt within 45 days was introduced in 2013, it hasn’t moved forward.

A second potentially helpful bit of legislation, introduced today by Sen. Maxine Waters of California, would provide consumers with the ability to avoid and fix problems on their credit reports that were created by wrong and outdated information – of which medical debt is a prime culprit.

“This proposal addresses many of the flaws with the existing consumer reporting system,” she said, “by making common-sense changes that enhance consumers’ rights, create more transparency over the consumer reporting and credit scoring process, and increase the accountability of credit reporting agencies, furnishers, and companies that develop credit scoring models and formulas.”

Among other things, the bill would shorten the amount of time that hurtful credit issues remain on a consumer’s report from seven years to four years. It would also remove all settled debts from the report.

A U.S. House Financial Services Committee hearing Wednesday, which included the NCLC report author Chi Chi Wu as a witness, addressed some of the issues regarding the roles and responsibilities of consumer reporting agencies and how they use information.

“The current credit reporting and scoring system is fundamentally flawed. It is an overly blunt instrument that treats consumers who have fallen on bad luck or hard times as being the same as consumers who are truly irresponsible,” Wu said during the hearing. “Many consumers have low scores because of job loss, illness, other extraordinary life circumstances” – as well as abuse by lenders, debt collectors and others. Some of these consumers could be good borrowers after their misfortune, and would certainly be good workers.”

While the hearing regarded a broad overview of the credit reporting system, testimony understandably included addresses to Water’s new bill.

Stuart Pratt, the president and CEO of Consumer Data Industry Association, detailed at the hearing how the reporting system is designed to retain data longer than it’s currently being used. And in order to get a clear picture of a consumer’s intent or ability to repay, credit issuers wold need to see in formation from before, during and after the Great Recession.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.