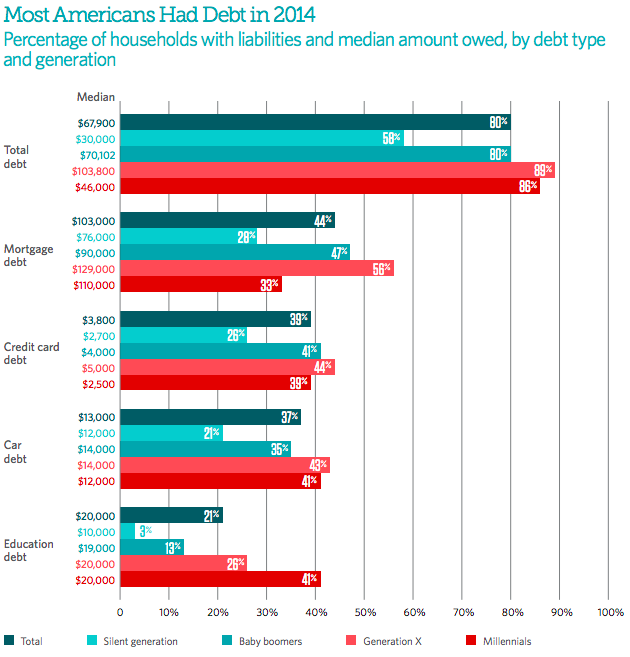

When most people think of debt, they probably conjure up a vision of consumers struggling to make ends meet after making unwise financial decisions. But that actually isn’t the case for most Americans. In fact, like other things, debt in moderation is actually a good thing. [More]

debt

Former Corinthian College Students Seek To File $2.5B Claim Against Bankrupt For-Profit Operator

Former students of now-defunct for-profit education chain Corinthian Colleges continued their fight to recoup the money they spent on classes at the company’s Heald College, WyoTech or Everest University campuses, filing a $2.5 billion claim against the bankrupt educator.

[More]

Discover Bank Must Pay $18.5 Million Over Illegal Student Loan Servicing Practices

As federal regulators continue to probe potentially unscrupulous student loan servicing practices, the Consumer Financial Protection Bureau has ordered Discover Bank and its affiliates to pay nearly $18.5 million in refunds and fines for, among other things, overstating amounts due on student loans and failing to notify borrowers of their rights. [More]

Agreement Could Temporarily Halt Legal Action On Loans For Some Former Corinthian College Students

Former Corinthian College students left with piles of debt after the company closed its Heald College, Everest University and WyoTech campuses earlier this year are getting a bit more relief, as the Department of Education announced it would temporarily suspend some legal actions related to borrower’s defaulted loans. [More]

Oregon Becomes Second State To Offer Free Tuition To All Graduating High School Students

Thousands of recent high school graduates in Oregon now have the chance to attend community college without the worry of accumulating loads of debt they may never be able to pay back, as lawmakers in the state recently approved a bill to establish the second program in the country to offer students help in paying for college. [More]

Regulators Shut Down Debt Relief Operation That Took Millions From Consumers

The Florida Attorney General’s Office and the Federal Trade Commission make a pretty effective pair when it comes to putting an end to companies and operations taking advantage of consumers. Just a day after the regulator and state’s attorney general teamed up to sue a company behind medical alert robocalls, the two entities announced they shut down a debt relief scheme that took million from consumers with credit card debt. [More]

Operators Of Massive Payday Loan Scheme Banned From Industry

The masterminds behind a massive payday loan scheme have agreed to be banned from the consumer lending industry to settle federal regulators’ charges they bilked millions of dollars from customers by trapping them into loans that were never authorized. [More]

Medical Debt Collector Must Pay Consumers $5.4M For Improperly Handling Disputes

What happens when you combine expensive — and often unanticipated — medical bills and overzealous debt collectors? An environment ripe for abusive, unfair collection practices. At least that appears to be the case for an operation that must pay $5.4 million in relief to consumers for allegedly mishandling credit reporting disputes and preventing individuals from exercising their debt collection rights. [More]

CFPB Report Finds 90% Of Student Loan Borrowers Who Seek Co-Signer Release Are Denied

Last year, the Consumer Financial Protection Bureau brought our attention to a relatively new phenomenon in which more and more private student loan borrowers found themselves placed in automatic default – even if they were up-to-date on payments – when their co-signer died or filed for bankruptcy. While the agency and consumer advocates urged these borrowers to seek co-signer release from their lenders, a new report finds that’s simply hasn’t been possible. [More]

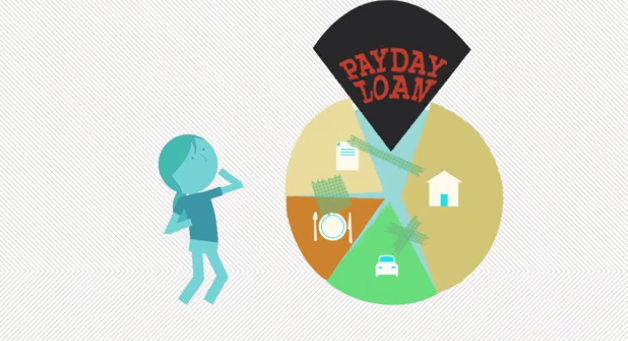

Pew Charitable Trusts Illustrates The Devastating Effects Of Payday Lending, How It Can Be Fixed

Back in March, the Consumer Financial Protection Bureau took its first long-awaited step in reining in the payday loan industry by releasing an outline for potential regulations over the small-dollar lines of credit known to thrust consumers into a devastating cycle of debt. While consumer groups were quick to applaud the steps, they also expressed concern that more could be done to protect people from the devastating consequences of such loans. This week, Pew Charitable Trusts released a video detailing the predicament nearly 12 million Americans face every year when taking out payday loans and how regulators might be able to find an answer. [More]

FTC Puts A Stop To Three Debt Collection Operations Using Threatening Text Messages, Robocalls

For the most part, we can’t say many glowing things about the debt collection industry that has, in the past, been known for using a litany of abusive and deceptive practices to pry money from consumers. Three such companies will no longer be bothering people after the Federal Trade Commission temporarily shut down the operations for engaging in nearly all of the hallmarks of shady collectors: threatening lawsuits or arrest, impersonating law enforcement and government officials and illegally contacting supposed debtors. [More]

Legislators Once Again Trying To Delay New Lending Protections For Military Personnel

The Department of Defense is trying to do something good for servicemembers by closing loopholes in the Military Lending Act that can leave military personnel vulnerable to predatory lenders. But these safeguards are now the target of a Congressman who has received substantial campaign contributions from payday lenders. [More]

JPMorgan Chase, Bank Of America Agree To Wipe Debt Cleared By Bankruptcy From Credit Reports

Two of the country’s largest banks are finally getting around to removing the debt consumers eliminated during bankruptcy proceedings from their credit reports, a move that puts Bank of America and JPMorgan Chase in line with federal law. [More]

House Panel Strikes Provision That Would Delay Added Military Lending Act Protections

Yesterday we reported that Congress would make a decision whether or not it would intervene to slow the Department of Defense’s work to create new rules aimed at closing loopholes in the Military Lending Act that often leave military personnel vulnerable to predatory financial operations. Thankfully, legislators saw the need for more protections regarding military lending and determined the rules could go into effect as planned. [More]

![The CFPB's electronic version of its Know Before You Owe Mortgage Toolkit includes interactive forms to help consumer find the right mortgage for them. [Click to Enlarge]](../../../../consumermediallc.files.wordpress.com/2015/03/screen-shot-2015-03-31-at-2-08-15-pm.png?w=300&h=225&crop=1)

CFPB Releases Mortgage Toolkit Aimed At Making The Home Buying Process Easier

In January, the Consumer Financial Protection Bureau released a report suggesting that many homebuyers spend more time looking for a TV than shopping around for the right mortgage. In an attempt to make things a little less daunting for prospective borrowers, the Bureau today released the “Know Before You Owe” mortgage shopping toolkit. [More]

“Bad Check” Debt Collector Deceptively Used Prosecutors’ Letterhead To Intimidate Consumers Into Paying High Fees

Late last year, Consumerist reported on a string of debt collectors paying to use prosecutors’ letterheads as a way to intimidate consumers into paying their debts. While the company facing the wrath of the Consumer Financial Protection Bureau today didn’t exactly pay to use the letterhead, they allegedly used the documents in a deceptive manner to get consumers to enroll in costly financial education programs. [More]

Consumer Groups Urge CFPB To Provide Better Oversight, Rules Over Student Loan Servicing

Two months ago, the Consumer Financial Protection Bureau took the first steps in tackling issues within the student loan servicing arena by asking consumers and organizations to share their thoughts on the state of an industry that is tasked with recouping the more than $1.2 trillion in outstanding student loan debt in the U.S. Now, as the deadline to submit comments has come and gone, we know a bit more about just how the industry is perceived by those tasked with sticking up for consumers. [More]