Debt Settlement Programs Often Do More Harm Than Good For Consumers

The “State of Lending: Debt Settlement” report [PDF] found that debt settlement remains a risky strategy for debt reduction and often leaves consumers more financially vulnerable than when they began the program.

On the surface, debt settlement companies seem too good to be true. The programs offer the promise of settling a consumer’s debt for a fraction of what they owe by negotiating down the outstanding debt to a more manageable amount.

But once consumers dive into the process, the high-risk nature of the program reveals itself.

Debtors must generally default on their debts in order to enroll in such programs. In that case, consumers can often face increased fees, interest rates and even lawsuits from creditors.

And even after taking on those dangers, consumers aren’t given a guarantee that their debt will be more manageable; some creditors won’t negotiate with debt settlement companies at all.

While a 2010 Federal Trade Commission regulation barred debt settlement companies from charging fees unless a settlement could be reached with a client’s creditors, CRL found that some companies claim to use a different settlement model to circumvent the rule.

The debt-settlement companies that continue to charge advance fees despite the FTC rule are said

to be using an “attorney model” of debt settlement, in which the presence of a loosely-affiliated

attorney is used to justify collecting advance fees, even though non-attorneys provide the actual

debt-settlement work.

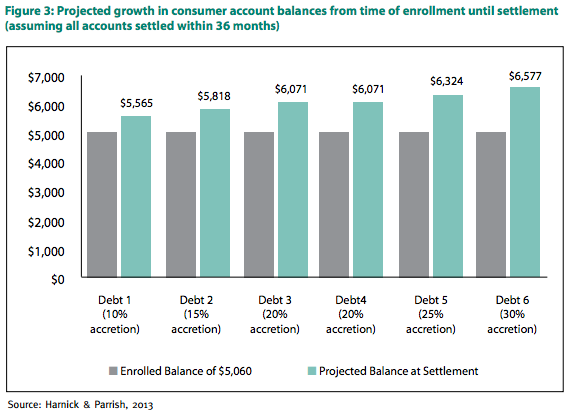

The new report found that successfully enrolling in a settlement program often increases a consumer’s debt by an average of 20%.

The increased balance, along with debt settlement fees and potential tax liability, can substantially reduce any savings the consumers hoped to achieve.

To better ensure consumers are protected from misleading or unhelpful debt settlement programs, CRL recommends that:

- States that currently do not allow debt settlement should not authorize the practice until the industry can demonstrate a significant majority of consumers benefit and risks are minimized.

- Debt settlement companies be required to ensure that debt settlement is appropriate for their clients. This can include screening clients before enrollment to gauge their financial status and including a “not worse off” provision to make sure debt settlement doesn’t further aggravate financial vulnerability.

- All debt settlement companies must be required to adhere by the same set of rules to ensure that no fees are charged until settlements are negotiated.

Debt settlement programs increase financial risk to vulnerable consumers [Center for Responsible Lending]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.