“US National Bank” is still at it, calling up people and threatening them with jail time unless they pay up for debts they never took out and USNB doesn’t own. Here’s K’s story of how “Harry Wilson” called him up screaming and yelling. But after speaking to a consumer lawyer, K learned what he needed to say to get the extortionist to stop phone-harassing him. You’ll learn too after you read the story inside…

debt collectors

Debt Collector Bullying Me To Sign Affidavit Saying I Can Pay More Than I Can

Sarah has $40k+ in student debt that went into default after she got sick and had to spend a lot of money on medical care. She’s been paying it off, but one of the companies that owns one of her loans, NCO Financial, has told her that unless she signs a legal document that says she can pay $260 a month, they’re going to place her account back in collections and start harassing her even more than they are now (they’re already calling her daily at home and work)…

Credit Blemished Over Imaginary Credit Card

The NES collection agency is coming after Nancy for a debt on an account number she’s never owned. She’s trying to beseech BoA billing for a resolution and to fix her credit history. That may be completely the wrong way to go about it. Here’s her story:

Collector Threatens Jailtime Over Dead Debt

Reader R. kinda messed up his credit years ago. He’s a good boy now and his credit score is 700+, but now RSI Claims Process Services is hassling him about a 12-year-old credit card debt. They scared him into thinking they’re going to send him to jail and managed to squeeze a $100 “good-faith” payment out of him, but now he’s got second thoughts. And with good reason: the statute of limitations on the debt has well passed and threatening to send a debtor to jail is a violation of Federal law. Here’s his story and our advice…

Interview: I Fought Off The US National Bank Scammers

Almost immediately after Laurie Lucas picked up the phone, the many from “Legal Affidavit Office” began reading off a litany of charges he said “US National Bank” had filed against her. Theft of property. Fraud. Money laundering. “Eric Matthews” said that he, “felt sorry for the tragedy that was getting ready to befall” her for her failure to pay back a $5,000 payday loan. They would be coming to arrest her tomorrow morning at 11am, he said in an identifiably Indian accent. When Laurie protested that she had never taken out such a loan, or even a payday loan in her life, and had never heard of US National Bank, Eric said she should have kept better records…

I Told Off The Debt Collector

Some punkass debt collector called trying to get a hold of some lady he thinks my girlfriend knows. Here’s roughly how the conversation went. Keep in mind I had just put a bunch of peanuts in my mouth…

Zombie Debt Collectors Find You At Grandma's

Palisades Collection is offering Jeremy a great deal: he can pay half off his debt of $237.64 and get the account settled! Small snag, though, Jeremy never ordered the Verizon service they’re trying to collect on, the debt has passed the statute of limitations, and he got it expunged from his credit report years ago. Still, Palisades persists in sending collection notices for him to his grandma’s house. What’s a boy to do? Read on and find out.

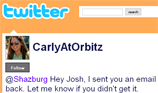

Update: Orbitz Sent Reader To Collections For Ticket They Never Sold Him

Here’s some updates on the post about reader Josh, whom Orbitz wanted to make pay for a ticket they never sold him and he never used. Turns out that between when he sent his original letter to us in February and when we posted it, Orbitz sent him to collections. But now that his story got on here and Digg, Orbitz’s ass-covering machine has been activated…

Customer Battles Lowe's Online Over $3500 Fence, Wins

Last year, Lowe’s horribly botched Allen’s $3500 fence installation (see picture, left). When he complained, the installer and Lowes dodged responsibility, but still demanded $3500. Allen refused to pay and they sent his bill to collections. So Allen put up Lowes-sucks.com with pictures, correspondence and phone recordings of his customer service debacle. Instead of fixing Allen’s problem, Lowe’s sent him a cease-and-desist to get him to take down the website, claiming “trademark infringement.” That’s when our site picked it up, along with Ars Technica, Digg, and others, driving lots of traffic to Lowes-sucks.com That was a year ago. Now it seems Allen has won his fight.

PayPal Refunds $50 Defraud, Sics Collections On You

Last year, Gpotato.com fraudulently took $50 from reader Adam’s Paypal account. He disputed the charge, Paypal agreed it was fraud and returned the funds, and Adam closed the account. Now all of a sudden Paypal’s internal collections agency is calling up Adam and making rude and insistent demands that he pay this $50 immediately.

Psycho Debt Collectors Will Not Stop Calling Me About Someone Else's Debt

Reader Rachael wants to know if there’s any way she can get a harassing debt collector to stop calling her 3 times a day — looking for someone else who used to have her number.

Debt Collector Sends Verizon Collection Notice To A Fluffy White Dog

You may think this dog is cute, but that’s bullshit. This dog is a deadbeat that doesn’t pay its Verizon bill.

80-Year-Old Woman Files Lawsuit Over $6 Sears Datebook

Margaret Vail (pictured left), an 80-year-old woman from Mansfield, OH., is fed up with Sears and the numerous collection agencies that claim she ordered a $6 datebook back in 2003. According to the Mansfield News Journal, Margaret never ordered the datebook, yet Sears sent her one anyway and put it on her Sears charge card. Her local store won’t accept returns on mail-order merchandise and she refuses to pay shipping to return it. Over the years, the balance has ballooned to $130 which doesn’t faze Margaret who is spending over $200 in fees to file her lawsuit. Details, inside…

How To Protect Yourself Against Aggressive Debt Collectors

Millions of Americans are in debt, so it stands to reason that there are over 6,500 collection agencies in the U.S.. Most of these agencies operate under the law but a growing number of them do not. According to statistics from the Better Business Bureau, complaints filed against debt collectors rose 27% in 2007. Even if you legitimately owe the debt, you should know there are laws that protect you against harassment and the unfair practices often employed by these rogue debt collectors. CNN Money discusses the Fair Debt Collection Practices Act and laws which protect the consumer. Details, inside… [More]

A Debt Collector Offers You A Credit Card, What's Wrong With This Picture?

Like countless others, reader Ryan is in debt. His debt is to the tune of $1,364. He received an interesting offer from the debt collector who is offering “debt reduction” in the form of a pre-approved Visa card in which his $1,364 debt would be reduced to a $1,200 balance if he accepts the card. He would need only to to pay off the balance under the terms of the credit card to eliminate his debt. Ryan wisely wrote to us to ask if this is a good idea. Actually Ryan, it’s a really really really bad idea. His letter and our advice, inside…

Closure For NYMag Sub Never Ordered, Collections Threatened

How would you feel to learn that not only had your household become subscribed to a magazine against its will, you were not getting threats that your account was overdue and was about to be sent to a debt-collection agency? That’s exactly what happened to husband and wife Keith and Stacy with New York Magazine. After our post went up about them, NYmag, wanting to defend what Communications Manager Lauren Starke called, “the good name of our circulation department—one of the most solid in the industry.” We put them in contact with Keith. After a flurry of testy emails between the two, here’s what happened.

Third-Party Debt Collectors Misusing Courts To Increase Profits

The Chicago Tribune writes that “More than 119,000 civil lawsuits against alleged debtors are clogging [Chicago] courtrooms,” but since collection agencies make money off of volume business, the suits filed are based on too little information. The result: cases based on mistaken identities, or for debts already settled, or against debtors who have made good-faith efforts to work out repayment plans. “The system is out of control,” one attorney tells the paper.