As we told you in September, a woman is suing a debt collector for her husband’s final heart attack and death. [More]

debt collectors

Judge Tells Debt Collection Firm To Pay Stranger $115 For Dragging Him To Court

Last week, a Brooklyn judge ordered strongly suggested that the law firm of Pressler & Pressler, “one of the biggest in the collection industry,” pay a day’s worth of income to the man they falsely accused of owing an unpaid debt. To encourage the firm to do the right thing, Judge Noach Dear scheduled a sanctions hearing but told the firm’s lawyer, T. Andy Wang, that he might drop it if they pay up. [More]

Am I Responsible For My Parents' Debt?

Jay’s parents have gotten quite, uh, spendy with their retirement income, and now they’ve got a lot of debt they can’t pay off. This has become Jay’s problem not because he’s a party to any of the debt, but because they’ve put him down as a reference and now bill collectors are harassing him.

Bill Collector Accused Of Offering Debt Forgiveness For Sex

A Rent-A-Center employee near Detroit has allegedly found a new approach to helping consumers get out of debt: making their bills go away in exchange for sex.

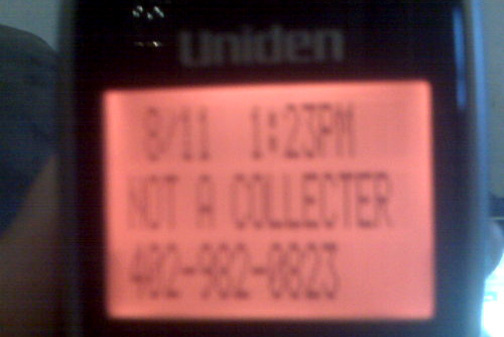

Debt Collector On Tape: "I'm Gonna F**** You Up"

“When I see you, I’m gonna f*** you up,” says debt collector “Mickey,” pictured at left, on the answering machine of a guy who bounced a check. WTSP obtained the messages, some of the worst debt collector recordings I’ve ever heard, and you can listen to them here.

Lawsuit: Debt Collector Harassment Contributed To Man's Death

When a Florida man suffered a heart attack, he needed to leave his job. Between everyday expenses and medical bills, he fell behind on his mortgage and other bills, and debt collectors began calling. And calling. And calling. Eventually, a lawsuit alleges, the stress from the harassing and abusive phone calls led to the man’s death. Frivolous lawsuit? Maybe not.

How To Fight Back Against Debt Collector Ninjas

Debt collectors, like vampires, have certain rules they must follow. For example, both are vulnerable to sunlight and garlic, but only vampires glitter when they’re playing baseball.

Wave Of Fake Debt Collectors Hints At Possible Data Breach

The Better Business Bureau has released a warning to be aware of scammers calling to threaten people with arrest “within the hour” for defaulting on payday loans. What makes them stand out from normal debt collecting scammers is these callers have huge amounts of personal info on their victims, including Social Security and drivers license numbers; old bank account numbers; names of employers, relatives, and friends; and home addresses.

Debt Collectors Will Stop Calling If You Sue Them

“Litigant Alert” from WebRecon promises to help debt collection companies ferret out “overly-litigious debtors” with “a history of suing collection agencies.” It’s basically a Do Not Call list of troublemakers who had the nerve to fight aggressive collection practices with the law. Debt collectors are apparently willing to pay $1,595 to figure out who they should leave alone.

Debt Collectors Mess With Your Head To Get You To Pay More

Santana had actually already sought permission from the bank to settle for as little as $10,000. It’s an open secret that if a debtor is willing to wait long enough, he can probably get away with paying almost nothing, as long as he doesn’t mind hurting his credit score. So Santana knew he should jump at the offer. But as an amateur psychologist, Santana was eager to make his own diagnosis – and presumably boost his own commission.

Your Credit Card Company Is Building A Psychological Profile Of You

The next time you apply for a credit card, your credit report and income will be only a part of the criteria used to determine your creditworthiness. For that matter, as long as you have the card, what you use it for will be noted and added to a growing set of data that makes up your psychological profile, which will then be referred to every time the bank deals with your or reevaluates your risk as a customer.

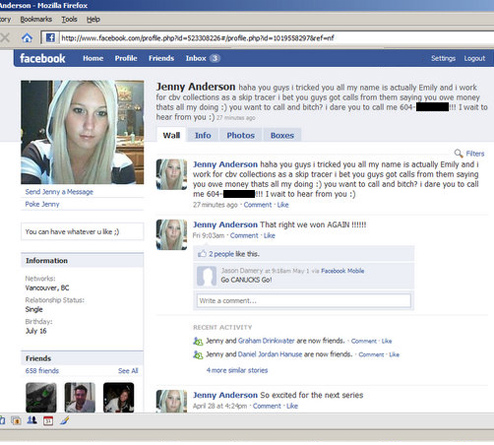

Debt Collectors Using Cute Chicks On Facebook As Bait

Debt collectors are using cute chicks as bait on Facebook to track down and keep track of debtors. For some reason, someone at CBV collections decided to out the truth behind the online construct “Jenny Anderson,” that she was the tool of professional skiptracers, to all 658 of her “friends.” Reader Bryan, who happens to be a reporter, was one of them, and he took a snapshot and interviewed “Jenny” a bit. The story, inside…

IRS Fires Private Debt Collectors, Plans To Pursue Deadbeats On Its Own

The IRS has ended a controversial program that allowed private debt collectors to pursue individual debts owed to the government. The private debt collectors, described as “bounty hunters who collect taxes from vulnerable people for profit,” were allowed to keep 25% of any collected debts for themselves. Before we celebrate, let’s all take a moment to join Senator Charles Grassley of Iowa in thinking about those poor private debt collectors who no longer have jobs harassing and abusing people…

Debunking The Debt Collectors' Spin Doctors

The nation’s economic woes make debt collection a topic du jour, but while there are some good bits mixed into the Washington Post’s article, “When Debt Collectors Disrupt Dinner,” it probably should have been titled “What Debt Collectors Would Like You To Say And Do When They Call About The Credit Card.” Read it with a shaker of salt. Read on for the good, the bad, and the lazy reporting, plus what you should actually to protect and exercise your rights as a debtor…

Even Debt Collectors Are Having Trouble Paying Their Bills

You would think tough times would be boom times for debt collectors, but debt collection company First American Recovery Services is filing for bankruptcy. “The amount of debt out there is 10 times what it had been, but the ability to pay is less,” Tim Smith, FirstSource Advantage collections vice president told The Buffalo News. Don’t dance on their grave quite yet. The debts will just get sold to someone else, and usually each generation of debt owners has successively less scruples. But you have to wonder, how long before there is just too much debt that’s just too hard to collect in time before the statute of limitations expires?