Erin was the recipient of a recent scam attempt from Moreno and Woods, a debt collection agency that—according to her account and others found online—uses abusive tactics and fraudulent claims to try to con people into paying off debts they never owed to avoid things like wage garnishments and lawsuits. Erin fought back, and shared her story with us to warn others.

debt collectors

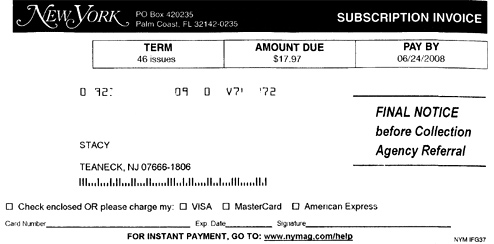

UPDATED: NYMag: Collections Threatened For Sub You Think You Never Ordered

You know we’re at death’s door for the print industry when they have to resort to a sleazy subscription tactic like this debt collection warning New York Mag sent Keith’s wife for a subscription she believes she never signed up for. Keith called the number on the back of the card and a customer service rep said that an “affiliate” put in the order. Dawn let Keith cancel the order without fuss. When Keith asked why the company was threatening to send people to collections for something they never ordered , “Dawn” said, “Don’t worry…it doesn’t make a difference since we don’t have your social security number and we will never ask for it.” As if that’s going to protect you from a debt collector. UPDATE: NYmag says the subscription renewal was valid and the customer must have forgotten about it. Full response inside.

DC Tickets And Tows Stolen Car, Releases It To Thief, Then Sends Collection Agency After Owner

Steve Steinberg refused to pay a parking ticket issued after his car had been stolen, so the Washington, DC Department of Motor Vehicles sent a collections agency after him. Steinberg’s car was stolen in September of 2006. After he reported the theft, Steinberg says, the DC police and DMV ticketed his car, towed it, then released it to the thief.

AT&T Sends Bills To Collections Ten Days After They’re Mailed Out

Reader Tom wrote in to let us know that during a conversation with AT&T customer service, a representative told him that it is typical to send out collection notices ten days after the original bill is mailed. Factoring in two or three days for the bill to arrive, two or three days for the check to get back to AT&T, and a Sunday or two, that leaves three to five days for customers to pay their bills before the angry letters and phone calls begin.

38.6% Of Reported Debt Collectors Demand More Money Than Is Legal

Debtors have rights, and sometimes they get violated. The FTC released its annual Fair Debt Collection Practices Act report, part of which documents the number of complaints they get about debt collectors violating consumers rates. FTC received 70,951 DCPA violation complaints in 2007. Of them:

Mugger Used Our Credit Card, Now CapitalOne Sued Us Without Us Knowing For $1200 And Won

Andrew’s wife got mugged, the thief rand up purchases on her credit card, and now CapitalOne has sued them for $1200 and won. How can this be? Andrew writes:

In May of 2005 my wife was mugged at one of the elevated train stations in Chicago. After calling the police and filing a police report, she started calling each credit card company to cancel each account. Except she forgot about one card, her CapitalOne card. A card hardly ever used and only had a $500.00 limit…

Debt Collectors Don Sheep's Clothing

“[Debt] Collectors actually care about consumers… They want to teach consumers how to get out of debt. They’re trying to put themselves out of business.” – Rozanne Andersen, general counsel of ACA International (formerly the American Collectors Association) as quoted in this morning’s NYT article, “Debt Collectors Try to Put on a Friendlier Face.” As times get tougher and the options for borrowing from Peter to pay Paul shrink, more accounts are becoming delinquent. This means booming business for debt collectors, but increased activity could bring scrutiny from politicians and regulators, as well as consumer backlash. So, infamous for harassing debtors with abusive and threatening language and incessant calls (all violations of Federal regulations), the industry is trying a new tactic: playing Mr. Nice Guy. They’re conducting personal finance management courses, writing columns about how Abraham Lincoln couldn’t pay his debts, and opened a full-time lobbying office in Washington DC this month.

Consumers Reported 69,204 Fair Debt Collection Practices Act Violations. FTC Responds With One (1) Lawsuit

Consumers have filed over 69,000 complaints against scummy debt collectors for violating the Fair Debt Collection Practices Act, prompting the FTC to rush to our collective defense by taking action against three debt collectors who showed a “culture of harassing the debtors from which they collect.” Two debt collectors settled and one went to court. Still, when you receive over 69,000 complaints—and these are from the people who know to complain to the FTC—it’s reasonable to assume that more than three collectors encourage a culture of harassment. More harrowing revelations from the FTC’s annual report to Congress, after the jump.

../../../..//2008/02/04/a-consumer-who-received-a/

A consumer who received a collections notice that began, “DEAR SHITFACE,” will sue the collections agency next week. [Caveat Emptor]

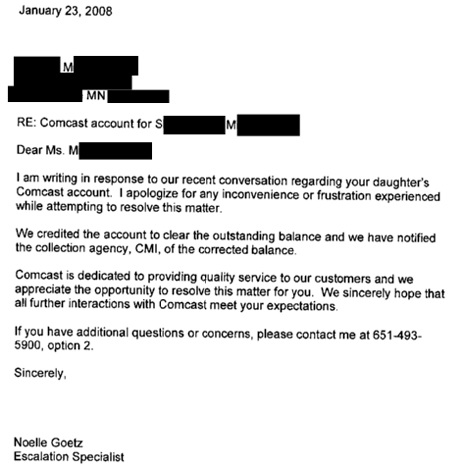

Comcast Billing Gone Bonkers

SM writes:

This story starts in March 07 when my sister moved out of the country and canceled her Comcast account. I returned her modem, and they told me her account was settled. Then, my mom (who has power of attorney) gets a bill for around $193. Comcast customer service tells my mom that she really only has to pay around $35, so she sends a check for that amount, but another bill arrives for $135.35. Again, Comcast customer service tells her, no actually you only need to pay $43.86. My mom tries to dispute the bill, but Comcast sends my sister’s account to a collection agency called CMI…

../../../..//2008/01/04/after-a-7-year-old-riding-a/

After a 7-year-old riding a bike collided with a van, he got a bill from a collections agency for $650. After the local news team got involved, the company said they were dropping the matter as “it wasn’t their policy to send notices to little 7-year-olds.” They’re also giving him $100 for a new bike. Aw. [KPHO]

Family Sues Racist Debt Collector For $854,389.81, Wins

Lazy, fat, inbred, black, pathetic, stupid, liar, thief, nigger. Those are some of the defamatory words Merchants Retail Credit Association (MRCA) used on Dolores Madduxes’ family when they tried to collect on a debt Dolores Maddux, who is dead, owed CitiFinancial. For these violations of the Fair Debt Collection Practices Act, the Madduxes sued MRCA and won $854,389.81. Even delinquent debtors have rights and it’s important to know them and call an attorney if they’re being violated.

Man Fakes Death For Three Years To Avoid Debt Collectors

Man fakes death for three years to avoid debt collectors. Hides in in house and flees via secret compartments whenever guests are over. When he finally resurfaced, he did it by walking into a police station and claiming to be suffering from amnesia. He was arrested on suspicion of fraud. Debt makes people do crazy things. That’s why we’re allergic to it when it comes to buying depreciating assets (unless they’re needed to make more money.

Charter Bills For Returned Equipment, Sends Account To Collections

Charter accused Kevin of failing to pay for unreturned equipment, even though Kevin paid his final bill in full and has a receipt for a returned cable box. Charter customer service representatives were happy to play whack-a-mole whenever the bogus charges for the equipment appeared on Kevin’s bill, but Charter eventually tired of the infuriatingly unwinnable game and sent Kevin’s account to collections.