You surely already know better, because you’re a loyal Consumerist reader, but stay far, far away from the form of legalized usury known as car title loans! CNN has published an overview of the industry, noting that APRs frequently exceed 200%, and that added fees and loan “rollover” options help keep borrowers in a cycle of debt.

credit

Lehman Brothers CEO Got Punched In The Face

Dick “It Wasn’t My Fault” Fuld, the CEO of bankrupt investment bank Lehman Brothers, (seen here being heckled after testifying on Capitol Hill) was apparently punched in the face while working out in Lehman gym on the Sunday following the bankruptcy, according to CNBC’s Vicki Ward.

What Is Commercial Paper And Why Is The Federal Reserve Suddenly Buying It?

The Federal Reserve today announced the creation of something called the Commercial Paper Funding Facility (CPFF), that will buy commercial paper directly from issuers. So, you’re asking yourself, what is commercial paper? Why do I care that the Federal Reserve is buying it?

../../../..//2008/10/06/the-stock-market-is-not/

The stock market is not doing well. The Dow Jones industrial average fell below 10,000 for the first time since 2004, and is currently down 440 points. [NYT]

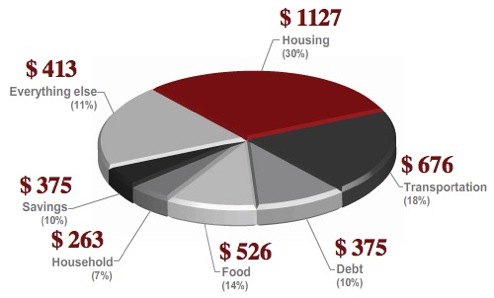

On The Money's Budget Calculator Helps Guide Your Monthly Spending

On The Money’s budget calculator makes it easy to determine how much you should be spending across the seven categories that make up any responsible budget. Regardless of income, tracking and limiting your overall spending is a foolproof strategy for keeping your accounts in the black. Though the percents will vary according to geography and personal situation, On The Money’s calculator gives you a quick glance at concrete spending targets that you can compare against your credit card bills and bank statements. Give it a try and tell us in the comments what other tools you use to control your spending.

Don't Ignore The Fourth Credit Reporting Agency: Innovis

Did you know there are more than three credit reporting agencies? Sure, you’ve heard of Experian, Equifax, and TransUnion, but what about Innovis? Smaller agencies can do just as much damage to your ability to get a good deal on credit as their bigger brethren. Learn how to pull your credit report from Innovis, inside.

Hundreds Of Car Dealerships Are Apparently Doomed

After the failure of the nation’s largest Chevy dealerships brought the plight of the car dealer to everyone’s attention, the bleeding hasn’t stopped. The California New Car Dealers Association says dozens of dealerships in CA have also closed.

The 10 Cities With The Most Crazy Expensive Loans

The Chicago Reporter took a look at some recently released mortgage data with an eye to how many successful refinances there were last year. In addition to concluding that people who most needed a refinance (those with crazy expensive loans) were also the least likely to get one, the Reporter also found that Chicago lead the nation in the total amount of high-cost loans for the fourth year in a row. High-cost loans are loans that are at least 3% above the U.S. Treasury standard.

Bailout Plan Gets Tax Cuts And Other "Sweeteners" To Help It Pass

Despite the fact that unprecedented outcry from taxpayers overwhelmed the servers hosting the Web sites of the House and its members, forcing administrators to limit e-mails from the public for the first time ever, the steady push toward a bailout plan continues. The newest version of the plain contains what CNN is calling “sweeteners” — tax cuts and health care reforms that are meant to appeal to the holdouts.

Judge Orders Credit Reporting Bureaus To Strike Forgiven Debts From Records

The three big credit reporting agencies—Experian, TransUnion, and Equifax—have been inaccurately reporting debts on millions of consumers’ credit reports even after the debts have been forgiven during bankruptcy filings. Once forgiven, the debts are supposed to be removed from credit reports, but the agencies are continuing to report them as active. They have until October 1st to comply with Judge David O. Carter’s order to “revamp their systems,” writes Jane J. Kim on the Wall Street Journal’s finance blog. Now if you’re in debt trouble, you can look forward (?) to having either unpaid debts on your credit report, or a bankruptcy filing, but hopefully no longer both at the same time.

When Things Get Crazy, Rumors Get Even Crazier

We received a tip today that Bank of America supposedly plans to close nearly all of its customers’ credit cards on October 1st, but the only source we can find for this rumor is a single post at iReport.com, CNN’s public journalism free-for-all. Everything else online that mentions this is traced back to that one short post. So, until we find out more, we’re going to say this one is bunk—and a great example of how wild rumors can pop up during desperate times. (Thanks to Joseph!)

Advanta Raises Your 8% Credit Card To 20% Because The Economy Is Bad

I have had an Advanta Credit Card for a little over a year now. My interest rate prior to a few days ago was 8%. My credit rating is very good, and I have always made my payments on time. As I was looking over my bill for September I noticed a fee of $75 dollars. A few clicks later I found that my interest rate had been raised to 20%.

Consumer 101: Get Your Free Credit Report From "Annual Credit Report.com"

You’ve probably seen those commercials featuring a friendly looking jackass and his factually inaccurate songs about what can happen to you if you don’t check your credit report. It’s true, checking your credit report is a good idea, but you can avoid subscription-hawking pay sites and, instead, go to AnnualCreditReport.com.

Ex-Credit Card Bankers: "Every Customer Who Calls In Is A Mark. It's A Great Big Con."

CNN has an interview with two former credit card bankers who are admitting that their job was to get consumers to max out their credit cards and take on as much debt as possible, regardless of the customer’s ability to afford it. They both worked for MBNA at their “sprawling consumer call center in Belfast, Maine.” The bankers say that they were told to aggressively push cash advances, and were trained to convince consumers that they needed the maximum amount of debt at the highest interest rate.

House Passes Credit Card Bill Of Rights… But Senate Is Too Busy With The Bailout

The House of Representatives passed legislation that’s commonly known as the Credit Cardholders’ Bill of Rights today, but the bill is expected to be ignored by the Senate while they work on that whole $700 billion bailout thing.

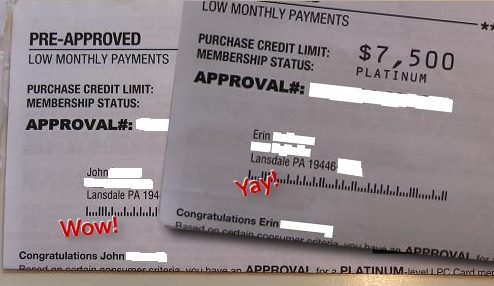

LPC Has Pre-Approved Your Neighbor For Credit—Please Let Him Know

I just opened my mail for today. I just received a pre-approved credit card application and they ::oops:: included another one for my neighbor, in my envelope.

PRBC Helps You Create A Credit Score From On-Time Rent, Bill Payments

Payment Reporting Builds Credit (PRBC) is an alternative credit reporting agency that will record your payment histories for things like rent and utilities bills. PRBC says you can then use this verified credit history to supplement your FICO score and credit history from the big three reporting companies. It’s meant in part as a way to help people who don’t have extensive standard credit histories, or who have always paid monthly expenses on time but have other blots (like medical bills) on their official credit histories.

Can't Afford A Soda? Get A Circuit City Credit Card!

Reader Sue saw this sign at Circuit City and snapped a picture of it for us.