Re: Countrywide Sends Fraud Alert Letters: ‘Your Info May Have Been Sold,” Reader Esqdork writes, “Yesterday, I phoned Countrywide to get them to extend the credit monitoring service [that they offered in their apology letter] to my co-borrower and was promptly hung up on.” The only surprise here is that they even picked up in the first place.

credit

Ex-Countrywide Employee Sells Your Data, They Offer Credit Monitoring Service, Hang Up When You Ask For It

Countrywide Sends Fraud Alert Letters: 'Your Info May Have Been Sold'

I received a letter from Countrywide today that says:

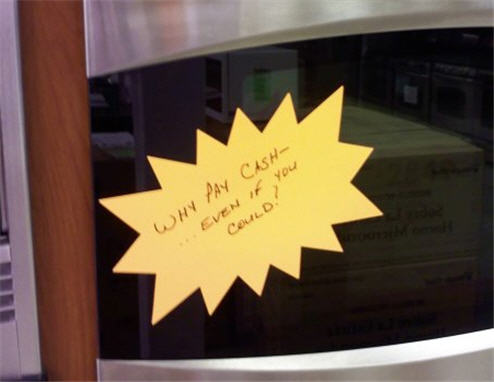

Home Depot Asks: "Why Pay Cash Even If You Could?"

Reader Dan thought we’d be interested in this sign he spotted in his local Home Depot. It reads: “Why pay cash even if you could?”

Another Consumer Scammed By FreeCreditReport.com

Freecreditreport.com is NOT actually free, nor is it related to Annualcreditreport.com, the free credit report that you are entitled to under federal law. So why are people still being tricked into signing up for a credit monitoring service in order to get something that they are entitled to under federal-freaking-law? Because the credit bureaus are linking them to the website and most consumers don’t believe that a major credit bureau would try to trick them. Always read the fine print!

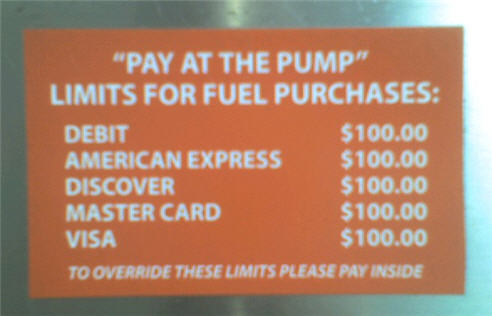

Sign Of The Times: $100 "Pay At The Pump" Limit

Reader Paul sends in this photo of a sign he saw at a gas station in Texas. First people were upset that gas stations were putting “outrageously high” holds of $100 on their cards when they paid at the pump. Now $100 is just the most you can buy at the pump without going inside and having them swipe your card. Sad.

2008 Consumer Action Credit Card Survey Declares Credit Cards 'Really !@$% Evil!'

Credit cards are so much worse than you thought, according to the 2008 Consumer Action credit card survey. Creditors have carte blanche to do pretty much whatever they want, including randomly changing terms, conditions, and rates, even to cardholders with perfect payment histories and pristine credit scores.

U.S. Foreclosures Double: 1 in Every 171 Households Affected

Hmm, wasn’t this housing bubble crap supposed to be slowing down? Guess not. The foreclosure numbers for last quarter are twice as bad as last year according to the new numbers from RealtyTrac (a firm that tracks foreclosure filings.) 1 in every 171 households nationwide was foreclosed on, received a default notice or was warned of a pending auction in the second quarter of 2008. Bloomberg says this is an increase of 14% from last quarter and an increase of 121% from this time last year.

Wachovia: We Just Lost $8.9 Billion!

Wachovia just lost $8.9 billion dollars, and will cut 6,350 workers as the credit crisis keeps on truckin’, says the Associated Press. This is um, a lot more than Wall Street had been expecting. Earlier this month, Wachovia had projected a $2.6 billion loss.

Beware Long-Term Cardholders With Perfect Payment Histories, Your Credit Lines May Be Slashed

Oliver paid off his Citibank platinum card on time, in full, every single month since 1989, but that didn’t stop Citibank from slashing his credit limit when a minor mistake popped up on his credit report.

Help! AT&T Wants A $750 Deposit, But I Really Want An iPhone!

Dana’s divorce left her with crappy credit and now AT&T wants a $750 deposit! She’s wondering if anyone has any advice for avoiding such a large deposit…

Sears Cancels Your Account Of 44 Years Because Your Husband Died Ten Years Ago. What?

Meet Judy, Sears’ ideal customer. When Judy’s husband died ten years ago, Sears, like her other creditors, assured her that she could continue using her account. Since then, Judy has used her Sears card to buy a washer, dryer, and refrigerator. Yet when Judy recently tried to buy a $142 saw, Sears insisted on immediately closing her account because it was in her late-husband’s name.

How A Forgotten Blockbuster Video Caused A 2 1/2 Year Battle With Discover Card And Collection Agencies

“Universal Default” is when your credit card company adjusts the terms of your loan because you “defaulted” with another company. In reader P.’s case the “default” was a Blockbuster video that his friend forgot to return. Discover Card took this opportunity to double P.’s interest rate. When he tried to fight it by closing his account, it launched him into a 2 1/2 year legal battle with Discover, a collection agency, and now the credit bureaus.

Help! Sears Is Charging Me Interest On A "0% For 24 Months" Deal And They Won't Stop!

Reader Mike asks:

Bank of America Gives 6-Year-Old A Credit Card

Didn’t you hate not having access to credit when you were 6? Today’s kids don’t have to suffer like you did. Meet Bennett Christiansen of Aurora, IL. He’s got a shiny new Bank of America credit card with a $600 limit.

Hospitals To Patients: "How About You Put That Liposuction On Your Credit Card?"

A Consumer Reports study finds that medical professionals are pushing high-interest lines of credit and financing options on patients. Credit agencies are even partnering with hospitals to offer branded credit cards so patients can finance elective cosmetic surgeries like liposuction and hair removal.

Bloomingdale's Sends You To A "Collection Agency" Over $5.00

Reader Haven accidentally underpaid a Bloomingdale’s credit card bill by $5, and so it was off to the collection agency…