Despite sending customers letter saying otherwise, American Express now insists that it never blacklisted cardholders based on where they shopped. Those notes explaining that “other customers who have used their card at establishments where you recently shopped have a poor repayment history with American Express?” Whoops! Just a big misunderstanding! Not unlike the comment they gave to ABC explaining that “shopping patterns” were used as a “contributing factor” in slashing credit lines, a statement AmEx later retracted. So what’s really going on? Let’s explore…

credit

AmEx Denies Existence Of A Store Blacklist, Will Slash Your Credit Whenever They Want

Can Canceling A Credit Card Really Hurt My Score, Or Did Discover Card Lie?

Reader David said he called Discover Card to cancel his account — but was advised against it because canceling credit cards can hurt your credit score. He wants to know if it’s true.

../../../..//2009/01/19/the-credit-card-regulations-that/

The credit card regulations that the Fed enacted last month won’t take effect until summer of 2010, so Congresswoman Carolyn Maloney is reintroducing the Credit Cardholders’ Bill of Rights, which offers the same reforms but would come into effect 90 days after the president signs it.

Prepare For A Budget Meltdown By Conducting A Financial Fire Drill

You’re fired! Now what? It’s the nightmare scenario, and you can prepare for it by conducting a financial drill. Take a moment and pretend you have no income. Ask how you would pay pay for rent and food, and what lifestyle changes you could make on two week’s notice. To guide your planning, the New York Times has a few unorthodox and downright scary suggestions that are worth considering in a worst case scenario.

Can Businesses Really Check My Credit Report Before Offering Me A Job?

Reader Brandon wants to know if those freecreditreport.com commercials are being misleading when they tell you that your credit report can affect where you get a job.

Consumers Are Learning The Hard Way: There's No Such Thing As A Fixed Rate Credit Card

For years personal finance experts have been telling consumers to watch out — that there was “no such thing” as a “fixed rate” credit card — the bank can raise your interest rate whenever it wants as long as it gives you a little notice. You don’t have to miss a payment. You don’t have to do anything “wrong.” Now some consumers are learning the hard way.

../../../..//2009/01/06/the-consistently-useful-get-rich/

The consistently useful Get Rich Slowly has some New Year’s resolutions for you: 9 Methods for Mastering Your Money in 2009. We especially like methods 3 and 7, as they’re easy fixes that shouldn’t take more than a couple hours to implement.

../../../..//2008/12/31/if-you-used-your-debit/

If you used your debit card at Macy’s on the Saturday before Christmas, you might have been charged twice.

Buried Under Books, Borders Goes Above and Beyond

Reader Katie writes to us with an amazing Borders customer service story, full of love, loss, credit, and a fiery inferno of possible death. Katie’s letter inside.

What's Your FICO?

FICO: I’ll show you mine if you show me yours. Take our poll and see how you measure up.

AMEX Cuts You Off Unless You Show Them Your Tax Returns

The credit crunch is affecting all of us differently. Right now its affecting Nick as he sits in a hotel 3,000 miles from home.

Illinois Stops Doing Business With BoA Until It Restores Window And Door Company's Credit

The state of Illinois has suspended doing all business with Bank of America until they restore the line of credit to Chicago-based Republic Windows & Doors necessary for paying their workers.

Help! They Closed My Credit Card Because I Didn't Use It!

Reader Kevin is upset with WaMu because they closed his credit card due to inactivity. Had he known they were going to do this, he says he would have been happy to pay a small fee to keep it open, etc. The card is the oldest one on his credit report — and closing it has affected his FICO score.

Stock Market Pleased By New Phase Of Bailout

Today the Federal Reserve announced the creation of a new special purpose entity that will buy consumer and business debt. Under the new plan, the Treasury will provide $20 billion dollars in of credit protection (from the Troubled Asset Relief Program) — and will absorb most of the losses, should they occur.

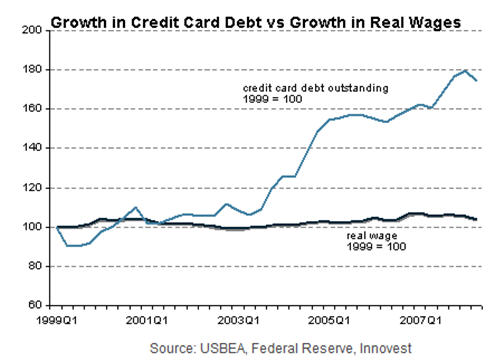

Attention: Credit Card Companies Have Realized That You Are Broke

The New York Times has an article detailing what promises to be the next fun financial crisis — credit card debt! Apparently, credit card companies have only just now realized that you people are broke! Whoops.

Yet Another Reader Scammed By FreeCreditReport.com

Here it is folks, your semi-annual reminder that FreeCreditReport is not free. Free credit reports can be found at AnnualCreditReport.com. FreeCreditReport.com is a pay site. As in you will be billed. As in not free.

Hold On To Your Hats And Sunglasses, Here Comes The Credit Card Meltdown

We hope you’re enjoying our current economic roller coaster because it’s likely to continue — According to a new report from research firm Innovest Strategic Value Advisors, titled “Credit Cards at the Tipping Point,” the fun has only just begun. As the credit crunch begins to affect consumers, they’re going to have more difficulty paying their credit card bills. The report suggests that credit card companies’ misleading practices and cavalier extension of credit may come back to bite them. Who should be worried? Capital One.

Government May Begin Buying Bank Stock Within Weeks

As it is now apparent that the credit crisis has spread to the global economy and has not been contained in any way, the Bush Administration is considering an option included in the $700 billion dollar bailout package that would allow them to invest directly in banks — buying preferred stock in exchange for a “cash injection.” White House spokesperson Dana Perino said taking partial ownership of banks and other moves associated with the financial rescue plan would not be “part of [Bush’s] natural instincts,” according to the NYT, but acknowledged that the situation has gotten sufficiently dire as to warrant a change of heart.