Lenders can use the data from your credit report to deny you credit for any one of several reasons. If you are denied, you receive a letter identifying the credit reporting agency that provided the report, along with a risk factor reason code. Bargaineering published a list of the common risk factor codes that lenders use to deem you unworthy of credit. For all three reporting agencies, the cardinal sins are owing too much and failing to pay your bills. The list of codes, inside.

credit

Hiring Consultant Warns: "No Connection Between Credit History And Job Performance"

Almost half of all employers use credit reports to judge job applicants, even though credit histories have no relation to job performance. Personal finance goofs are only relevant for jobs that deal directly with money—cashiers, account managers, and the like. For everyone else, negative credit reports keep otherwise capable people from securing a job to help avoid further financial problems. So why do so many companies still ask for credit reports?

Crackpots Detail Insane Ideas For Banking Reform

Credit Slips has this wild idea about reforming the banking system by letting some fairy-tale character named “Bob” run around issuing loans to qualified people in his community. We normally love Credit Slips as a well-researched piece of scholarly work masquerading as a blog, like cauliflower disguised as Cheetos, but this “community banking” idea? Ridiculous, right?! Grab a juice box and hit the jump to see what happens when economists take a stab at children’s fiction.

Let's Perma-Ban Consumer Predators

Regulating consumer predators is a bit like Whac-a-Mole. No matter how many times you put the bad guys out of business, they keep popping up again and again. Maybe it is time to consider a lifetime ban from financial services for the worst offenders. The Consumer Financial Protection Agency proposed by the President may be just the right watchdog for the job of handing out such banishments.

Chase Cancels Your Credit Cards With No Notification

If you have any Chase credit cards, call to make sure they haven’t been canceled out from under you with no notice. Huh? Are credit card companies allowed to do that? Don’t be silly. Of course they are.

The 8 Secret Credit Scores

Remember when AMEX lowered the credit limit of Kevin Johnson because he shopped at the wrong store? It finally showed the world that credit card companies rely on more than a FICO credit score to make decisions.

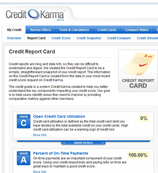

Take Your Score From 650 To 800 With The Credit Karma Report Card

Credit Karma recently launched the free Credit Report Card service that assigns letter grades to each component of your credit score. If you want to improve your credit score, try to bring up your performance in areas where you have low or failing grades. Not every component has the same bearing on your score, so underneath each section Credit Karma tells you how much weight it has. For those who look at their reports and scratch their head, the Credit Karma report card, which is drawn from your TransUnion report, makes understanding why your credit score is the way it is a snap. Full screen shot inside.

Why Credit History Employment Inquiries Matter

Last week, we covered a story in which a job seeker was denied a job because of his credit report.

Are You A Deadbeat? Suddenly You're Attractive To Card Companies Again

“Revolvers”—customers who keep a revolving balance on their credit cards—used to be the cash crop for credit card companies. But now more and more of them are turning into expensive charge-offs, and the new CARD act is going to make it harder to acquire those riskier customers anyway. As a result, card companies are beginning to look more closely at the customer who was most hated back in the credit-orgy years: the deadbeat.

../../../..//2009/05/22/there-is-apparently-serious-concern/

There is apparently serious concern that the United States will eventually lose its AAA credit rating. [Bloomberg] (Photo:donbuciak)

Credit Scores: How Do They Make 'Em?

A three-digit number that creditors use to quickly evaluate whether to give someone a loan and how favorable the terms should be, the credit score remains something of a mystery to many. How is it figured out? What matters, and what doesn’t matter? The exact scoring system is a proprietary secret of the Fair Issac corporation, but there are 5 general categories, each weighted differently, that determine where you sit on the range from 300-850. In easy-to-read outline form, let’s take a closer look.

5 Things to Avoid Before Buying A Home

With low mortgage rates and a battered housing market, it’s a ripe time to buy a home. Here are five credit score related things you should avoid doing before buying a home.

Your Credit Card Company Is Building A Psychological Profile Of You

The next time you apply for a credit card, your credit report and income will be only a part of the criteria used to determine your creditworthiness. For that matter, as long as you have the card, what you use it for will be noted and added to a growing set of data that makes up your psychological profile, which will then be referred to every time the bank deals with your or reevaluates your risk as a customer.

Got Debt So Bad It's Defaulted? 3 Ways To Deal

Getting into debt is easy. Winding up in default is easier yet; all you have to do is not pay your bills for several months! So how do you deal when the lender doesn’t want to wait around for you any longer and has moved on to more drastic action? Here’s three ways, only two of which are advisable.

Understanding Credit Utilization

With the recession, a lot of personal finance experts have started dispensing credit advice. They advise that you never cancel cards because it’ll hurt your score. Do you know why?

Big Shocker: Students Are Abusing Credit Cards

Sallie Mae‘s 2009 study of credit card use shows that students just love binging on plastic. Kids these days have more than four cards on average, and most of them carry a balance pushing $3,000. Many don’t tell their parents, and almost a fifth graduate with more than $7,000 of debt. This is how meltdowns start…