As we mentioned earlier this week, credit card rewards programs can be overly complicated and come with rules and limits that drain their value. Now the Consumer Financial Protection Bureau says it is looking into these programs to determine if cardholders are being misled about the costs and benefits of these offers. [More]

credit card rewards

How To Not Suck… At Understanding Credit Card Rewards

From rewards points to airline miles to cash back, there are many, many ways to earn so-called rewards by using a credit card. But rewards programs are often confusing and are sometimes limited by byzantine rules that can make them worthless or cause points to vanish into thin air. [More]

Man Loses Out On $217 In Credit Card Rewards Over Vague Definition Of “Pay At The Pump”

“Pay at the pump” generally means you swipe your credit or debit card at the machine. But in New Jersey, where you’re forbidden from pumping your own gas, there really is no other choice than paying at the pump, though the card isn’t always swiped at the actual pump. This vague distinction between “pay at the pump” and “giving your card to someone at the pump” is why one Jersey driver is out $217 in credit card rewards. [More]

Adventures In Honesty: Chase Credit Card Rewards

Zach’s parents used their Chase rewards points to send him a nice gift. He was thrilled to find three $25 gift cards to Amazon! Except, um, they had only sent him one. It was obviously a mailing error, and Zach reached out to Chase to straighten it out. Having a customer call in to complain that he received too many gift cards was apparently an unprecedented event at this Chase call center. But for raising an honest son, Chase will reward his parents with extra points. [More]

Citibank Cannot Credit Your Credit Card Rewards To Your Account, No Matter What

Chris had a pretty simple request. He writes that he wanted his credit card issuer, Citibank, to save a few trees and save him some legwork, and credit his rewards to his account instead of cutting a check. No one in the Citibank call center hierarchy had the power to make this happen. [More]

Chase Doesn't Want Your Paltry $16 Haiti Relief Donation

Chris writes that while closing a Chase credit card, he had to decide what to do with his leftover rewards credit. He tried to donate his rewards to charity, but learned that $16 isn’t enough to be considered a valid donation. Bwuh? [More]

Free Money From The U.S. Mint: Scheme, Scam, Or Gamble?

Earning easy money online: it is possible! That’s what fans of a particular scheme involving credit card rewards and the U.S. Mint claim. Is it worth the work and the risk?

Chase Cancels Your Credit Cards With No Notification

If you have any Chase credit cards, call to make sure they haven’t been canceled out from under you with no notice. Huh? Are credit card companies allowed to do that? Don’t be silly. Of course they are.

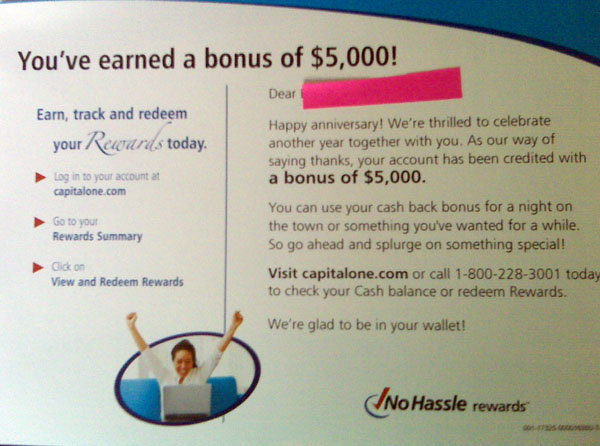

Capital One $5,000 Credit Card Customer Bailout Is Just A Typo

What’s in Lori’s wallet? Not $5,000. She received a letter from Capital One, telling her that since it was her anniversary date with the card company, she had earned a $5,000 bonus, to be credited to her account. Really? It must be true. Capital One wouldn’t send a letter like that out by mistake, now would they?