As foreclosures continue to skyrocket, debt counselors have become a last resort—sometimes the only resort—for thousands of panicked homeowners who don’t know how they’re going to keep their homes. “I don’t think people fully appreciate the pressure that’s being put on those counselor organizations today,” says a Housing and Urban Development official. In addition to offering financial advice, the counselors try to help negotiate payment plans with lenders, stave off foreclosure notices, and even offer mental health support for people so distraught that they become depressed or suicidal. The average pay: $30-50,000 a year.

credit

6 Basic Things Teens Should Know About Credit Cards

Organizations like the Jump$tart Coalition and NFCC have rolled out programs that help you teach your kids about the ins and outs of credit cards, credit ratings, interest rates, etc., but Janet Bodnar at Kiplinger says that there are some basic facts that you should focus on. She thinks too much detail bores a kid; we think it depends on the kid, but agree that at the very least, hitting each point on the following list would give your offspring a decent foundation for making good credit decisions.

Widow Loses Credit History Along With Husband

Widows finds that she’s lost more than just a husband, she’s also lost decades worth of credit history, as creditors are unwilling or unable to transfer the joint accounts into her name. Takeaway: married couples, make sure your credit history is correct and listed under your individual name. Free credit report copies available at annualcreditreport.com.

No More Home Equity? Bust Out The Credit Card, Consumer Borrowing Is Up

With home equity harder to find these days, one might suspect that there would be a drop in consumer borrowing. Nope.

Experian, Equifax, and TransUnion To Offer Credit Freezes

All three credit reporting agencies recently announced plans to let consumers freeze their credit files. Credit freezes provide security at the cost of convenience: access to credit reports and scores is prevented without the consumer’s express authorization, making it difficult to open new accounts or lines of credit. Freezes are considered one of the best, albeit drastic, ways to guard against identity theft.

Should Car Insurance Rates Be Based On Your Credit Score?

For a decade now, all the major auto insurers have used a customer’s credit rating to some degree in determining premiums. They claim that it results in lower rates for “most” customers, and that the data prove that people with lower credit scores make more claims and for higher amounts. The FTC released a report this summer that validated the practice—but also confirmed an unpleasant truth critics have been saying for years: because a higher percentage of Hispanics and African-Americans have low credit scores, there’s a good chance they’re disproportionately affected.

Baltimore Feeling The Pain Of The Housing Slump

In the spring quarter, 25 percent of the foreclosures were in the city itself. The numbers are up even in Belair Edison, a stable working-class neighborhood of neat, two-story row houses adjacent to a picturesque wooded public park.

The University Of Iowa Removes Athletes From Credit Card Promotions

This University of Iowa credit card scandal is getting more interesting every day. Today’s development: The University has “backed away” from allowing athletes to be used in the U of I alumni association credit card program.

Worst Month For New Home Sales In 6 Years

Here’s a cute but meaningless graphic from ABC News that illustrates a very important statistic: New home sales are down. Way down. 8.3% down. It’s the worst month for new home sales in 6 years.

Fraud Protection: What's The Difference Between Credit And Debit?

Federal Reserve Board Regulation E is the federal regulation that governs Electronic Fund Transfers and includes provisions that makes debit-card transactions instantaneous. Instantaneous means that the money is technically spent from the account the moment the card is used, which is important because your debit card draws from a bank account as opposed to a line of credit.

"Green" Credit Cards Are Silly

Bankrate has an article about co-called “green” credit cards that donate a portion of your purchase to environmentally friendly causes. Why are we saying they’re silly?

TransUnion Will Let You Freeze Your Credit Report

Beginning October 15th, credit reporting company TransUnion will let consumers freeze their credit reports, which means imposters will not be able to use your credit to do things like open new phone accounts or sign up for credit cards. While this is great news, the other two major credit reporters, Experian and Equifax, are so far not offering a similar feature, although they say they’re considering it.

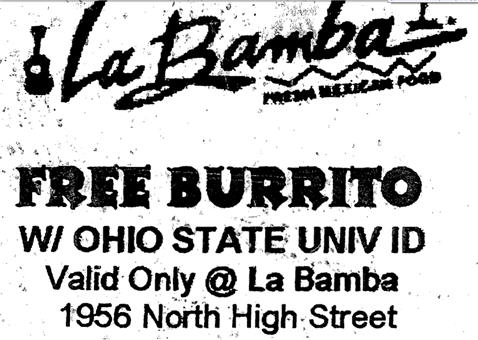

Ohio Attorney General Sues Credit Card Marketers Over Ohio State "Free Burrito" Event

Ohio Attorney General, Mark Dunn, is suing Citibank-affiliated credit card marketers for violating Ohio’s consumer protection laws during a “Free Burrito” event at Ohio State University.

In Wake Of Fed Cuts, Mortgage Rates Rise Slightly

Bankrate has a really interesting article about the effect that the Fed’s rate cuts are having on the mortgage industry. As constant readers of the site are already well aware, the subprime meltdown has lead to a crisis in the secondary mortgage market—investors are no longer interested in purchasing non-conforming loans.

Fed Cuts Rate by Half Percentage Point

The Fed cut interest rates by half a percentage point this afternoon, citing “tightening of credit conditions” that have the potential to “intensify the housing correction.”

ETrade Exits Wholesale Mortgage Business, Warns Investors About Subprime Fallout

E*Trade is warning its investors that profits will come in 31% below estimates and that it is exiting the wholesale mortgage business and “streamlining” its direct mortgage operation due to the “disturbance in the credit markets.”

Make Credit Card Companies Your Bitch

Blueprint for Financial Prosperity reminds us that savvy consumers can take advantage of credit card companies hellbent on turning a profit. Most credit card companies will go to great lengths to keep their customers happily spending away. Use these tips to make them cater to your every financial desire: