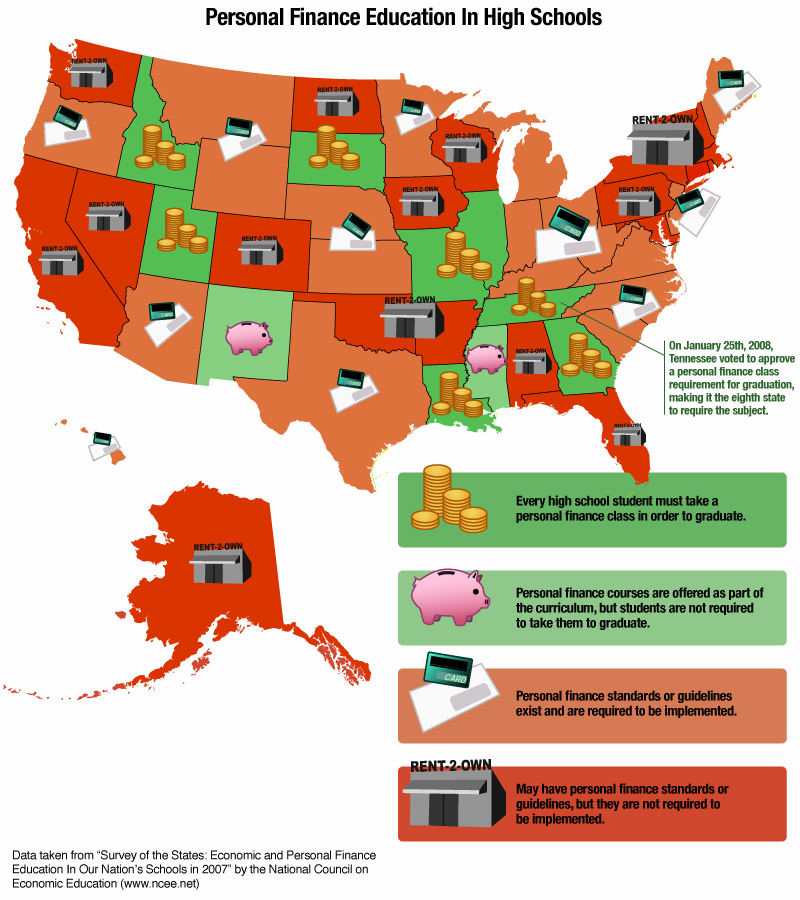

Less than a week ago, Tennessee voted to require a personal finance class of all graduating high school students, starting with this year’s seventh graders. Unfortunately, less than 20% of states have similar requirements. We’ve made a fancy-schmancy graphic to show which states are teaching tomorrow’s citizens how to manage money, and which states are likely to be great places to set up payday loan shops. Inside, see the chart nice and big.

teaching

Tennessee May Soon Require Financial Literacy Classes For High School Students

The Tennessee State Board of Education is expected to pass a bill on January 25th that will make Tennesee the eighth state (after Georgia, Idaho, Illinois, Louisiana, Missouri, South Dakota, and Utah) to require that its high school students take a personal finance class before graduation.

6 Basic Things Teens Should Know About Credit Cards

Organizations like the Jump$tart Coalition and NFCC have rolled out programs that help you teach your kids about the ins and outs of credit cards, credit ratings, interest rates, etc., but Janet Bodnar at Kiplinger says that there are some basic facts that you should focus on. She thinks too much detail bores a kid; we think it depends on the kid, but agree that at the very least, hitting each point on the following list would give your offspring a decent foundation for making good credit decisions.