When you consider the risk and high cost of identity theft, it pays to be skeptical whenever someone calls you and claims to be from your credit card company. How can you verify that they’re legit? Reader Cathy points us to bloggingawaydebt.com, which offers five simple things to do if you want to make sure you’re not being scammed.

credit

Facing Foreclosure? Take A Deep Breath And Don't Panic

The ongoing subprime meltdown will claim its next victims in October, when adjustable rate mortgages worth over $50 billion reset, but homeowners facing foreclosure can keep a roof over their head by following a few common-sense tips. Above all, don’t panic, and don’t ignore the problem – instead, try the following:

The World's Worst Credit Card

Golb at Money, Matter, and More Musings has located the worst credit card in the world. It is designed to prey on subprime borrowers who, sadly, cannot get a better card…

Pending Home Sales Plummet 12% In July

“The housing market is bad and is going to stay bad for some time,” said Zach Pandl, an economist at Lehman Brothers Holdings Inc. in New York, who predicted a 3 percent drop. “This number does not look good for existing home sales for August.”

September Is Last Month To Qualify For Hybrid Vehicle Tax Credit

If you’re still thinking of purchasing a hybrid vehicle this year, time is running out to get in on the Alternative Motor Vehicle tax credit. We pointed out the official IRS schedule of expiring credits back in March, and now you’ve got less than 30 days to score a small credit (currently 25% of the original credit amount) on a Toyota or Lexus hybrid—after September 30th, the credit disappears for good. Honda tax credits may be cut by 50% after September 30th, but the verdict’s still out on this one.

Credit Card Late Fees Might Be Unconstitutional?

Over at the Consumer Law & Policy Blog they’ve posted the abstract of a article that considers the constitutionality of credit card late fees. Apparently, there are “constitutional constraints upon the imposition of punitive damages.” Neat. The article by Seana Shiffrin and is called “Are Credit Card Late Fees Unconstitutional?”

State Farm Mutual Automobile Insurance Co. v. Campbell articulated serious and specific constitutional constraints upon the imposition of punitive damages. Justice Kennedy’s majority opinion announced that, apart from exceptional cases, punitive damages should not exceed nine times the amount of the actual losses sustained by the plaintiff and should usually be far lower…

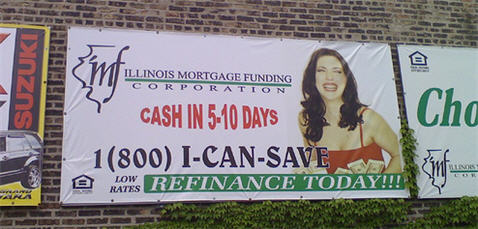

Mortgages Are Disappearing But The Advertising Isn't

Even as lenders face bankruptcy and banks are closing down their mortgage divisions and cutting jobs, the advertising for subprime and non-conforming loans is still going strong. What’s the deal?

Capital One To Close Mortgage Unit

“Current conditions in the secondary mortgage markets create significant near-term profitability challenges,” Capital One said in a statement. “Further, recent and continuing developments in the mortgage markets reduce the long-term outlook for profitability in the business, as the company expects markets for prime, non-conforming mortgage products are likely to remain challenged.”

Later, gator.

Got An Inactive Macy's Store Account? Here's Your New Citibank Mastercard

Recently, a Consumerist tipster sent in an internal memo from Macy’s explaining that the store was “flipping” 3.5 million inactive store accounts into Citibank Mastercards. The memo reads:

“Approximately 3.5 million inactive (24-48 months) Macy’s accounts have been selected to “flip” to the Citibank Mastercard. That means the customer will be sent a Citibank Mastercard to replace their inactive Macy’s card. “

MBNA Refuses To Appear For Binding Arbitration, May Still Prevail

Elizabeth Warren, the doyenne of consumer debt, received a frank email from a lawyer that shows the anti-consumer bias of binding arbitration. The lawyer was attempting to arbitrate a dispute with MBNA, a difficult task complicated by the bank’s refusal to participate.

Capital One Raises Your Interest Rate

We’re getting complaints that Capital One has raised interest rates across the board for its customers. One reader says his wife’s rate went from 9.9% fixed to a variable rate, making it about 15%.

Don't Let Divorce Affect Your Credit Score

Divorce can break your heart, and ruin your credit. Before parting ways, divorcing couples must untangle any assets acquired during the marriage. Ask The Advisor put together a useful guide for any couple unwilling to wait until death to do them part:

The Truth About Credit Card Debt

Recently we noted that 90% of American households thought they held average or below average levels of credit card debt. This made us think that Americans were in denial when it came to their credit card debt since “90%” and “average” simply don’t mix.

Liveblogging the Senate Commerce Committee Oversight Hearing On Telemarketing Fraud

Join us at 2:30 we liveblog the Senate Commerce Committee’s oversight hearing on telemarketing fraud. The Committee wants to fight telemarketers who target vulnerable senior citizens, so they’re going to ask the FTC to take center stage and explain its implementation of the Do-Not-Call list and the Credit Reporting Organizations Act (CROA.)

Subprime Meets Wall Street, Investor Forced To Sell Yacht

Meet the subprime mortgage meltdown’s other victim, a millionaire mortgage investor who has been forced to put his yacht up for sale—for $23.5 million.

Easy Money Drying Up, Taking The Economy With It?

What happens when easy credit, the lifeblood of our economy for the past few years, dries up? Consumer spending slows and people start mouthing the word “recession.”

You're Never Too Young To Have Your Identity Stolen

The NYT has an article about Gabriel Jimenez, a 25-year-old who has been battling an identity thief for half his life. His SSN was stolen and used by an illegal immigrant when he was 11, and it’s been a nightmare ever since.