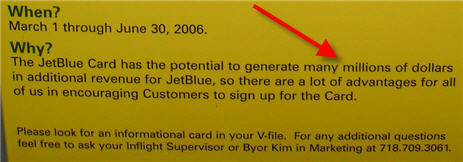

My girlfriend and I had a layover at JFK last week. While I was waiting for her in the bathroom I started reading a poster that seemed to be prompting me to get a JetBlue American Express card.

credit cards

Misplaced Poster Reminds You To "Generate Many Millions of Dollars" For JetBlue

Save On Medical Expenses With Healthcare Credit Cards

Citibank and Bank of America both offer special credit card programs based on health and medical expenses. If you’re disciplined about not carrying revolving debt, and you have recurring medical expenses, they can help reduce your total cost over a year. Bank of America’s cards are point-based programs—if you’ve got Aetna insurance, you can accumulate points that you can turn into “cash direct deposits to a health savings account, or other standard rewards.” Caremark members can redeem points for awards only, although BoA’s standard awards catalogue “includes health and wellness products like fitness equipment and blood pressure monitors.”

Credit Card APR Magically Raises From 7.99% To 21.99%

I keep reading and it says that I can “reject this amendment” by doing so in writing by 2/29/2008.

6 Reasons To Keep More Than One Credit Card

Keeping a second credit card won’t lead to financial ruin, and may prove useful in several situations. Bankrate offers six reasons to stash away a spare card.

Missing Data On 650,000 Customers Related To Credit Card Fraud Surge?

On Tuesday we speculated that the surge in credit card fraud and forcible card reissues our readers have been reporting to us were the result of a recently discovered breach at a “major retailer,” and now GE Money Bank reported that the data of over 650,000 customers of JC Penney and hundreds of other retail stores is missing. Are these two events related? The official line is no. GE Money Bank says the data, which was stored on magnetic tapes, “was created in such a manner to make unauthorized access extremely unlikely and difficult, even for experts with specialized knowledge and technology.” But guess what?

Data Tape On 650k Customers From 230 Retailers Is Missing

Today GE Money reported that a data tape containing personal information on 650,000 customers from “about 230 retailers including J.C. Penney Co” is missing. Social Security numbers for about 150,000 customers were also on the tape. It was “being stored at a facility operated by Iron Mountain Inc, an information protection and storage company,” but there’s no evidence currently that it was stolen—it may just be sitting somewhere in a vast matte-painted warehouse like the Ark of the Covenant. However, it may also be the source of the recent wave of ID theft issues we’ve noticed.

TV Breaks Right After The Warranty Expired? Call Your Credit Card Company

Reader Brendan’s TV decided to die right after the manufacturer’s warranty expired. He tried asking Polaroid to extend the warranty. (They wouldn’t.) He tried getting the TV repaired. (Too expensive.) Not knowing what else to do, he sent us a 1,000-ish-word-long complaint detailing the frustrations one could expect when dealing with Polaroid. (It was very well written.)

It's Time To Call The Credit Card Company When…

If you want to consolidate balances, you can ask them to waive balance transfer fees…

"Major Retailer's" Data Breach Results In Wave Of Credit Card Fraud?

Anecdotal evidence suggests that a recently reported data breach by an undisclosed “major retailer” has resulted in a jump in consumers having their debit cards forcibly reissued, or calls from their bank to verify their recent purchase history. The problems seem to have started just around Christmas time and have continued into mid-January.

../../../..//2008/01/14/how-to-cancel-dead-parents/

How to cancel dead parent’s credit cards. Remember that when closing down a deceased relative’s accounts, any outstanding balances are to paid by their estate, not their heirs. [Kiplinger]

Need A 2-Liter Bottle Of Pepsi? Just Apply For A Walmart Credit Card!

This is not funny. This is sad. Very, very sad. They should at least offer Coke.

American Airlines Refuses To Accept American Airlines Credit Card

American Airlines told Justin that they could not accept his American Airlines credit card due to a bug in their spiffy new booking system. Justin wanted to charge a trip to Disney World on the card, which unlike standard credit cards, is supposed to work exclusively for purchasing tickets with American Airlines.

American Express Writes Down $275 Million Because You Can't Pay Your Bills

American Express stock fell 7% after saying it would have to write off $275 million, thanks to more and more customers not paying their bills. What is probably happening is that people can’t tap their home equity so they’re going to the next easiest line of credit, credit cards, and failing to pay their bills there as well. In Walden, Thoreau talks about how early New Englanders would make their first homes by digging a cellar in the ground and putting a roof of saplings and bark over the top of it. My, that would make a mighty fine recession shelter.

JetBlue: You're 4 Years Old, Would You Like An Amex?

Thought you might enjoy this: We got an application for a jetBlue-branded American Express card in the mail today for our oldest daughter. She is four. We flew on JetBlue about four months ago, so I suppose they sent their entire passenger manifest over to AmEx.

Creditreport.com Is A Scam

One lady reports that she started to get inexplicable credit card charges from Creditreport.com. After speaking to 12 different reps, she reached a supervisor who threatened to sue her because she had signed a contract. When she asked for the contract to be mailed to her, the supervisor said, they “couldn’t” print it out, they could only email it. To which the lady responded, “So how exactly is this going to hold up in court? What are you going to do, Email the judge?” Oh snap. Eventually, after a little more hassle, they canceled her account. Someone should have told her that the only place to go to for a free, no strings, no monthly fee access to your credit report is annualcreditreport.com.

15 Credit Cards With Good Rewards Programs

The financial columnist at MSN Money quizzed five credit card industry experts and a frequent flyer expert to find the best cards when it comes to travel programs, cash back programs, and savings programs. She narrowed it down to a top six—two in each category—and a bunch of near misses.

The Downside To Alternate Payment Systems

If you use services like Bill Me Later, eBillme, or Pay Payl’s Pay Later—payment options designed to let you pay online without using a credit card—you should be aware of the risks as well as benefits that come with them, writes SmartMoney. The most important thing to consider: as far as FICO is concerned, you’re applying for a line of credit (with the potential for high interest rates) when you pay with one of these systems, and your credit score may drop accordingly.

How To Never Wait On Hold With Your Credit Card Company

Reader Jamie shares a neat workaround so that he never has to wait on hold with his credit card company. He says that whenever he calls, “I do not use the 800-number on the back of the card. Instead, I use their outside-the-US instructions on the back of the card and call them collect at their regular phone number. When the credit card thinks that they are paying international collect call charges, they do NOT put you on hold – they take your call right away!”