The Chase customer service rep whose 10 Confessions we posted last week has been reading your comments and has responded to some of your questions. The rep also offers five more tips that they forgot to include in their original post.

credit cards

Geeks.com Website Hacked, Customer Data Stolen

If you bought anything from Geeks.com in at least the last year or so, you might want to start paying close attention to your credit card statements—the company sent out an email on Friday telling former customers that they “recently discovered on December 5, 2007 that customer information, including Visa credit card information, may have been compromised.” Full email after the jump.

Royal Farms Gas Pump Charges You Even After The Gas Stops Flowing

Royal Farms refuses to fix a broken gas pump that charges customers even after the gas stops flowing. The pump in Abingdon, Maryland has overcharged Tom on five separate occasions, and Royal Farms refuses to issue a promised refund.

10 Confessions Of A Chase Customer Service Rep

Do you know the one thing to never say to a customer service rep if you’re late on your bill? Do you know how Chase ranks you, and how you’re ranked determines whether they help you out in a bind? Do you know the best way to get what you want from customer service? After you read these 10 confessions from a Chase customer service rep, you will.

Credit Card Delinquencies Skyrocket

Nobody Knows The True Cost Of Credit

Credit card companies make it impossible for consumers or markets to know the true cost of credit, according to Georgetown Law professor Adam Levitin. The professor makes his point with a pop quiz:

… what’s the interest rate on the credit cards you’re carrying? How about the default rate? Do you know what constitutes an event of default? What will trigger a penalty fee or surcharge? How much are those fees? If you’re like most Americans, you probably cannot answer many or all of these questions.

Hollywood Video Signing Customers Up For Magazine Subscriptions Without Permission?

We’ve received two letters claiming that Hollywood video is signing their customers up for magazine subscriptions without their consent. The scam sounds similar to the ones that Best Buy is accused of in their on-going racketeering lawsuit.

Yes, New York City Cabs Take Credit Cards

New York taxi drivers have resigned themselves to a fate with credit cards, according to a New York Times investigation. Cabbies struck twice this year to protest regulations forcing them to accept credit of all stripes. To see if cabbies are following the new rules, the Times asked five reporters to hop in twenty cabs each with one question: “I’ve only got a credit card, is that O.K.?”

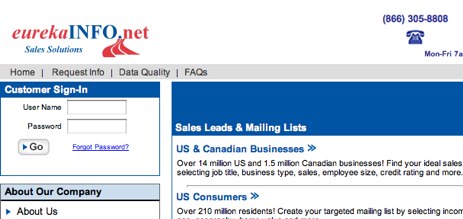

Watch Out For Mysterious $8.95 Charge To Your Account

A reader writes in that he noticed an unusual charge for $8.95 on his bank card recently. He looked up the number connected to the charge—866-305-8808—at the website 800notes.com and found that it belongs to some company called Eureka or EurekaInfo.net, and that there are others who have discovered the same unauthorized charge in recent days.

Card Skimmer Harvests $10,000 From 45 Victims At California Gas Station

Police suspect that a card skimmer installed at a gas station in El Monte, CA is responsible for $10,000 in credit card fraud, says KNBC:

“It looks like the victims were gassing up here and using the outside pump terminals, and their credit card information was compromised,” El Monte police Detective Brian Glick said.

Want To Shop At Amazon.com Without A Credit Card?

BusinessWeek says Amazon is buying a stake in “Bill Me Later” a firm that offers open lines of credit to customers so they can shop without using a credit card.

How To Report Merchants For Requiring A Minimum Purchase Or Making You Show ID

Stores are violating their contract with the credit card companies if they set minimum or maximum charges, or force you to show ID in addition to your credit card (with the obvious exception being for age-limited purchases). Depending on your state and your card issuer, surcharges or “convenience fees” may be banned as well. The best way to straighten these guys out is to report them to the credit card company. People who have done so on the Credit Boards message board say that when they report a merchant, they get a letter from the credit card company and when they go back to the store, the shenanigans have stopped. Here’s all the contact infos for the credit card companies to file a merchant complaint, as well as links to merchant agreements, in case you feel like standing up for your consumer rights. Someone better warn Amy’s Ice Cream!

Stores Can't Force You To Show ID With Your Credit Card

Here’s an interesting fact in this Red Tape Chronicles post about how to protect your private data bits from retailers who don’t know any better: by the terms of their merchant agreement with credit card issuers, stores are not allowed to force you to present ID in addition to your credit card.

Get $25 From The Credit Card Companies

You may be entitled to a cash prize if you had a Visa, MasterCard, or Diner’s Club Cards during any time between February 1 1996 and November 8 2006. A successful class action lawsuit contended that credit card companies overcharged customers for foreign transactions and didn’t disclose the fees well enough. You can apply for a straight $25 refund, 1% of estimated foreign transactions, or annual estimation refund of 1-3% of foreign transactions for which you have records . Claim your moneys by filling out forms that were mailed to you, going to ccfsettlement.com, or calling 1-800-945-9890. It is not is necessary to have actually conducted foreign transactions to claim the money.

The Subprime Meltdown Is The Tip Of The Credit Iceberg

The ongoing subprime meltdown is merely the first destructive wave of credit catastrophe to wash over Wall Street, according to Slate’s resident explainer. Americans drunkenly bandy credit around in several forms: mortgages are the most prevalent loans turning sour, but credit card debt, student loans, and auto loans are silently conspiring to threaten our macroeconomic well-being.

../../../..//2007/12/08/credit-cards-and-banks-are/

Credit cards and banks are starting to let people charge their rent or mortgage on your credit card. Great for earning rewards points or frequent flyer miles, but it’s only a good idea if you can pay off your credit card in full every month. [NYT]

Citibank Sends You Letters To Let You Know Your Paperless Statement Is Ready

Corey writes:

I have a lovely Citi Mastercard with lots of rewards. I hate having to deal with paper statements, so I signed up for paperless statements (like I’ve done with all my accounts), available for viewing online at their website.

AmEx Incompetence Unleashes Zombie Debt Collectors On Innocent Reader

Richard writes:I am an MD-PhD, working at a medical center in New York. In 2006 I came here form Wisconsin, and at that point I called American Express (had a credit card with them for about 7-8 years before), explained my move, and the new academic position I was taking on, and asked them if they…