Reader Sue saw this sign at Circuit City and snapped a picture of it for us.

credit cards

Forever 21 Aftershocks? Citibank Cancels Cards Due To Retailer Security Breach

We’ve received queries from readers telling us that their Citibank cards have been replaced, and asking whether we’ve heard about any new security breach. Other than Forever 21 we haven’t, so we’re wondering whether they’re responsible for the stories below.

Capital One Mails Fraud Claim To The Person Committing Fraud

“Lisa” writes, “I recently found out that I was a victim of identity theft.” What shocked her, and us as well, is that after Capital One notified her that they’d approved the card with another address, they followed up by sending their fraud claim to the criminal’s address instead of Lisa’s.

98,930 Affected In Forever 21 Data Breach

Forever21 announced Friday that the Secret Service told it criminals had jacked 98,930 credit and debit card numbers from its computers. Based on their forensic analysis, your digits could be in the hands of unsavory individuals if you shopped there on…

Ever Used A Gift Card At Buy.com? Surprise, You May Owe Them Money

Seth was recently contacted by Buy.com and told that due to an error, an order he placed over a year ago had a balance due. They’ll be debiting his credit card “on or about 09/22/08.” Seth emailed them back to ask why they were just now settling the billing issue—surely it hadn’t taken them this long to notice it. Apparently, it had, and it’s not just Seth’s account that’s messed up.

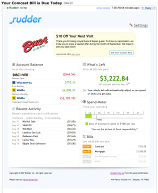

'Rudder' Provides Your Daily Financial Status Via Email

Rudder is a new personal finance service that differs from the dozens of other ones now available in two key ways: it presents a simplified overview of your available funds, which it calls “What’s Left,” and it delivers it (along with bill reminders and balance notifications) to your email inbox instead of requiring you to visit a website. Think of it as a highly customized “Very Short List” or “Daily Candy,” only the topic is always your current financial health.

../../../..//2008/09/11/this-appears-to-be-a/

This appears to be a higher-level BoA credit card services number where a real person picks up in just a few rings and is actually competent and help you out with your requests: 800-792-9008

What Can You Do With $1,000?

It used to be that $1,000 was a good amount of money. Then again, it used to be 1980 once too.

3 Days Late? BoA Jacks Rate To 29.99%

Many of you know that if you’re late on your credit card bill payments they can raise your rates as high as 29.99%, but that’s just for scalawags, right? Nope. JLP at All Financial Matter’s brother was late twice on his Bank of America bill, once by three days, and once by one day. That was enough to make Bank of America say, OMG, this guy is way too risky and we need to penalize him and send his rates as high as they can legally go!

Mythbusters Host Retracts RFID Censorship Comments

Mythbusters host Adam Savage is retracting comments he made at a hackers conference where he said an episode exposing security flaws in credit card RFID technology was squelched by credit card company lawyers. In a new statement Adam says, ” If I went into the detail of exactly why this story didn’t get filmed, it’s so bizarre and convoluted that no one would believe me, but suffice to say…the decision not to continue on with the RFID story was made by our production company, Beyond Productions, and had nothing to do with Discovery, or their ad sales department.”

BoA Reopens Credit Card Closed 10 Years Ago

At Bank of America, your accounts are Buddhist. As in, undergoing “eternal return,” where accounts that have been closed and passed on will reemerge, rejuvenated, reopened, even if you closed them long, long, ago. Reader Chip writes:

What To Do When A Store Sells You Box Of Crap And Won't Take It Back

We get a lot of complaints about people buying things from stores like Best Buy and Target and finding that once they get them home — there’s a bunch of bathroom tiles in the box instead of the item, or that the item is used, broken or smashed. When they try to return the thing, the store tells them that they’re out of luck. When you ask why they think they can get away with selling you a paperweight instead of an XBOX, they point to some bullsh*t policy and send you on your way. You don’t have to put up with this. In this post, we’ll tell you a) How to keep this from happening to you in the first place. b) How to equip yourself with tools that will help you in the event that this does happen to you. c) How to take advantage of these tools so that you never get stuck with someone’s old broken PS3.

Citibank Must Pay Back The $14 Million It Stole From Customers Over A Decade

Between 1992 and 2003, Citibank operated an “automatic sweeping” program that would without notice remove positive balances from customers’ credit card accounts—mainly those of the poor and the recently deceased—and pocket the money. Now it’s paying back $14 million dollars to the affected customers, plus another $3.5 million in penalties to California, thanks to that state’s Attorney General.

Discover Won't Let Man Opt Out Of Arbitration, Even Though Their Terms Allow It

When John signed up for a Discover card a few months ago, he noticed an interesting item in the fine print—he could opt out of binding arbitration if he sent in a written request that contained a few lines of necessary info and his signature. John followed the instructions, but Discover rejected it. Since then they’ve rejected his request a second time, failed to call him back when promised, and transferred him to CSRs who don’t know what the word means. The latest news: now that 30 days have passed, he’s no longer eligible to opt out. John’s thinking about canceling the card.

Amex Tops JD Power Credit Card 2008 Customer Satisfaction Survey

JD Power and Associates ranked American Express at the top of their 2008 Credit Card Satisfaction Study. Customers gave the company high marks in interaction, billing and payment processes, reward programs, fees and rates, and benefits and services, with the first three factors standing out in particular. Capital One and HSBC, which target revolvers with lower credit scores, received the worst marks. Oddly, Discover got second place. People must really like their two-cycle billing (see “Two-Cycle Billing And Why It’s Evil“). Full rankings inside…

Credit Card Junk Mail Decreases By 260 Million

The number of credit card offers clogging mailboxes took a nosedive in this year’s second quarter, 1.54 billion vs 1.8 billion for the same period last year. An aftershock of the credit crunch and sub-prime meltdown, the decrease reflects a shift in the banking industries thinking, trending towards higher standards from its borrowers than merely the fact that they are carbon-based lifeforms. A good way to take that number even lower is to register with OptOutPrescreen.com and stop the tide of credit card offers almost entirely.