For several years and in different forms, Citi has had an interesting idea to get you/help you to pay off your credit card called the Citi Payment Partner Program. How it works is if you enroll and make above the minimum payment due for four months, on-time, at the end they will match 10% of the amount you paid off above your minimum payment. The max cap is $550. But there are two important caveats:

credit cards

Reader Pays Off $14,330 In 20 Months With Our Tips

Stuck in a $14,300 debt hole, reader Trixare4kids was able to dig herself out using tips she learned about on Consumerist.com. Let’s learn how she attacked her personal finances and learned to live frugally, and did it all in 20 months.

Your Inactive Credit Cards Could Be In Danger

If you’ve got a few credit cards lying around that you haven’t used in a while but don’t want to lose, you might want to talk them out for a walk.

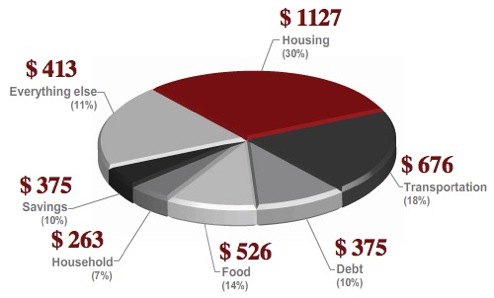

On The Money's Budget Calculator Helps Guide Your Monthly Spending

On The Money’s budget calculator makes it easy to determine how much you should be spending across the seven categories that make up any responsible budget. Regardless of income, tracking and limiting your overall spending is a foolproof strategy for keeping your accounts in the black. Though the percents will vary according to geography and personal situation, On The Money’s calculator gives you a quick glance at concrete spending targets that you can compare against your credit card bills and bank statements. Give it a try and tell us in the comments what other tools you use to control your spending.

Staying Out Of The Red Is The New Black

All of a sudden, everyone is interested in how their banks, credit cards, credit scores, credit reports, mortgages, and money actually work. Staying out of the red is the new black. Have you found yourself talking more about money matters and strategies with friends, family, co-workers, and even strangers?

How To Get Out Of Debt

J is in a debt hole and needs help getting out. We’re going to give it to him: [More]

Southwest's "Credit Cards Only" Policy Increases Sales By 8%

Here’s the real reason for an airline to switch to credit-card-only sales on board its flights: people spend more. Southwest Airlines’ customer service veep, Daryl Krause, told the Dallas Morning News that “since Southwest began accept credit cards (and no longer taking cash) on Sept. 9, its drink sales are up about 8 percent.” Since in general “the goal was one more drink sale per flight,” we wonder whether that wasn’t the real reason for going cashless all along.

Citi Credit Card Cautions You Against Spending

Citi’s been burned enough by its cardholders’ profligate spending, apparently. Check out the message on this activation sticker on a new card. We like the inclusion of a sort of Yin-yang background, as if to remind us that debt and repayment are equal elements of the consumer credit world. A balance must be maintained! Just, you know, not so high a balance that you can’t make your monthly payments.(Thanks to Jerry!)

When Things Get Crazy, Rumors Get Even Crazier

We received a tip today that Bank of America supposedly plans to close nearly all of its customers’ credit cards on October 1st, but the only source we can find for this rumor is a single post at iReport.com, CNN’s public journalism free-for-all. Everything else online that mentions this is traced back to that one short post. So, until we find out more, we’re going to say this one is bunk—and a great example of how wild rumors can pop up during desperate times. (Thanks to Joseph!)

American Express Randomly Cut My Credit Limit From $25,000 to $1,800

Reader Pierre is a small business owner who has an American Express Business Account that used to have a $25,000 limit, but has now been cut to $1,800. He says his company’s bill is usually around $12,000 a month, and it is always paid in full — on time. While Pierre is clearly upset with American Express, the Wall Street Journal says that all banks are cutting access to credit.

Honey, Was That PotBelly's Sandwich $4.23 Or $858,432?

Sorry PotBelly Sandwich Works customers, you can’t order the Chicken Salad Sandwich unless you qualify for a mortgage. Ashley’s husband thought his usual lunchtime meal cost $4.23, but, as his wife discovered when trying to pay their credit card bill, the sandwich actually costs $858,432.06.

Advanta Raises Your 8% Credit Card To 20% Because The Economy Is Bad

I have had an Advanta Credit Card for a little over a year now. My interest rate prior to a few days ago was 8%. My credit rating is very good, and I have always made my payments on time. As I was looking over my bill for September I noticed a fee of $75 dollars. A few clicks later I found that my interest rate had been raised to 20%.

Do The Math, Southwest: 25-Minute Layover, 20-Minute Security Screening

…I flew from Sacramento to the connection hub in San Diego, where I had a 25 minute layover. While I would not have chosen a 25-minute layover,

Southwest doesn’t give you your flight times until you’ve booked….the two gates were in separate parts of the building, separated by security…

Personal Finance Roundup

Bank crisis: 10 things to know now [MSN Money] “If your bank goes bust, how do you get your money out? Are credit unions protected? What about investments? It’s time to get your ducks in a row.”

One Day Left To Register For TransUnion Class Action Lawsuit

September 24, tomorrow, is the last day to register for the class action against TransUnion for selling consumer’s private data to businesses without permission. If you held a credit card between January 1, 1987 to May 28, 2008, you’re eligible to receive benefits. You can choose from one of three options:

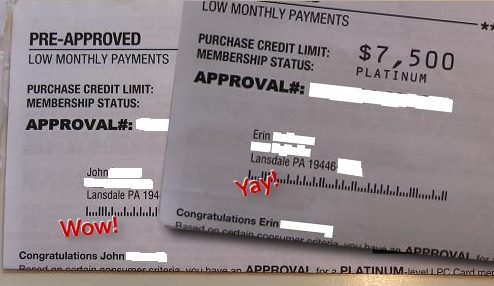

LPC Has Pre-Approved Your Neighbor For Credit—Please Let Him Know

I just opened my mail for today. I just received a pre-approved credit card application and they ::oops:: included another one for my neighbor, in my envelope.

Retailers Like Target May Be In Trouble As Consumers Run Out Of Money

Forbes says that Wall Street is starting to be concerned about Target because of an increase in the amount of delinquencies in its credit card operation. Uh oh…

'Identity Theft-Proof' Wallet Blocks RFID, Goes In Front Pocket

If you’re concerned about your RFID-chipped credit cards being skimmed, you might want to consider shielding them. DIFRwear makes a wallet with the shielding already included, and now roguewallet in Maine has introduced its own RFID-shielded version, with a fin-shaped design so it fits better in your front pocket to thwart pickpockets. Unfortunately, it’s also $50, compared to $20 for the more conventional looking DIFRwear hip-pocket design. (Both are FIPS 201 compliant, if that means anything to you.)