This man says he saw a 10-year-old girl (not pictured) on Halloween dressed as a credit card. Cute. What financial-crisis-related costumes did you see this year? [Adverts Ruin Everything]

credit cards

"I Fell For The Locksmith Scam"

There are lots of honest locksmiths out there — but there are dishonest ones too — and they’re notorious for bullying helpless consumers out of a lot of money. Here’s the scenario: You’re locked out of your car, so you call a locksmith. You’re quoted a price that seems reasonable, but when the “locksmith” shows up, he bullies you into paying more money — a lot more.

Paying Cards Off Doesn't Mean Reported Balances Are Zero

Personal finance columnist Liz Pulliam Weston saw Rebekah’s story yesterday, “Is It OK To Use Credit Cards For Everything, If You Pay Them Off Every Month?” and wanted to clarify something important. If you pay off the cards in full, the balances reported to the credit bureaus will not be zero. More likely, it will be the balance from your last statement. Liz writes:

Is It OK To Use Credit Cards For Everything, If You Pay Them Off Every Month?

Reader Rebekah has a question about credit cards. She and her husband pay off their cards every month, but like to charge most of their expenses because they enjoy the reward points. She’s wondering if this is a good idea and how it affects her credit.

Attention: Credit Card Companies Have Realized That You Are Broke

The New York Times has an article detailing what promises to be the next fun financial crisis — credit card debt! Apparently, credit card companies have only just now realized that you people are broke! Whoops.

Capital One Explains Minimum Balance Calculation Changes

Capital One wrote to explain why they were changing lowering the minimum balance calculations, as we posted about yesterday. Pam Girardo in Capital One External Communications wrote:

How Outsourced Call Centers Are Costing Millions In Identity Theft

A former Chase call center rep tells the story about this one thief who was able to rip off one customer for over $40,000, thanks to his constant outwitting out the internationally out-sourced security department. It wasn’t that hard. Over and over again, he was able to commit credit card fraud just knowing the guy’s name, social, and mother’s maiden name.

Did Turkish Police Beat Information Out Of A Suspect In The TJ Maxx Credit Card Case?

Christopher Soghoian over at Cnet is reporting that Turkish police may have used violence to get the encryption keys of one of primary ringleaders in the TJ Maxx credit card theft investigation. The suspect, Maksym Yastremskiy, is apparently a “major figure in the international sale of stolen credit card information.”

Please, Citibank, Stop Sending Us Random Amounts Of Money!

Readers M & C are honest people, so when Citibank started randomly depositing money that clearly wasn’t theirs into their account, they called to tell them about it. And Citibank took the money back. And deposited it again. And then sent them a check. M & C say that they’ve begged, they’ve pleaded Citibank to stop sending them random checks — but nothing has worked.

Reach Citibank Executive Customer Service

Having trouble getting people at Citibank to help you out? If you’ve tried regular customer service and supervisor multiple times and failed, try these numbers:

Credit Cards Scammers Pretend To Be From BBB

Robo-scammers are ringing up consumers and pretending to the Better Business Bureau, saying, “We’re from BBB – Because of bailout, we can offer you a low-rate credit card.” In this iteration, we see several three common scam characteristics combined: *Unexpected communication * Automated communication * Mention of topical event * Use of recognizable institution’s name * Money-saving opportunity. Investigators were unable to tell the exact nature of the scam. It could be been to steal your account numbers, or it might have just been a marketing affiliate’s sleazy way of generating leads for a credit card company trying to get people to transfer their balances. Complaints have been received about the scam at a BBBs serving Washington, West Oregon and Northern Idaho, as well as Midland,Texas.

24% APR Crushes Reader To Death

I have a card with one bank (that I am trying my hardest to pay off ASAP) that is 24% APR. It is killing me. A week or two ago, you had an article about a woman who paid off all her credit card debt over the course of 20 months or so. Good for her and it was a good story. One thing about it had me wondering though. She said that she negotiated with her lenders to get lower interest rates on her cards. How do you suggest I do that?

AMEX Says You Closed Your Account While In Coma

According to the credit report, AMEX says Dan’s father-in-law closed a credit card he had with them while he was in a coma. Now Amex is using that to come after the mother-in-law for $15,000. Read the rest of the story, inside…

Hold On To Your Hats And Sunglasses, Here Comes The Credit Card Meltdown

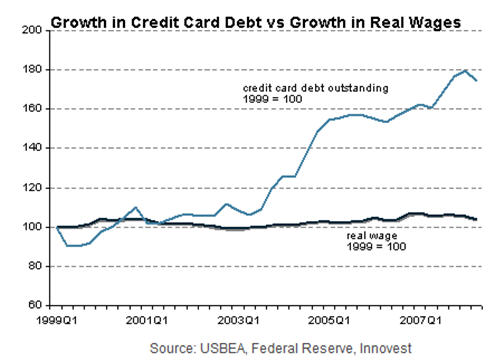

We hope you’re enjoying our current economic roller coaster because it’s likely to continue — According to a new report from research firm Innovest Strategic Value Advisors, titled “Credit Cards at the Tipping Point,” the fun has only just begun. As the credit crunch begins to affect consumers, they’re going to have more difficulty paying their credit card bills. The report suggests that credit card companies’ misleading practices and cavalier extension of credit may come back to bite them. Who should be worried? Capital One.

12 Signs You're Addicted To Debt

The headlines are screaming that America is more addicted to debt than crack. Then there are people out there who actually have a psycophysical need to spend spend spend. Are you one of them? Is your partner or friend? These are the 12 warning signs to watch out for…

American Express Judges You Based On Who Holds Your Mortgage, Where You Shop

Has your credit limit been inexplicably lowered lately? Well, it might not be anything personal. The problem might be with your mortgage lender. Or where you’ve been shopping. Or where you live. American Express, long rumored to judge customers based on this criteria, has admitted that it evaluates who you do business with and where you live when determining how much credit to give you, says MSNBC.