Each year consumers spend nearly $32 million in exorbitant overdraft fees to their banks and credit unions without fully understanding the way in which these fees work or how much they spend on each overdraft. Today, the Consumer Financial Protection Bureau reminded banks that using consumers’ lack of knowledge to collect more fees isn’t acceptable by imposing a $7.5 million fine against Regions Bank for unlawful overdraft practices. [More]

consumer financial protection bureau

Many Americans Still In The Dark About Overdraft Fees & Other Bank Practices

While millions of consumers contribute to the $32 billion in overdraft fees collected each year, a new video shows that many checking account holders don’t fully understand the way overdrafts work or how much they spend on the fees each year. [More]

FICO Expands Program To Give Millions Of Consumers Free Access To Credit Scores & Reports

Millions of financially struggling consumers who work with qualified nonprofit counseling agencies now have access to free credit scores and credit reports with the expansion of the FICO Score Open Access program. [More]

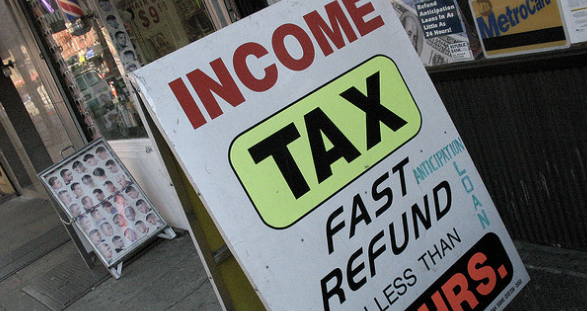

CFPB, Navajo Nation Team Up To Put An End To Tax Scheme Targeting Low-Income Consumers

For many low-income consumers, tax time provides an opportunity to catch up on bills and get back on track financially. Unfortunately, there are unscrupulous companies out there that aim to make money of these same consumers by pointing them in the direction of high-cost tax-refund-anticipation loans. That appears to be the case for the owner of New Mexico-based H&R Block franchises and a tax-time loan company operating an alleged illegal tax-refund scheme. [More]

CFPB Takes Action Against Mortgage Relief Company Deceptively Using VA & FHA Logos On Ads

As we’ve mentioned in the past, it’s illegal for a company to misrepresent itself as an agent of the government, if it isn’t in fact affiliated with the government. But that doesn’t stop some companies from using these false affiliations to lure in customers. Such was the case for a California-based mortgage relief company recently taken down by federal regulators.

CFPB Launches Effort To Bring Financial Education To Schools

While it’s never too late to become financially literate, it certainly helps if you start early. That’s why the Consumer Financial Protection Bureau is launching a national effort to improve financial education in schools.

![The CFPB's electronic version of its Know Before You Owe Mortgage Toolkit includes interactive forms to help consumer find the right mortgage for them. [Click to Enlarge]](../../../../consumermediallc.files.wordpress.com/2015/03/screen-shot-2015-03-31-at-2-08-15-pm.png?w=300&h=225&crop=1)

CFPB Releases Mortgage Toolkit Aimed At Making The Home Buying Process Easier

In January, the Consumer Financial Protection Bureau released a report suggesting that many homebuyers spend more time looking for a TV than shopping around for the right mortgage. In an attempt to make things a little less daunting for prospective borrowers, the Bureau today released the “Know Before You Owe” mortgage shopping toolkit. [More]

Current, Former Corinthian College Students On “Debt Strike” Plan To Meet With Gov’t Officials

Last month, we told you about the Corinthian 15, a group of current and former students at crumbling Corinthian College Inc.’s WyoTech, Heald College, and Everest University campuses who were refusing to pay their federal student loans in protest of the government’s support of the for-profit college company. Now that group has grown to what could be called the Corinthian 100+, and it’s made plans to take its case to several government agencies this week.

“Bad Check” Debt Collector Deceptively Used Prosecutors’ Letterhead To Intimidate Consumers Into Paying High Fees

Late last year, Consumerist reported on a string of debt collectors paying to use prosecutors’ letterheads as a way to intimidate consumers into paying their debts. While the company facing the wrath of the Consumer Financial Protection Bureau today didn’t exactly pay to use the letterhead, they allegedly used the documents in a deceptive manner to get consumers to enroll in costly financial education programs. [More]

Outline For Payday Lending Rules A Good Start, But Not Enough To Fully Protect Consumers

Today, the Consumer Financial Protection Bureau released the first details of long-awaited regulations governing payday loans and other small-dollar lines of credit known to thrust consumers into a devastating cycle of debt. While consumer advocates were quick to applaud the Bureau’s work, and those in the financial industry to voice displeasure with aspects of the potential rules, both groups agreed that the coming months will involve more time and effort to craft meaningful protections for both sides of the issue. [More]

Can New Payday Loan Rules Keep Borrowers From Falling Into Debt Traps?

Nearly one in four consumers continue to turn to high-cost, short-term financial products like payday loans, auto-title loans and other pricey alternatives when struggling to make ends meet, even though research shows these expensive lines of credit often leave consumers worse off than when they began. After nearly three years studying the issue, the Consumer Financial Protection Bureau is now announcing its first attempt to protect consumers from predatory lenders. [More]

Can’t Pay Your Student Loans? In Some States It Might Cost You Your License To Drive Or Work

In addition to causing irreparable damage to their credit scores, student loan borrowers who default on their debts face a much more devastating and counter-intuitive danger: the lost of their driver’s or occupation licenses, including those used by nurses, doctors, teachers and emergency personnel [More]

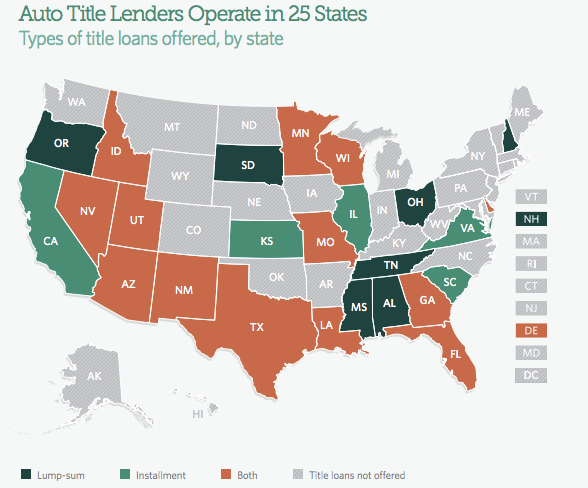

Report: Auto Title Loans Just As Bad, If Not Worse Than Payday Loans; Should Face Same Rules

Each year millions of consumers turn to high-interest, short-term loans to make ends meet. While you may be more familiar with payday lenders who charge triple-digit interest rates with the goal of trapping borrowers into taking out new loans to pay off the old ones, a new report finds that payday’s lesser-known relative, auto title loans, have equally destructive repercussions. [More]

More Than 100 National Consumer Groups Urge The CFPB To Issue Rules Over Forced Arbitration Clauses

Just weeks after the Consumer Financial Protection Bureau released a report showing that tens of millions of Americans have clauses in their credit card, checking account, student loan and wireless phone contracts that take away their rights to sue those companies in a court of law, more than 100 consumer groups have signed a letter urging the Bureau to address the use of forced arbitration clauses by issuing rules forbidding the clauses. [More]

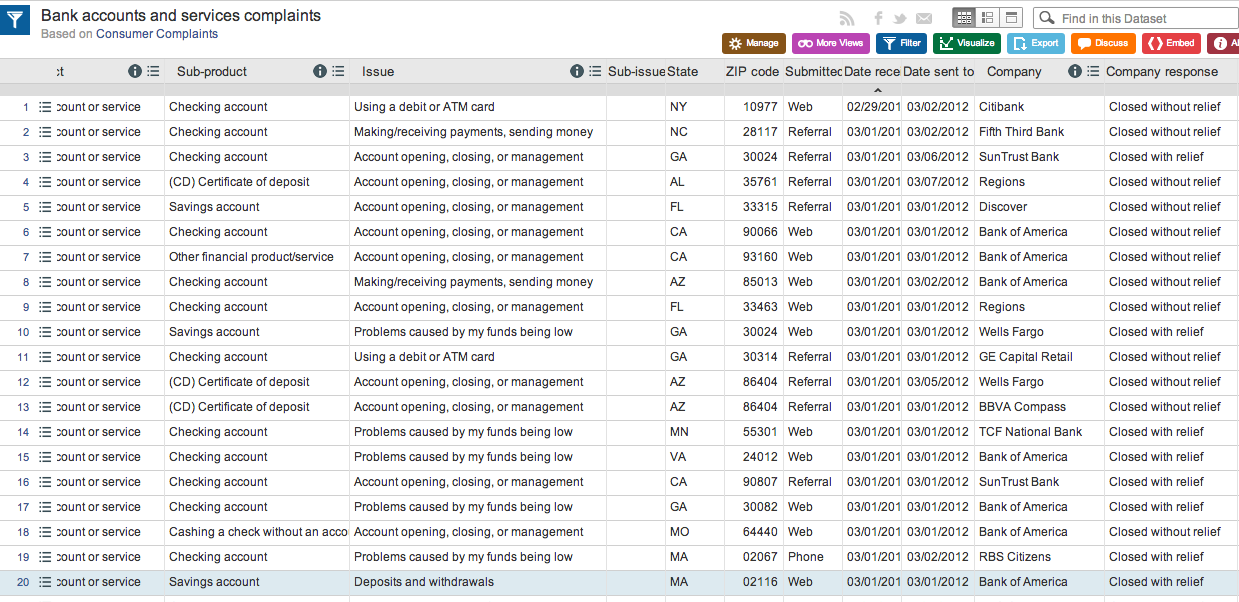

Revamped CFPB Complaint Database Allows Consumers To Publicly Air Financial Grievances

The Consumer Financial Protection Bureau’s quest to allow consumers the option to publicly air their grievances about consumer financial products and service became a reality today. [More]

Are Pension Advance Companies The New Payday Loan Lender?

While many consumers who are short on cash between paychecks might seek help from the often predatory payday lending industry, more and more retirees are turning to their equivalent – pension advance lenders – when struggling to make ends meet, sometime with devastating results. [More]