CFPB Takes Action Against Mortgage Relief Company Deceptively Using VA & FHA Logos On Ads

As we’ve mentioned in the past, it’s illegal for a company to misrepresent itself as an agent of the government, if it isn’t in fact affiliated with the government. But that doesn’t stop some companies from using these false affiliations to lure in customers. Such was the case for a California-based mortgage relief company recently taken down by federal regulators.

The Consumer Financial Protection announced today that it levied a $250,000 fine against RMK Financial for allegedly deceiving consumers with ads that implied an affiliation with the U.S. government.

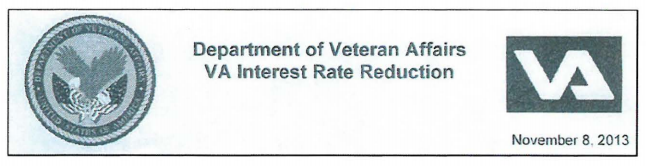

According to the CFPB’s complaint [PDF], RMK Financial – which also operates under the name Majestic Home Loans – mailed print advertisements that included the names and logos of the Department of Veterans Affairs (VA) and the Federal Housing Administration (FHA) to more than 100,000 consumers in several states – including some 10,000 servicemembers, veterans and others holding VA-guaranteed mortgages.

The CFPB claims that the advertisements were produced in a way that implied that they were sent by the VA or FHA, or that the company and its product were endorsed or sponsored by the government agencies.

A typical RMK advertisement for VA loans included the Department’s seal and logo at the top of the page and described a loan product as part of a “distinctive program offered by the U.S. government.”

Consumers were instructed in the ad to call the “VA Interest Rate Reduction Department” using a telephone number that belonged to RMK.

Other advertisements included envelopes with an “FHA Benefits” label and the Statue of Liberty. The mailings also included a warning citing the U.S. Code and threatening fines and imprisonment for tampering with the letter.

The suggestion that RMK was affiliated with the FHA and VA often continued when consumers called the company seeking additional information on the loan programs.

In addition to misrepresenting a connection to the government, the CFPB alleges that RMK’s ads featured incorrect information about loans’ interest rates and estimated monthly payments.

Under the CFPB’s consent order announced today, RMK is prohibited from falsely implying a government affiliation in future advertisements and must pay a civil penalty of $250,000 to the CFPB.

CFPB Takes Action Against Mortgage Lender for Deceptive Advertising [CFPB]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.