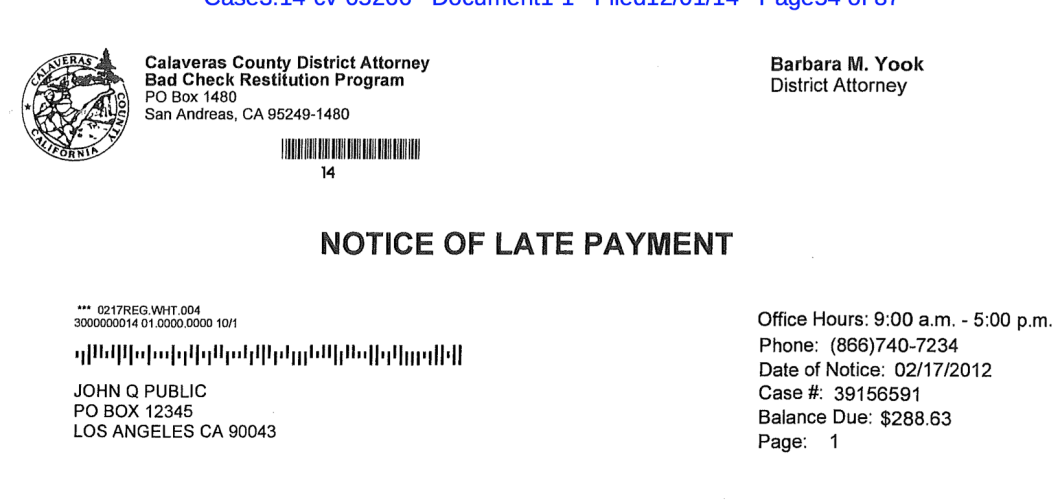

Debt Collectors Paying To Use Prosecutors’ Letterheads To Get People To Pay Image courtesy of This "late payment" notice appears to come from the office of the Calaveras County district attorney, but in fact was sent by a debt collection firm that manages the county's "Bad Check Restitution Program."

This “late payment” notice appears to come from the office of the Calaveras County district attorney, but in fact was sent by a debt collection firm that manages the county’s “Bad Check Restitution Program.”

There are programs around the country through which for-profit debt collectors can be allowed to use prosecutors’ letterhead in correspondence with consumers about debts or allegations of writing bad checks.

For example, in California the state’s Bad Check Diversion Act allows local district attorneys to refer bad check-writers to “diversion programs,” that let them avoid prosecution by paying fully restitution (plus a limited fee). Prosecutors may use third-party collectors — who turn over a percentage of the collected fees in return — to manage such programs.

But people are only supposed to be referred to a diversion program if “there is probable cause to believe” that the person violated state laws regarding the passing of bad checks. The law also requires that a prosecutor — an actual lawyer, not just someone in the DA’s office — must review a slate of factors each time a case is referred to one of these diversion programs. These factors include the amount of the bad check, the writer’s prior criminal record, any history of passing bad checks, and any evidence that the check-writer was intending to defraud the recipient.

However, not all district attorneys’ offices are being vigilant about these requirements, allowing some debt collectors to use their letterhead for these diversion programs without anyone doing a proper legal review to make sure the claim is legitimate.

Just a few weeks ago, the American Bar Association’s committee on ethics issued an opinion [PDF] condemning the practice and said that allowing debt collectors to use prosecutors’ letterhead without mandated legal review violates the Bar Association’s rules against misconduct and unauthorized practice of law.

Then on Monday, a debt collection company called CorrectiveSolutions was sued in a U.S. District Court in San Francisco, alleging violations of the federal Fair Debt Collections Practices Act, which forbids debt collectors from misrepresenting themselves and making false threats of criminal prosecution.

The complaint [PDF] contends that even though CorrectiveSolutions uses letterheads from various California prosecutors’ offices, “no prosecutor has reviewed the evidence, made a probable cause determination, or charged the check writer before he or she is offered ‘diversion.'”

And though many of these notices claim that the “diversion” program is a way to avoid prosecution, the plaintiffs maintain that “it is unlikely that a check writer that ignores the diversion offer will be charged with a crime.”

The L.A. Times’ David Lazarus recently spoke with the lead plaintiff in the case, who ended up in CorrectiveSolutions’ files after she stopped payment on a $75 check to a car insurance company.

She subsequently received a notice on the letterhead of Orange County, CA, District Attorney Tony Rackauckas. It said she’d been accused of writing a bad check but could avoid prosecution (and to a year in prison) by paying the $75 plus another $210 in fees.

The letters continued, all on the prosectors’ letterhead, and each reminding her that she’d allegedly violated the law and could be prosecuted, even though she’d written the check in Sacramento County, several hundred miles away from Orange County.

Additionally, she’d done nothing wrong by stopping payment on the check; the state’s diversion programs are only for people accused of deliberately writing a check with an intent to defraud. Oh, and the fee demand of $210 is three times the state’s maximum of $65 in fees.

“I’m angriest with the D.A.’s office,” the plaintiff told Lazarus. “I don’t think they should be prostituting themselves in this way.”

A rep for Orange County DA Rackauckas says that the notion underlying the county’s diversion program is “to keep these cases out of a very crowded court system.”

The program allows businesses who believes they have been passed a bad check to file a grievance with the county. Problem is, that the grievance doesn’t go to the DA’s office, but to a mailbox run by CorrectiveSolutions. And the senior assistant district attorney overseeing the county’s restitution program admitted to Lazarus that no one in the DA’s office other than a paralegal is vetting these complaints.

So any business in Orange County could file a complaint about an alleged bad check-writer and the only person reviewing these claims was a paralegal. Not only does this lead to situations like the one described by the plaintiff — where she’s being told she could be prosecuted for a debt she doesn’t owe — but it could also result in people entering a diversion program when they don’t have to, just to avoid the threat of prosecution.

After being contacted by the Times and being made aware of the Bar Association’s ruling, the DA’s office says a lawyer will now be reviewing bad check complaints. Orange County is also seeking guidance from state-level officials.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.