Since its creation as part of the 2010 Dodd-Frank financial reforms, the Consumer Financial Protection Bureau has been a target of pro-bank, anti-regulation lawmakers who contend that the agency lacks legislative oversight and puts too much authority in the hands of a single director. With the recent political power shift in the Senate and another presidential election on the horizon, some advocates are concerned that the anti-CFPB movement may take hold on Capitol Hill. [More]

consumer financial protection bureau

CFPB Returned $19.4M To 92,000 Consumers In The Last Half Of 2014

Each year the Consumer Financial Protection Bureau supervisory examiners hold hundreds of companies accountable for violations of fair lending and debt collection rules. During the last half of 2014, those actions resulted in the return of $19.4 million to more than 92,000 consumers, according to a new report from the agency. [More]

Credit Bureaus Agree To Revamp Practices For Handling Errors, Unpaid Medical Bills

Experian, Equifax and TransUnion – the three largest companies to collect and disseminate credit information for millions of Americans – must undergo an overhaul of credit reporting practices as part of an agreement with the New York Attorney General’s Office. [More]

CFPB Wants Better, Faster Database Of Credit Card Agreements

Much like a restaurant that has to shutter for a short time while installing new kitchen equipment, federal regulators occasionally have to press pause on an important process to fix things for the long haul. So in order to improve the Consumer Financial Protection Bureau’s public database of credit card agreements, the agency is planning to give banks a brief break from having to file those documents with the system. [More]

More Than 50M Consumers Have Free Access to Credit Scores, But Some Don’t Know What To Do With Them

Last year the Consumer Financial Protection Bureau began an initiative urging credit card issues to provide consumers with free credit scores on their monthly bills. Since then, a number of financial institutions have begun providing the information, leading more than 50 million consumers to have free and regular access to their scores. [More]

CFPB Orders Mortgage Company To Pay $2M Penalty For Deceptive Advertising & Kickbacks

The Consumer Financial Protection Bureau continued its ongoing crackdown of companies deceptively marketing products to U.S. veterans by ordering NewDay Financial, LLC to pay $2 million and revamp its business practices. [More]

Reverse Mortgage Complaints Show Consumers Confused By Loan Terms

While reverse mortgages are only available to a select group of consumers – those 62 years and older – the alternative loan product still makes up a large portion of complaints received by the Consumer Financial Protection Bureau. Today, the Bureau released a report highlighting the most common consumer complaints about reverse mortgages, along with advice for borrowers [More]

Deal Provides $480 Million In Debt Relief To Current & Former Corinthian Colleges Students

When student-loan servicing company Educational Credit Management Corporation revealed it would purchase 56 campuses belonging to embattled for-profit college chain Corinthian Colleges, regulators and consumer advocates began working to ensure that students affected by CCI’s collapse would be protected under the deal. Today, the Consumer Financial Protection Bureau and the U.S. Department of Education announced some students would receive the help they deserve in the way of $480 million in debt relief. [More]

Report: CFPB To Release Rules Governing Payday Loan Industry Soon

Last March, the Consumer Financial Protection Bureau said it was in the “late stages” of crafting rules to rein in the often predatory payday lending industry. Nearly a year, later the agency is reportedly on the cusp of announcing said rules. [More]

CFPB Proposal Aims To Improve Mortgage Access In Rural & Underserved Areas

A new proposal issued by the Consumer Financial Protection Bureau this week aims to make it easier for consumers in rural and underserved areas of the United State to obtain mortgages. [More]

Proposed Scorecard Could Help Protect Students From Dangerous Banking Products

For the past several years, federal agencies, lawmakers and consumer advocates have shared their displeasure with the rather cozy relationship between the financial industry and higher education institutions and set out to protect consumers from the often shady deals made between the two groups. Now the Consumer Financial Protection Bureau is setting out to protect students by creating a scorecard that would help ensure colleges have all the pertinent details when it comes to partnering with financial institutions that offer checking and prepaid accounts to students. [More]

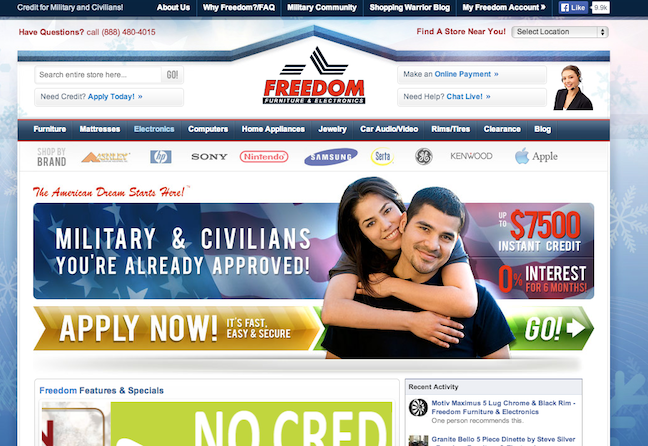

CFPB Urges DoD To Close Loopholes That Cost Military Personnel Millions Of Dollars

Nearly three months ago the Obama administration and the Department of Defense announced a proposed overhaul of the Military Lending Act that would aim to close loopholes regularly exploited by predatory lenders in order to sink their hooks into military borrowers. Now, a new report from the Consumer Financial Protection Bureau highlights just how devastating – and costly – those loopholes can be for servicemembers. [More]

CFPB: Retailer Allegedly Using Illegal Debt Collection Practices Against Servicemembers Must Refund $2.5M

The Consumer Financial Protection Bureau continues its fight against companies that continuously take advantage of members of the military, despite protections afforded to them under federal laws. Regulators’ latest victory? A settlement demanding over $2.5 million in consumer relief from three companies that allegedly used illegal tactics to pilfer money from servicemembers and their families. [More]