Readers M & C are honest people, so when Citibank started randomly depositing money that clearly wasn’t theirs into their account, they called to tell them about it. And Citibank took the money back. And deposited it again. And then sent them a check. M & C say that they’ve begged, they’ve pleaded Citibank to stop sending them random checks — but nothing has worked.

citibank

Reach Citibank Executive Customer Service

Having trouble getting people at Citibank to help you out? If you’ve tried regular customer service and supervisor multiple times and failed, try these numbers:

Wells Fargo Wins, Will Buy Wachovia

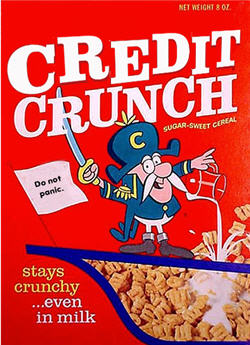

Wells Fargo is the winner in the battle for Wachovia, says the New York Times. Apparently, Citibank became nervous about splitting the bank when they saw the size of the “bad assets” it would have to take on, and quietly walked away. The bank will continue to seek $60 billion in damages, however.

Citibank, Wells Fargo May Carve Up Wachovia, Feast On Its Bones

Bloomberg is reporting that Wells Fargo and Citibank may split Wachovia. Neither bank would get assistance from the government and taxpayers under the deal being discussed now.

../../../..//2008/10/03/surprise-wells-fargo-is-buying/

Surprise! Wells Fargo is buying Wachovia, even though Citibank said at the beginning of the week that it was going to. (Check out the full post here.) Unlike Citibank, Wells Fargo will absorb all parts of Wachovia, including its securities and retail brokerage biz, in a “$15.1 billion all-stock merger.” [DealBook] (Thanks to Stephen!)

March Madness-Style Bracket Makes Bank Mergers Fun

TechCrunch has posted this “March Madness” style bracket of the recent financial meltdown. It was reportedly created by a general partner at Sansome Partners named Mark Slavonia, says TC.

Citi Credit Card Cautions You Against Spending

Citi’s been burned enough by its cardholders’ profligate spending, apparently. Check out the message on this activation sticker on a new card. We like the inclusion of a sort of Yin-yang background, as if to remind us that debt and repayment are equal elements of the consumer credit world. A balance must be maintained! Just, you know, not so high a balance that you can’t make your monthly payments.(Thanks to Jerry!)

Citigroup Buys Wachovia

Part of Wachovia will remain independent — including its massive brokerage business which ballooned after it purchased AG Edwards in 2007, as well as its Evergreen investment management division.

Forever 21 Aftershocks? Citibank Cancels Cards Due To Retailer Security Breach

We’ve received queries from readers telling us that their Citibank cards have been replaced, and asking whether we’ve heard about any new security breach. Other than Forever 21 we haven’t, so we’re wondering whether they’re responsible for the stories below.

Citibank Must Pay Back The $14 Million It Stole From Customers Over A Decade

Between 1992 and 2003, Citibank operated an “automatic sweeping” program that would without notice remove positive balances from customers’ credit card accounts—mainly those of the poor and the recently deceased—and pocket the money. Now it’s paying back $14 million dollars to the affected customers, plus another $3.5 million in penalties to California, thanks to that state’s Attorney General.

What To Do When Citibank Charges You Interest On A Zero Balance

A Consumerist reader was surprised to find that Citibank had applied a finance charge on a zero balance account. She did what every good Consumerist should do: prepared her evidence, jumped quickly ahead to a live person on the Customer Service side, and resolved the issue. Here’s what happened:

Citibank's Website Glitch Tricks Man Into Overpaying $755, But They Won't Issue Refund

Citibank’s website isn’t reliable, at least according to them. Matt assumed that a website from a bank could be trustworthy, and that if there was no scheduled payment showing up, then he must have forgotten to arrange it. He scheduled a second payment, but then both payments went through one day apart. Now Citibank refuses to give him a refund: he should have called or emailed before rescheduling, they’ve told him, and not trusted what the website was telling him.

Citibank: Sorry We Illegally Ruined Everything You Own Because Your Landlord Was In Foreclosure

Do you know what your rights are if your landlord is in foreclosure and people show up at your door to try to evict you instead of him? What if they load all your crap onto a truck and lock you out? No? Neither did “Tabitha,” a renter whose landlord was in foreclosure and whose possessions were destroyed as movers kept illegally loading them onto and off trucks over and over again.

Beware Long-Term Cardholders With Perfect Payment Histories, Your Credit Lines May Be Slashed

Oliver paid off his Citibank platinum card on time, in full, every single month since 1989, but that didn’t stop Citibank from slashing his credit limit when a minor mistake popped up on his credit report.

../../../..//2008/07/03/google-now-helps-catch-criminals/

Google now helps catch criminals. The FBI identified a Citibank PIN thief by cross-referencing security camera footage with an ICQ handle and personal photos on ham radio enthusiasts sites. [Information Week]

Here's What The World Of ATM Hacking Looks Like

Wired has been covering the ongoing investigation into recurring ATM pin thefts from Citibank accounts, and their latest article tracks how Ukrainian immigrants, a ringleader back in Russia, a hacked company named Fiserv that runs Citibank-branded ATMs in 7-Elevens, and an online payment service that also offers money laundering for a small fee all come together to steal your money. It’s an amazing look at how the U.S. tries to combat the threat of ATM-related theft.

Citigroup May Reinstate Universal Default

Last year Citigroup pledged to abandon the customer-screwing policy of universal default, where an unrelated late payment or credit score change can trigger an interest rate increase on your Citibank card. They even used a marketing phrase to promote their promise: “a deal is a deal.” According to the New York Times, Citigroup is “quietly reconsidering its pledge” and may decide to reinstate universal default as early as this week.