Here’s a change of pace: After seemingly countless stories of mysterious debits and charges on consumer’s accounts, here’s a story of a man who found that his checking account suddenly included $917 he knew didn’t belong to him. [More]

bank error in your favor

Banks Blame Each Other For Erroneous $10 Million Account Balance

When a woman in Australia checked her bank account balance earlier this week, she was surprised to see that she had $10 million available in her account. (That’s worth about $7.8 million US dollars, if you’re wondering.) She wondered whether it was an error or a prank, so she called her bank instead of running off on an international spending spree. The bank told her that it was no error: she was an unwitting millionaire. [More]

Chase Sends Me Updates On Bank Account I Don't Have

Consumerist reader Jesse has recently started receiving account balances and deposit info via e-mail for a bank account with Chase. This would be wonderful and helpful — if Jesse had an account with Chase. [More]

That Mysterious $230,000 Deposited In Your Bank Account Is Probably Not Yours

If you checked your bank account balance to see a mysterious $230,000 deposit, what would you do? If your answer is “contact the bank and make sure the money goes back to its rightful owner,” you are correct. If you said “buy a Camaro and a new wardrobe, check into a hotel, and brag about your windfall to a police officer,” you are incorrect. Unfortunately, an Alaska fisherman chose that second option, and now he’s in jail. [More]

Amex Gives You Money It Can't Explain, Won't Take It Back

Reader Chad was deployed to Iraq from 5/05 to 6/06. American Express gives a special rate to service members when they are deployed, but apparently Chad wasn’t getting it. They figured this out and let him know that they would be crediting his account with a mysterious number they couldn’t explain. Then they credited all his accounts with this exact amount of money– even new ones he didn’t have while in Iraq. Free money is nice, but he’d rather they just give him the right amount. [More]

If The Bank Accidentally Gives You $11,000 And You Won't Give It Back, You're Gonna Get Arrested

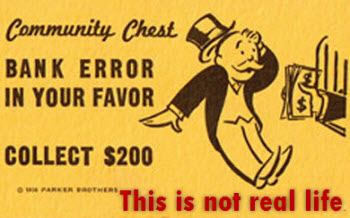

“Bank error in your favor” may help you out in Monopoly, but in real life — you gotta give the money back. One New York man didn’t agree, and now he’s been arrested and has been charged with grand larceny.

Did Washington Mutual Just Give Me $500?!

Daniel filled out a Washington Mutual deposit slip listing several checks and $500 in cash, but “forgot” to hand over the cash. He normally isn’t a fan of “shady business,” but now that he has a bank statement crediting him for the $500 hiding in his wallet, he’s suddenly not sure what to do…

../..//2009/05/28/looking-for-updates-in-the/

Looking for updates in the New Zealand bank error fugitives case? According to various news reports. the couple have split up to evade capture, the sister who posted the fateful Facebook message is back in New Zealand, and the couple face seven years in jail once they are caught.

New Zealand Bank Error Fugitives Foiled By Facebook Status Update

You know how it goes. You go out and have too many beers, then post a Facebook update with a bit too much information about your evening. Maybe you take it down once you sober up the next day, but not before the damage is done.

$10 Million Bank Error In New Zealand Leads To International Manhunt

Leo Gao, the co-owner of a BP station in Rotorua, New Zealand, applied for a $10,000 NZD ($6,142 USD) overdraft line from Westpac bank. An error by a bank staff member somehow put $10,000,000 NZD ($6,139,614 USD) in his account. He and his business partner haven’t been heard from since.

Please, Citibank, Stop Sending Us Random Amounts Of Money!

Readers M & C are honest people, so when Citibank started randomly depositing money that clearly wasn’t theirs into their account, they called to tell them about it. And Citibank took the money back. And deposited it again. And then sent them a check. M & C say that they’ve begged, they’ve pleaded Citibank to stop sending them random checks — but nothing has worked.