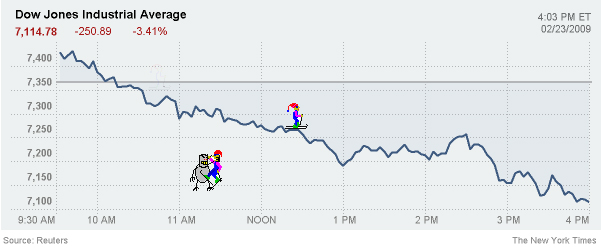

Bad day on Wall Street today, folks. The S&P 500 closed at the lowest level since April 1997.

citibank

../../../..//2009/02/23/the-wall-street-journal-is/

The Wall Street Journal is reporting that the government may end up owning a 40% stake in Citibank. [WSJ]

Citibank Sends Nigerian Scammer $27 Million

37-year-old Nigerian scammer Paul Gabriel Amos convinced Citibank officials to wire him $27 million belonging to Ethiopia. Rather than go with the usual Nigerian nom de plumes like prince or will executor, Famous Amos pretended to be an official with the National Bank of Ethiopia. Amos forged “official-looking” documents that confirmed his status with the central bank and instructed Citibank to await faxes telling them where to send the country’s cash.

Market Convinced Banks Will Be Nationalized, Freaks Out

Shares of banking stocks are dragging down the markets as investors become increasingly convinced that the banks will be nationalized, says Reuters. Investors are shunning the companies, worried that shareholders will be wiped out in a government takeover, and are fleeing to U.S. Government bonds and gold, which rose to above $1,000 an ounce.

Shrink Ray Now Hitting Rewards Programs

We’ve seen food items, airline mile programs, and credit card limits all shrink as the economy worsens. Now it’s time for other rewards programs to become just a little less rewarding—and somewhat sneakily, too, in these two stories recently sent in by readers.

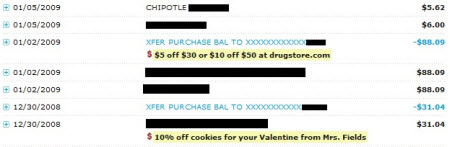

Citibank Inserts Advertising Into Your Account Activity

Reader Eric was looking at his credit card account activity when he noticed something odd. No, it wasn’t an unauthorized charge. It was advertising.

8 Banks Took $153.4 Billion In Tax Payer Money, Spent $845 Million On Naming Rights

Should bailout out banks be buying naming rights? Dennis Kucinich doesn’t think so, and last week he urged the Treasury department to cancel one such deal between Citibank and the New York Mets. Now Bloomberg says that seven more bailed out banks are spending money on stadium rights.

Should Citibank Pay $400 Million To Name A Stadium While Taking Taxpayer Money?

The New York Mets are getting a new stadium. It’ll be called Citi Field and that honor cost Citibank (and by extension, one could argue, taxpayers) $400 million.

White House To Citi: Don't Even Think About Buying Luxury Jets With Taxpayer Money

Yesterday, we wrote that Citigroup had decided to spend $50 million of its bailout money on a French luxury jet to ferry execs around town. The White House was not pleased about this.

Bailed Out Citigroup Stimulates French Economy By Purchasing $50 Million Corporate Jet

With $45 billion in taxpayer funds burning a hole in its pocket, Citigroup is purchasing a $50 million Dassault Falcon 7X, according to the New York Post. Apparently none of the existing jets that ferried execs to Washington to ask for bailout funds was ironic enough.

Scammed Lawyer Sues Citibank For Verifying Fraudulent Check

Banks usually avoid having to deal with the consequences of advance fee fraud, since they make the depositor responsible for coming up with the missing money when a check turns out to be fake. But a lawyer who just got scammed is taking Citibank to court, because he says their “unconditional” guarantee that the check was legit led directly to his loss of $182,500.

Citibank Will Split Into Two Companies, Promises To Lend To Consumers

Vikram Pandit, CEO of Citigroup, announced today that the company would be split after reporting a net loss for 2008 of $18.72 billion. He also promised to put the money from the $700 bailout to work by extending credit to consumers and businesses… responsibly.

On Heels of Bailout, Citi Raises Rates on Millions of Cardholders

We know the credit markets remain seized: late on Black Friday when no one was listening, the Federal Reserve issued a statement that its emergency lending to banks had increased over the prior week. Thus, massive amounts of money continue to flow to large financial institutions in an effort to stimulate economic activity, but by all appearances the money is not flowing into the broader economy. Quite the contrary; as the Fed lowers rates and adds record amounts of loaned cash to bank balance sheets, big banks are actually increasing consumers’ cost of borrowing and reducing their lines of credit. Witness Citibank’s recent adverse actions against cardholders.

Citibank Teaches Us How To Destroy A $244 Billion Banking Institution

Only two short years ago, Citibank was worth $244 billion. Now, after its stock lost half of its value in just the past week, the bank is estimated to be worth $20.5 billion. What happened? The New York Times attempted to answer that question Saturday, and it pointed the finger at the usual suspects — conflicts of interest between those who were supposed to manage risk — and those who stood to benefit from making risky bets.

20% Of Citigroup Cardholders Can Expect Rate Increases For 2009

If you have a Citigroup-issued credit card and you haven’t had a rate increase over the last two years, expect to be notified of a 2-3% rate increase on your November statement. Congratulations! You’re going to help Citigroup offset its losses in the global credit card division, whether you were directly part of those losses or not. As the New York Times points out, by doing this Citigroup is breaking the promise they made to Congress in 2007 that they would not arbitrarily raise rates on accounts—which may be why they’re offering a fairly lenient opt-out policy.

Secret Phone Numbers And Email Addresses To Reach Executives At 101+ Companies

Inside, email addresses, phone numbers, and addresses for over 100 different companies to inject your customer service complaints into their corporate executive offices, and get it well on the way to success.