When Citibank offered free 4 GB iPod Minis to new customers in 2004 and 2005, the product was retailing for $249, and Citibank indirectly acknowledged the value of the product by saying they’d substitute an mp3 player of “equal or greater value” if there were fulfillment problems. There weren’t, but by the time Citibank got around to passing out the iPod Mini, it had dropped in price and a new 6 GB version was now on the market for $249. Citibank chose to take the savings and distribute the now cheaper 4-gig versions. Now there’s a class action lawsuit against Citibank in California, where it seems all class actions are born. You can read the ruling for the certification here (PDF).

citibank

Round 41: Wal-Mart vs Citibank

This is Round 41 in our Worst Company in America contest, Wal-Mart vs Citibank!Here’s what readers said in previous rounds about why they hate these two companies…

Citibank Swears The Card Is In The Mail. Liars.

Tammy’s been trying to get a new Citibank card to replace her expired one since March. For two months Citibank has lied, stalled, and generally screwed around with her access to her money. For two months, a a series of increasingly senior people have told her her card is on the way. They even told her they’d overnight it, twice. Read her story,

Citi Announces One Of Its 'Bold Steps': Stricter Rules On Student Loans

Two readers have forwarded us a second email sent out by Citibank today, but it’s not another vaguely worded PR blast from the CEO. Instead, this one announces that Citibank is adopting the zero-tolerance approach to late payments favored by the credit card industry—miss a payment due date and you’ll lose any interest rate discount(s) you currently enjoy.

Citi CEO Emails To Inform You Of Citi's "Bold Steps," Neglects To Tell You What The "Bold Steps" Are

Reader Ben writes:

Citibank Promises To Credit ATM Fees, But Will Try To Get Out Of It Unless You Badger Them

Tim was pretty sure he met all the conditions of Citibank’s offer to refund ATM fees—he opened his account online and he doesn’t live near a Citi Financial center. When he wasn’t credited, he contacted them to ask why, and was told he had to meet the conditions he’s already met. He had to contact them four times to finally get the $2.00 fee credited as per their advertising. You might be asking yourself, “All that trouble for two dollars?” Well, that’s why he ends his email with this: “Can someone point me in the direction of a better bank that actually provides ‘reimbursement of the fees other banks may charge you for using their ATMs’ without hassle?”

Man Sentenced For $3.6 Million Credit Card Fraud

A Californian named Andrew Michael (not pictured at left) was sentenced to four years in federal prison last week for scamming Citibank and credit card companies by fraudulently applying for an $8.5 million commercial line of credit—some $2 million of which he spent on personal goods for himself, including “170 troy ounces of silver, 479 tubes of gold flakes, [and] a Rolex watch.”

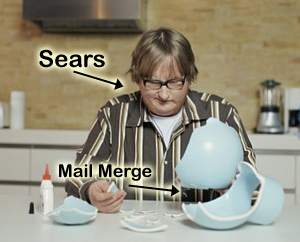

Follow-Up: Citibank Steps In, Forces Sears To Remove The $1070 Charge

Tom just sent us a follow-up to yesterday’s post, and it’s good news:Score another one for The Consumerist! This morning I contacted Sears’ Executive Customer Service Department. They attempted to contact the store manager on my behalf. I stress “attempted” because they were hung up on too.

Citicard Exec On Ending Universal Default: "It's Like Telling People You Stopped Beating Your Wife."

I was talking to a high-up marketing type person from Citicards recently and she wanted to know what Consumerist readers were complaining about with regards to the little plastic devil she pushes. She told me how Citicards had recently stopped doing Universal Default, which is where if you’re late on your payments with one creditor, other creditors get to treat you like you defaulted with them and spike your APR. She said she was personally appalled after finding out that her company had the policy in the first place, but then struggled with how to tell customers about it, because, she said, “It’s like telling people you stopped beating your wife.”

Sears Takes Customer Account Security 80% Seriously

On Wednesday, April 9th you received an email with the subject line “Get $25 From Citibank”. We recently discovered that the email we sent to you incorrectly contained the salutation “Dear Donna Robinson” rather than “Dear MATTHEW F”. We apologize for the confusion this may have caused and want to assure you that the email is a legitimate Sears card email.

Oh Sears. Well, according to Matthew F, at least the account number was his.

Round 18: Sears vs Citibank

This is Round 18 in our Worst Company in America contest, Sears vs Citibank.

../../../..//2008/04/02/citibanks-online-banking-site-was/

Citibank’s online banking site was down all day yesterday for some readers. Some folks were told a server went down, others were told it was a system upgrade. The site is supposed to be back up today.

Credit Card Expert Disputes Erroneous Charge, Frustration Ensues

Georgetown law professor and Credit Slips blogger Adam Levitin is having trouble disputing an erroneous $176.96 charge on his Citibank Amex card from PACER, the federal court’s online docket system, which he accesses for free. The professor is a consumer credit expert and should have no problem understanding and fixing the error, right? Fat chance.

Citigroup Developing Citi-Branded Phone That Can Make Contactless Payments

Do you wish you had a way to spend your money more easily, without all that opening-the-wallet or punching-the-pin-number manual labor? The trade publication Cards & Payments (registration required) says that it’s received a copy of a report filed with the FCC that indicates Citigroup is developing a Near Field Communication, or NFC, mobile phone that would allow its customers to make contactless payments at participating retailers.

Citibank Uses Sneaky Way To Keep Sending You Junk Mail Even After You "Opt Out"

After he continued to receive mailings for months from his bank after he thought he opted out of their mailings, reader Perre asked Citibank if they had honored his request. They said, “yes you’re opted out of Balance Transfer offers and Cash Convenience Checks.” Then he cleverly thought to ask which mailing lists he was still opted in. Citibank told him he was still on “Sales and Marketing” and “Third Party Sharing.” They explained this by saying when you call to opt-out, they only take you off “in-statement offers.” We’re not sure what that means, it sounds like they’re just agreeing to not put additional marketing offers in your billing statement envelope, which is definitely not what any normal person would have in mind when they call to opt-out. Sneaky. When you call a company to opt-out of their mailings, be sure to also ask which lists you’re opted in, and then ask to get off those as well.

Congress To Subprime CEOs: How Come You Got Paid Millions To Wreck The Economy? Hm?

Congress got to ask the subprime CEOs what everyone else is thinking: Why did you get millions and millions of dollars to fail so spectacularly?

Apple Demands ID With Credit Card Purchases, Violates Merchant Agreement

We received the following strangely awesome, if a bit strange, letter from a consumer who was not allowed to purchase something at the Apple store because he would not show ID. It was sent to Steve Jobs and William Rhodes (of Citibank.) Let’s listen in: