Some Citibank customers recently received notice that the bank reserved the right to require 7 days written notice before authorizing a withdrawal on checking accounts. (It’s also on page 23 of Citi’s Client Manual [PDF].) As you can imagine, this freaked some people out. A Citibank rep quickly moved to clarify the rule, and he pointed out that it’s actually required by federal law for certain types of accounts, and it’s not unique to Citibank, and they don’t intend to enforce it. [More]

checking

Citibank Freaks Out Customers With Weird 7-Day Rule On Withdrawals, But It's Not As Devious As It Looks

It's Probably A Bad Idea To Cash A Check For A Stranger

I bet if some guy approaches you on the street right as you’re about to walk into your bank or credit union and asks you to cash a check for him, you’d say no. That’s a good idea. Apparently at least two people in Madison, Wisconsin thought they were doing a good deed and helped the man out. It turns out that the checks were drawn on a closed bank account in Atlantic City, NJ. [More]

Citibank Postpones New Checking Account Fees For Newer Customers

New York Attorney General Andrew Cuomo got Citibank to agree not to implement its new monthly fees on formerly free checking accounts, at least for some customers. If you signed up for one of Citibank’s EZ Checking or Access Checking accounts between January 1, 2009 and November 5, 2009, the new monthly service charge will be waived until this time next year. If you’re one of those customers, there’s nothing you have to do–you’ll get a notice in the mail from Citibank. [More]

"Move Your Money" Profiled On NPR

Last month, the Huffington Post launched a campaign called Move Your Money that urged people to support community banks. The idea is that by moving your money to a community bank, you can help put the “too big to fail” banks on a diet so that they get smaller, while at the same time help a local bank remain competitive. The NPR program All Things Considered took a look at the campaign over the weekend, and talked to some experts about whether it’s worth making the switch. [More]

Here's A Possible Way To Avoid Citibank's New Account Fees

Next month, Citibank will implement its new $7.50 fee on what were formerly free checking and savings accounts. The only way to avoid the fee is to keep a total of $1500 minimum in your linked accounts. John wrote in to tell us that when he went to his branch and asked about the new fee, they found a way to get around it. It may not work for anyone else, but it’s worth sharing. [More]

Don't Let Maintenance Fees Ruin Your Automatic Savings Program

If you participate in an automatic savings program like Bank of America‘s Keep the Change service, where debit card purchases are rounded up and the difference is deposited into your savings account, keep an eye on maintenance fees. James says he was hit with a $5 charge last month because he hadn’t met the minimum monthly deposit requirement of $25: “It turns out that I wasn’t even accruing $5 worth of change per month, so I was losing more money due to the maintenance fee than I was saving via Keep the Change!”

Citibank To Charge Fees On Checking Accounts

If you’re a Citibank customer who has one of the bank’s two smaller checking account plans—the ones where the monthly fee is waived as long as you use direct deposit or their online bill payment—then maybe it’s time to consider taking your business elsewhere. Starting in February, anyone with an average balance of less than $1500 will be assessed a monthly $7.50 service fee, reports the New York Post.

Former Customer Says Wells Fargo Bills Him $101.70 On Closed Account

Royal says it’s costing him more than $100 to break free of Wells Fargo after he closed his checking account before waiting for all pending charges to clear.

Wachovia's "Way2Save" Account Triggers Over $5,000 In Penalty Fees

Wachovia has a new financial product called Way2Save that automatically moves $1 from your checking account into a high interest personal savings account every time you make an electronic bill payment. Susan tried to maximize her contributions by making a lot of little bill payments, but Wachovia cut off access to her funds without notice and triggered an avalanche of penalty fees. Now she owes over $5,000 to her credit card companies, far more than she would likely have ever earned through Wachovia’s complicated savings program, and of course Wachovia is denying any responsibility.

Bank Of America Uses Temporary Hold To Trigger Overdraft Fee?

Bank of America got so fee crazy last week that it applied a $10 overdraft fee to Christopher’s account even though it wasn’t overdrafted. I went back and forth with Christopher to try to figure out what BoA could have done to trigger this, but as you can see from the screen cap below, he only had two debits on the day of the event.

All About Reward Checking Accounts

Reward checking accounts offer above market interest rates, higher than almost any other bank deposit account, if you can satisfy their requirements.

USAA Online Checking & Savings Open For Non-Military

If you’ve heard us rave about USAA’s stellar financial services but grown sad when you learned that it’s only available for military-members and their family, have heart: you can get still get access to some of their services like banking and checking.

Citizens Bank Now Charging An Overdraft Protection Fee

Lynne writes, “Citizens Bank is now charging customers an annual overdraft protection fee. This is a charge for linking your savings account to your checking account. Customers can be removed from the program and can get the fee back.” We don’t know when this started—they just say there might be fees involved and call for details on their website—but if you’re a customer of the bank you might want to make sure you haven’t been enrolled without knowing it.

The Free Checking Account Myth

One of the biggest myths of the financial industry is the “free” checking account. They have high minimum balance requirements, offer 0% interest, and have other annoying requirements. The worst part is that they’re not even free.

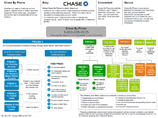

Chase Bank By Phone Telephone Tree Map

Should you ever get lost in the Chase bank-by-phone tree, this function map may help you. Or it may explode your brain all over the receiver. The choice is yours.

USAA: Deposit Your Checks With An iPhone!

The friendliest bank in the world, USAA, will soon let customers instantaneously deposit checks through its iPhone application. Here’s how it works: you snap a picture of the front and back of your check, and send the picture to USAA. That’s it.

The Maid Is Stealing Your Checkbook

Identity theft is rising in the recession, according to a Brooklyn public defender I talked to at a party this weekend. Most often the crime starts with the perp stealing the victim’s checkbook, he said.

updated: WaMu Accounts Become *Almost* Totally Chase July 24

Starting July 24, 2009, WaMu accounts will get fully transitioned to Chase. After that, ex-WaMuers will be able to fully enjoy the benefits of Chase banking, like making deposits into Chase ATMs, the full range of Chase branch banking services, and the luxury of paying Chase’s service fees which are higher than WaMu’s were.