This morning, President Trump began to fulfill his campaign promise to “get rid of Dodd-Frank,” putting his name to an executive order that directs federal regulators to revise the rules established by the 2010 financial reforms. While this latest directive from the Oval Office is largely symbolic and does little to change existing regulations, consumer advocates say there are still reasons to be concerned. [More]

dodd-frank act

Retailers Ask Congress To Please Not Roll Back Dodd-Frank Debit Card Reforms

Both the banking industry and conservative lawmakers are hoping that the incoming Trump administration will agree to repeal the 2010 Dodd-Frank Financial Reforms, but many in the retail world are calling on Congress to retain at least the portion of the law involving debit card transactions. [More]

Retailers Tell Fed: Debit Card Swipe Fees Are Still Too Dang High

Even though the Dodd-Frank financial reforms effectively halved the fees that retailers must pay to banks for each debit card transaction, the stores say that amount is still too much. And with all of their legal options exhausted, the retail industry is calling on the Federal Reserve to re-think the cap it put in place nearly five years ago. [More]

CEOs Of Chipotle, CVS, Discovery, Walmart Make The Most Compared To Employees’ Wages

Earlier this month, the Securities and Exchange Commission finalized a long-delayed rule that will require many businesses to publicly disclose the ratio of their top executive’s pay to the earnings of the typical employee. If the data in a newly released report is accurate, then the CEOs of Chipotle, CVS, Walmart, and Discovery Communications are each making more than 1,000 times the average salary of the people they employ. [More]

U.S. Companies Must Reveal How Much CEOs Earn Compared To Workers

Five years ago, the Dodd-Frank financial reform legislation directed the Securities and Exchange Commission to come up with rules requiring American companies to calculate and report the ratio between a CEO’s pay and that of the company’s typical employee. After repeated delays and claims from big business that the math was too complicated, the SEC has finally voted to approve these rules. [More]

New Rule Means Banks Will Have To Make Sure Borrowers Can Actually Repay Mortgages

When the housing market collapsed five years ago, it was due in no small part to mortgage lenders who handed out loans without really considering whether or not the borrower could ultimately pay that money back. Hoping to minimize the chances of this happening again, regulators have introduced a new rule today. [More]

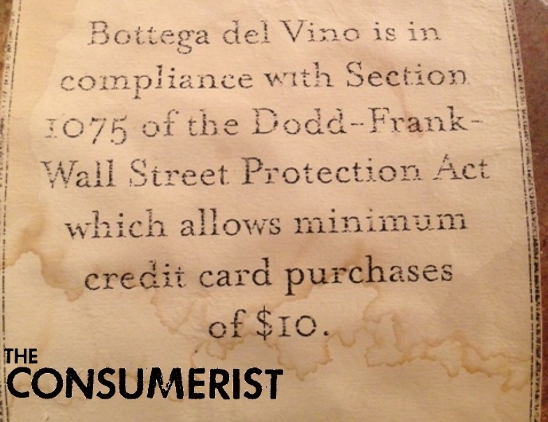

This Restaurant Really Wants You To Know Why It Can Now Require $10 Minimum For Credit Card Purchases

Rather than your typical hand-drawn sign letting customers know that they must buy at least $10 worth of stuff in order to use their credit card, this restaurant goes a step further and (sort of) cites the law that gives it the right to require the $10 minimum. [More]

Big Businesses Admit Being Really Bad At Math… When It Comes To How Much A CEO Earns

In March, a group of two dozen lawmakers prodded the Securities & Exchange Commission to finally get around to enforcing Section 953(b) of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, which requires publicly traded companies to disclose the ration between CEO pay and the median pay for the rest of their employees. Now that the SEC is prepping to release those rules, these companies are suddenly claiming a lack of basic math skills. [More]

More New Debit Card Fees Loom

Banks are making less money when you swipe your credit and debit cards because of new caps on interchange rates, the fee that they charge to process each of these transactions, that go into effect on July 1st. They have to make the money up somehow! We’ve seen new fee-incurring tripwires on checking accounts, and now they’re dreaming up even more fees for debit cards. Here’s what’s on their wishlist: [More]