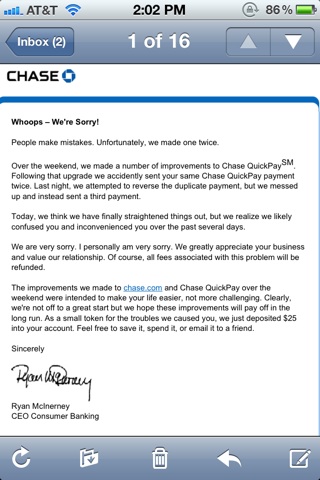

In the last few days, we’ve received a couple of e-mails from readers who were getting strange explanations from Chase about why automated payments had been deducted twice from their accounts. But before we could figure out what was going on, the bank has issued a “my bad” to affected customers, and thrown in $25 in “we’re sorry” cash. [More]

chase

Name Change On A Car Loan Completely Confuses Chase

Every day, people in America get married. Some of them change their last names. Evidently, though, no one in the history of Chase Bank has ever done this while they were in the middle of paying off their car loan. See, until the loan is paid, the bank has a lien on your car’s title. If you want to change the name on your car title and the loan hasn’t been paid off yet, Chase won’t let that happen. This isn’t a problem unless you have to move and register your car in a different state after your name change but before the car is paid off. That’s what happened to Michael’s wife, and how she ended up in a loop of bureaucracy sending them back and forth from Chase to the Maryland Vehicle Administration. [More]

Chase Pulls Plug On Tests For Two New Fees

Like several of its fellow mega-banks, Chase has been testing out various new checking account fees in different regions of the country. But a pair of those tests have come to an end — and will hopefully never be seen again. [More]

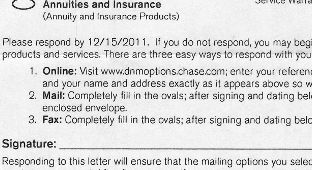

Chase Sends Letter To Non-Customers To Tell Them They Have To Opt Out Of Receiving More Unwanted Mail

It’s one thing to receive unwanted mail from a bank you don’t patronize. It’s another to receive a letter from that bank telling you that if you don’t reply to the letter, you’re opening the floodgates to even more unsolicited shredder-fodder. [More]

Chase Drops Plan For $3 Debit Card Fee

Chase joins U.S. Bancorp, Citigroup, PNC, KeyCorp and other large banks that have recently moved away from the plan to charge consumers a monthly fee when they use their debit cards to make purchases, reports the Wall Street Journal. The bank recently tested the fee in both Washington and Georgia. [More]

Ditch Your Big Bank, Miss Out On Groupon Refund

Like many other Americans, Casey broke up with his big bank, Chase, and joined a local credit union. The Consumerist commentariat should be very proud of him. Except that since changing banks, he received a refund for a Groupon he had purchased, which Groupon is powerless to give him because the debit card he used to purchase it has been canceled. [More]

Bank Of America, Chase, Wells Fargo, Visa, MasterCard Sued Over ATM Fees

Have you ever glared angrily at the ATM, knowing that you’re going to be saddled with fees and wishing you could sue everyone involved? Well, it looks like more than one person has followed through on this idea. [More]

People Are Back To Making Late Payments On Their Credit Cards

Two months ago, the number of people making late credit card payments was at its lowest since Justin Bieber was a twinkle in his parents’ eyes. Of course, when you reach a low like that, there is often nowhere to go but up. [More]

Consumers Union Urges Bank Of America CEO To Drop Debit Card Fee

Two weeks after asking regulators to investigate Bank of America’s plan to charge some customers a $5 fee to make purchases with their debit cards, our cousins at Consumers Union have taken their case directly to the bank’s CEO. [More]

Get $12 In Chase Credit Card Balance Transfer Class Action

You can file to get $12 because of a settlement in a class action lawsuit against Chase which alleged the bank enticed customers with promo interest rates on balance transfers, but then didn’t do a good enough job of telling them when the rates would expire. [More]

Chase Freezes Couple's Account, Screws Up Their Life, With No Explanation

A Washington state couple with tens of thousands of dollars in their Chase checking, savings and retirement accounts recently came home to find a letter from the bank telling them that, oh, by the way, your accounts are now frozen. [More]

Painting Of Chase Branch On Fire eBays For $25,200

Tapping into popular sentiment, Alex Schaefer’s painting of a Chase bank on fire just sold on eBay for $25,200. Part of what drove up the price was online buzz after police questioned him while he was painting it, asking him if he planned to do what the painting depicted. [More]

More Towns To Withdraw Millions From Chase Over Mortgage Mod Practices

We know the story. Chase and other banks got billions in bailouts that they were encouraged, but not required, to use to help people modify their mortgages. Instead they sat on it and smiled like cheshire cats. Now a movement has sprung up to punish Chase for its intransigence by withdrawing money from their accounts. On the individual account level, that’s not much. But in New York state, entire towns are getting in on the act. [More]

Wells Fargo And Chase Waive Fees For Irene-Affected Customers

Wells Fargo and Chase announced that they are waiving some fees for customers in NY, NJ and CT to help them out after Irene. [More]

Get $15, $30, Or $60 In Chase Credit Card "Payment Protection" Class Action

You’re eligible to claim cash if you had a Chase credit card and got charged for a payment protection product between Sept 2, 2004 and Nov 11, 2010, thanks to a recent class action settlement. [More]

Chase Wants To Alert You To Important New Policy Change… Four Days After It Goes Into Effect

Consumerist reader JP is a Chase customer who uses his debit card to pay for gas. Thankfully, the folks at Chase sent him this e-mail today explaining an important change to how the bank processes “pay at the pump” charges. Of course, it wasn’t important enough for Chase to actually send the e-mail before — or even a couple days after — the policy kicked in. [More]