A Texas widow and her family have filed a lawsuit against JPMorgan Chase and others, alleging that their efforts to refinance their mortgage with the bank only resulted in foreclosure, heartache and her husband’s fatal heart attack. [More]

chase

Chase Does Us All A Favor, Nixes Overdraft Fees For Purchases Under $5

Remember when you began vehemently swearing upon realizing that before you used your bank card to buy a $3 iced coffee, you were in the red already, making that a $37 iced coffee and overdrawing your account even more? That’ll change for Chase customers, as the bank announced its going to do its customers a solid by dropping overdraft fees for purchases under $5. [More]

Have You Found An ATM With Minimum Deposits?

When Paul’s wife brought a small check to deposit at a Chase bank ATM, she didn’t expect to have the machine spit it back out. Deposits, you see, have a $15 minimum. Wait, isn’t that the point of using an ATM to deposit checks – not having to waste a teller’s time on an $8 transaction? [More]

Want To Spy On Your Friends' Bank Accounts? Lend Them Your iPhone!

Letting someone borrow your iPhone to log in to their bank’s app quickly, then log back out is no big deal, right? Like letting a friend borrow your computer to check their web-based e-mail. They log in, they log out, they leave no trace. Unless it’s Chase’s iPhone app. Then you get all of their account alerts, no matter what you do. (Short of deleting the app, we assume.) [More]

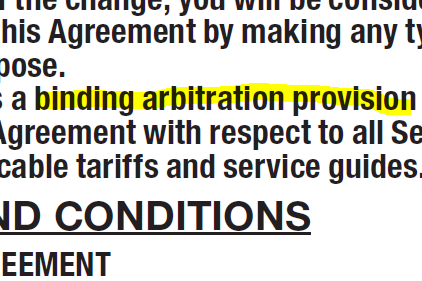

Which Worst Company Contenders Force Customers Into Mandatory Arbitration?

As we sifted through the mountain of nominations for this year’s Worst Company In America tournament, we noticed a trend of readers who cited companies’ mandatory binding arbitration clauses as a reason for nominating. And while it’s businesses like AT&T and Sony that have made all the headlines for effectively banning class action lawsuits, there are a lot of other WCIA contenders who are forcing customers into signing away their rights. [More]

Feds Probing Chase On Credit Card Collection Practices

Following the lead of whistleblowers, the Office of the Comptroller of the Currency has reportedly been investigating JPMorgan Chase over allegations that, over the course of at least two years, the bank used inaccurate records when suing thousands of delinquent credit card customers. [More]

How Much Have The Big Banks Been Penalized Over Mortgage Mess And Where Is All That Cash Going?

The last few years have seen numerous settlements between the nation’s biggest mortgage lenders and various federal and state authorities. And while we hear numbers like “a total of $25 billion,” exactly which banks are responsible for the biggest chunks of these settlements? [More]

Chase Puts Stop-Payment On Its Own Check, Tells Customer To Suck Up The Fee

When there’s some miscommunication between your bank and your credit card company, you would hope that the two parties could act like professionals and sort it out — especially if they’re both part of the same financial institution. But that’s apparently not the case with Chase. [More]

Chase Takes Its Time Looking Into How Woman Received Envelope Full Of Strangers' Account Info

It’s a good thing not everyone wants to steal identities or drain strangers’ bank accounts, because that could’ve been a likely outcome when Chase mailed the account information for three of its customers to a woman in Illinois. She was surprised to get that envelope, to say the least. [More]

Pair Of Positive Experiences Reminds Chase Customer That Good People Work For Bad Companies

JPMorgan Chase is a regular fixture in our annual Worst Company In America tournament, but like most of the businesses in the WCIA brackets, there are a lot of decent people who truly want to help their customers. [More]

Adventures In Honesty: Chase Credit Card Rewards

Zach’s parents used their Chase rewards points to send him a nice gift. He was thrilled to find three $25 gift cards to Amazon! Except, um, they had only sent him one. It was obviously a mailing error, and Zach reached out to Chase to straighten it out. Having a customer call in to complain that he received too many gift cards was apparently an unprecedented event at this Chase call center. But for raising an honest son, Chase will reward his parents with extra points. [More]

Big Banks Pinky-Swear To Overhaul Lending & Foreclosure Practices

Nearly a half-decade after the U.S. housing market collapsed like something that collapses really badly, the country’s five biggest mortgage providers — Bank of America, Chase, Wells Fargo, Citi and Ally — are oh-so-close to reaching a settlement with the states that could include overhauls to how they operate when it comes to the whole lending/servicing/foreclosing process. [More]

My Ex-Husband Wasn't Too Happy When Chase Used His Money To Pay My Credit Card Bill

Amanda might not be married to her ex any more, but that doesn’t mean she wants to be in hot water with him for using his money to pay her credit card bill. Unfortunately, Chase seemed to want her to have a belated Christmas present and did just that. [More]

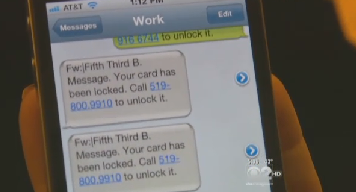

Don't Fall For The "Locked Debit Card" Text Alert Scam

With holiday shopping season heading into the home stretch, it’s prime time for ID thieves. Which is why some people might fall prey to scammers who text cell phone users with alerts that their debit cards have been locked. [More]

Bank Of America & Chase Continue To Be Penalized For Sucking At Loan Modifications

For the third quarter in a row, the Treasury Dept. has released its report card detailing how the country’s largest mortgage servicers are doing with processing loan modifications. And for the third consecutive quarter, both Bank of America and JPMorgan Chase will not receive incentive payments from the Treasury because the banks are doing such a craptastic job at complying. [More]

Chase CEO Wants Everyone To Lay Off On Hating Rich People

In case you’ve been asleep for the last few months, there are more than a handful of people out there who aren’t too happy about the fact that executives at bailed-out banks are reaping huge salaries while none of them have been called to account for the actions that required them to be bailed out in the first place. But thank heavens that one ultra-wealthy CEO is willing to stand up for his fellow bullied bankers. [More]